Tapestry is growing and we are hiring a Campaign Specialist. We spoke to Jenn Bryan, our Senior Campaign Manager, about what it’s like to support non-profits across Canada in raising community bonds.

Tapestry is growing and we are hiring a Campaign Specialist. We spoke to Jenn Bryan, our Senior Campaign Manager, about what it’s like to support non-profits across Canada in raising community bonds.

Mary and Ryan are stepping into their new roles as veterans of the organization, both having a deep understanding of social finance and its impact on communities across Canada. They played a central role in founding Tapestry and growing the organization from an idea to an incredible reality – an organization that has now raised over 70 million dollars in community investment for community owned assets. Mary, Ryan, and the entire team, imagine a future with clean energy, housing for all, inspiring spaces for the arts, and social services brought to life with community bonds.

Mary Warner is the longest serving member of our organization and a pioneer in the world of social finance. She joined TREC 11 years ago and supported the growth of leading bond issuers like SolarShare, ZooShare, the Centre for Social Innovation. As Co-Executive Director, Mary will oversee operations and finance.

“I bring the spirit of facing new challenges by working collaboratively in my new role. It is not a leap I take lightly or alone, and with the support of my Co-Executive Director, Ryan, and with deep confidence in our entire team, I am eager to continue our tradition of thinking big and finding ways to further the social and environmental causes that are fundamental to our mission and values.” – Mary Warner

Ryan Collins-Swartz has been an instrumental force in our organization and a champion for community bonds.. Since joining TREC to launch Tapestry 3.5 years ago, he’s built out our services, expanded our reach to new sectors and geographies, and worked closely with organizations to develop their bond campaigns for success. As Co-Executive Director, Ryan will lead the growth of Tapestry by working with partners, clients, and stakeholders.

“It’s inspiring to support organizations to engage their community, increase their impact and empower everyday investors and institutions to align their investments with their values. I believe in the power of community bonds to change not only our relationship to finance, but prove that together, we can create the communities we want to live in.” – Ryan Collins-Swartz

Deb Doncaster, one of TREC’s founding staff and now a Director at the Greenbelt Foundation, shared the Board’s perspective on co-leadership:

“Our Board was thrilled to unanimously approve Mary and Ryan as our new Co-Executive Directors. Co-leadership provides stability for the organization as a whole as well as for the co-leaders themselves. Together, they can support each other in this pivotal role and model a more inclusive, co-operative and rewarding form of leadership. We’re excited for our organization to continue to evolve and grow under their leadership” – Deb Doncaster, Board Member

If you have any questions about Tapestry or community bonds, please get in touch! We’d love to hear from you.

A huge congratulations go out to the Centre for Social Innovation (CSI) for reaching their 2020 Community Bond goal of $1.9M in only 41 days!

CSI has a successful history of using community bonds to support their work:

“I think the record success of this campaign to build the next economy, during this unprecedented time of hardship and activism, speaks to the moment: great challenges demand that we rise to meet them. We’re entering a new era and the potential we have today to reshape ourselves hasn’t existed since the post-war era. Our community of impact investors are some of the wisest most committed people in Canada. I think they saw the opportunity, and CSI’s track record of doing the work, and proving that big ideas are possible, and they wanted to be part of the solution.

We couldn’t have done this without the essential services provided by our long-term partners at Tapestry. From the sage advice, technology, process recommendations, and thorough knowledge of the regulatory dos and don’ts, to the careful, friendly, long-term investor management, we simply could not be in the Community Bond business without them.”

– Kyle Shantz, Director of Growth, CSI

With the help of Tapestry – and nearly 120 individual community investors like yourself – CSI was able to raise an impressive $1.9 M in under two months for their most recent bond project.

The CB 2020 bond offering was an invitation to their community of members and supporters to invest in the people, places, and programs that put people and the planet first.

The funds from this raise will support a variety of programs that are in line with the UN’s Sustainable Development Goals – Quality Education, Gender Equality, Decent Work, Reduced Inequality, Sustainable Communities, and Climate Action.

We are proud to be a part of this great success and look forward to watching the future unfold for the Centre for Social Innovation! Click here to learn more about this project!

If you are interested in learning more about bringing your dream project to life through community bonds, find out more here or e-mail Ryan Collins-Swartz at ryan@tapestrycapital.ca.

At Tapestry, we speak with many not for profit organizations on a weekly basis. Over the last few months, the Investment Readiness Program (IRP) has been a part of that conversation. When we bring up IRP, we tend to get a variety of responses ranging from excitement to confusion. What is the Investment Readiness Program? How can it benefit nonprofit organizations? What does investment readiness even mean?

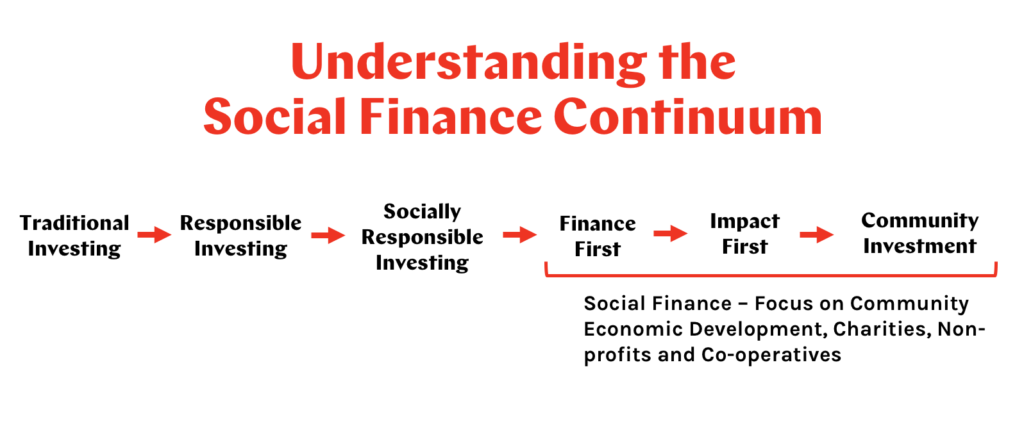

The idea of private capital being invested in the nonprofit sector is a new sort of conversation in Canada. In past blog posts, we’ve discussed the investment continuum and where community bonds sit in reference to traditional philanthropic tools. IRP is another piece in this financing conversation.

In this blog post, we’ll seek to:

On November 22, 2018, the federal government announced the establishment of a $755 million Social Finance Fund. The Community Foundations of Canada CEO, Andrew Chunilall suggests that the goal of the fund is to “attract increased investment to help vulnerable people and to solve pressing challenges like climate change, housing affordability, technological disruption of jobs, and other national and local priorities.”

Full details about the fund are still forthcoming, however, it is expected that the $755 million will be distributed in the form of a matching investment over the next 10 years, starting in 2021. In other words, like the funds from private investors, the social finance fund be a repayable investment into social purpose organizations.

In recognition of the fact that private investments and social finance are new concepts for many social purpose organizations, there has been $50 million earmarked to help get organizations ready for the planned release of the Social Finance Fund. These funds are being distributed as the Investment Readiness Program.

The Investment Readiness Program was launched in July 2019. The funds are being distributed in the form of grants through readiness support partners. These partners include:

Starting in 2020, these readiness support partners will put a call out to social purpose organizations (both for profit and not for profit), that are interested in becoming investment ready. In fact, the Canadian Women’s Foundation has already put out its first call out for applicants.

In practice, investment readiness refers an organizations ability to successfully participate in the social finance market. This means generating revenue through a new social enterprise, or scaling existing social enterprise activities. The capital earned through investment will allow organizations to increase their social impact, and being “investment ready” means the organizations will have the capacity to repay that investment.

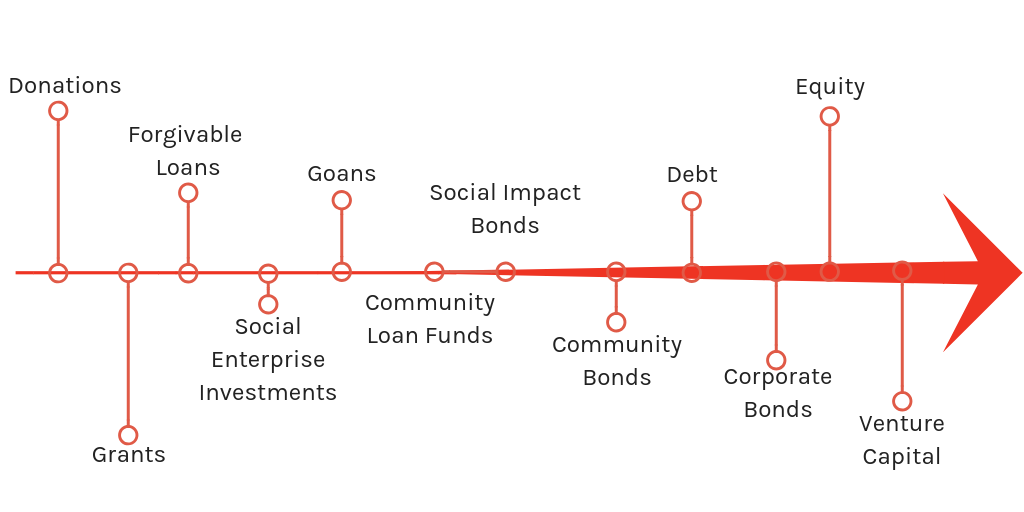

There are different financial vehicles that allow organizations to accept financing, including community bonds. What is common amongst these social finance vehicles, is the expectation of a financial return in addition to a social return.

For not for profit organizations that have only ever relied on grants and fundraising, the Investment Readiness Program presents an amazing opportunity to think differently about financing. In leveraging this opportunity to establish a Social Enterprise, or grow existing revenue generating activities, organizations can both position themselves for social investment, and create long-term sustainability that could come in the form of:

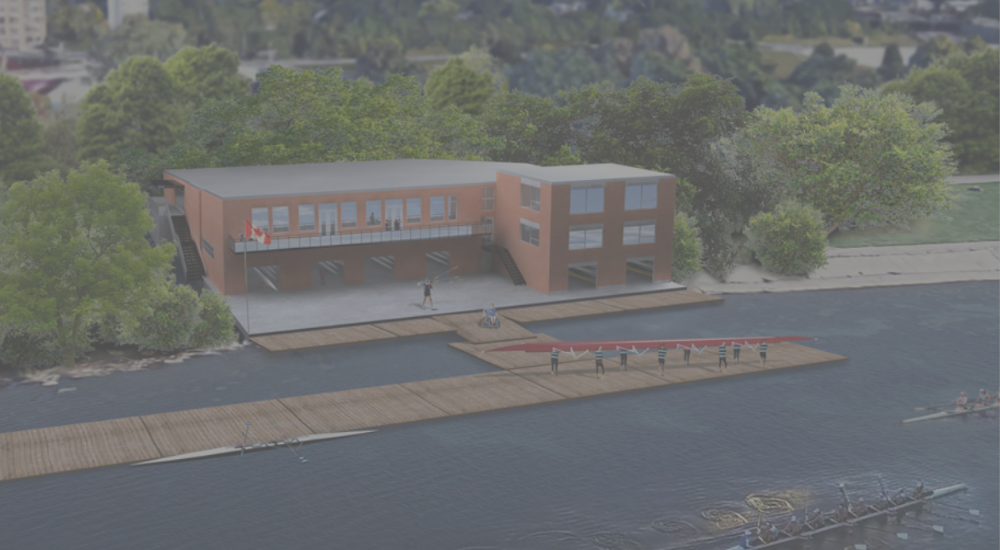

The Argonaut Rowing Club leveraged community bonds to raise $1.2 Million for their club revitalization project.

Organizations that we work with, like the Argonaut Rowing Club (ARC), are a great example of how private capital can enable a greater social impact. By leveraging community bonds, ARC was able to increase their clubs membership capacity, make the club accessible, and make essential improvements to the revenue generating events space. To learn more about how the Argonaut Rowing Club leveraged social finance, click here.

We will be working with Innoweave to host an Investment Readiness and Ideation session on Thursday, December 18 at 1:30pm. The session will be hosted by Tapestry at the Foundation House (Foundation House Board Room, #300-2 St Clair Ave East, Toronto, ON) and facilitated by Wayne Miranda the Social Finance Investment Readiness Lead.

If you’re interested in participating, signup through the link below:

In addition, before the end of the year, the Community Foundations of Canada will be announcing more information on the Investment Readiness Program. They will be one of the best resources to stay up to date on program developments, and gain access to program funds through community foundations. And, as we learn about funds being released through the different Investment Readiness Partners, we’ll be sure to let you know through the Tapestry Community Capital newsletter, on our Twitter account, or through LinkedIn.

Media Advisory

Historic Argonaut Rowing Club completes $1.2 million community bond raise to fund the ARC Next club revitalization

Toronto, ON, September 16 – The Argonaut Rowing Club, announced that their $1.2 million-dollar community bond campaign goal has been achieved. As a part of the club’s 5-year revitalization project called ARC Next, the club’s volunteer board of directors worked with Tapestry Community Capital to launch the bond campaign in March 2019, with a goal of raising the funds by September 15, 2019. The bond raise was well received by potential investors, with interest in purchasing bonds, exceeding the amount of bonds available. The bond raise goal was reached on September 13, 2o19.

When complete, the ARC Next club revitalization will support the next generation of rowers by offering a fully accessible space with a renovated event venue, new elevator, extended docks, new change rooms, enlarged weight room and an increased capacity for both membership and youth programming.

A celebration for club members and investors is being planned for early October.

About the Argonaut Rowing Club (ARC)

Founded in 1872 and located on the Western Beaches of Toronto, the Argonaut Rowing Club (ARC) is one of Canada’s oldest and largest clubs with a history of supporting Olympic and Paralympic champions. ARC provides programs for athletes, coaches, umpires and volunteers based on the Canadian Sport for Life (CS4L)/Long-Term Athlete Development (LTAD) model. Members at ARC include rowers of all ages, skill levels and abilities. They are supported by the ARC vision to inspire lifelong passions for the sport and to help their members achieve their personal level of excellence. For more information about the Argonaut Rowing Club, please visit www.argonautrowingclub.com.

About Tapestry Capital

Tapestry Community Capital is a not-for-profit co-op that supports other co-ops and non-profits in raising and managing community investment. Since 1998, the Tapestry team has supported some of Canada’s largest organizations across multiple sectors in successfully raising and managing $61 million from over 3,900 community investors. From investment structure, to branding and back-office support, Tapestry ensures each campaign and investment is managed reliably and professionally. Tapestry, and each one of their clients, strive to leave the world a better place. For more information about Tapestry Community Capital, please visit www.tapestrycapital.ca.

-30-

Interviews, photos or more information:

Judy Sutcliffe

arcnext@argonautrowingclub.com

Argonaut Rowing Club

On August 14, we published a blog post in collaboration with the Future of Good, giving a primer on Community Bonds!

In the post, we explored why not for profit organizations need to diversify their funding sources, and the advantages/disadvantages of some of the financing tools available to not for profit organizations.

Here are the key takeaways from the article that we wrote:

As one of the tools most readily available to not for profit organizations, we discuss grants quite a bit. While essential and hugely valuable, there are drawbacks to relying on grants. One of the main disadvantages is the relative lack of flexibility and stability.

In all cases, it’s the granting body that defines how a grant can be used, and typically, a not for profit organization will have to find a project that fits the granting parameters. Furthermore, it’s the granting body that decides when and under what circumstances the grant is available.

While organizations should pursue grants, caution should be taken in relying solely on grants for funding. In particular, for major capital development projects, relying on grants will likely be insufficient.

In considering how to establish a secure funding base, organizations should seek to diversify their funding sources. This could include any range of funding vehicles including: fundraising, crowdfunding, social entrepreneurship, community bonds and grants.

A range of purpose specific funding tools like grants or community bonds, and flexible funding tools that can be used for anything, like donations or social entrepreneurship, will provide your organization with the ability to escape the endless granting cycle and plan for growth!

We’re strong believers in leveraging the entire investment continuum when reviewing how to effectively plan for long-term financing. Much like you wouldn’t hammer a nail with a screwdriver, you should consider the tool being used when considering what you’re trying to fund.

Whether you’re seeking a tool that can help to reengage existing supporters, or looking for a new tool that can jumpstart your capital development ambitions, Community Bonds are an effective resource for organizations of all sizes. They provide your community to feel a sense of ownership over the project being funded.

The full article is available on the Future of Good website. If you’re interested in reading click here:

What’s a community bond, anyway?

If you’re interested in learning more about community bonds, or signing up for our Community Bonds 101 webinar, to see if this innovative financing solution is right for your organization, click the link below:

Last week, the Tapestry Team launched the first edition of The Thread, Tapestry’s bi-monthly community newsletter.

We’re excited to be able to bring you news and events related to community bonds, social impact investing and not for profit organizations, engaging their community to do amazing things all around the world. If you haven’t viewed the newsletter and don’t want to miss out on future editions, click the link below:

If you find an interesting piece of community bond news, have an event you want to feature, or just have questions/comments about the newsletter, please get in touch. We will review every comment and take it under consideration when designing the newsletter.

If you find an interesting piece of community bond news, have an event you want to feature, or just have questions/comments about the newsletter, please get in touch. We will review every comment and take it under consideration when designing the newsletter.

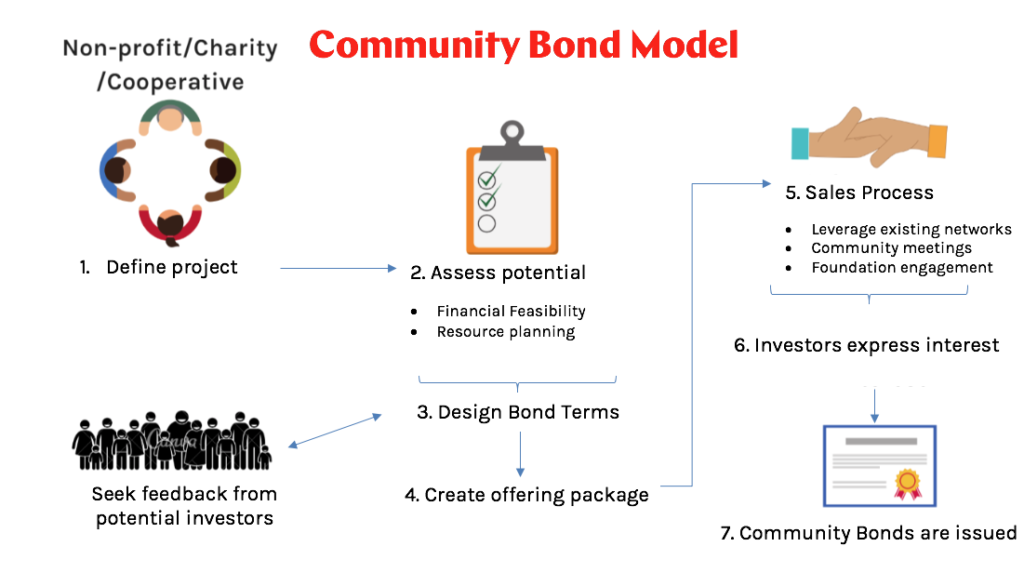

Over the last decade, governments and social purpose organizations have been responding to the growing need for social and environmental services by developing and using innovative finance tools to both grow the base of community assets, and expand programming. Two tools that have received a lot of attention, and are gaining traction, are Community Bonds and Social Impact Bonds.

At Tapestry, we’re often asked what the difference is between these two tools, so in this article we will attempt to set the record straight.

Community Bonds, by definition, are a debt financing tool issued a by non-profit, charity or co-operative organization. In simple terms, Community Bonds give these organizations the opportunity to take loans of varying sizes directly from their community of supporters. Both sides win – their supporters are paid interest for investing in a project that is meaningful to them, and the issuing organization gains access to the capital they need to grow.

In order to repay their investors, organizations issuing Community Bonds must have a revenue model. For example, an artist co-operative might issue community bonds to purchase a building. They will have revenue streams from operating a storefront, leasing studio space to their members, and renting out their event venue. This artist co-operative would be a good fit for a community bond raise because they have a way to repay their investors and have a strong base of supporters through their co-op membership and patrons.

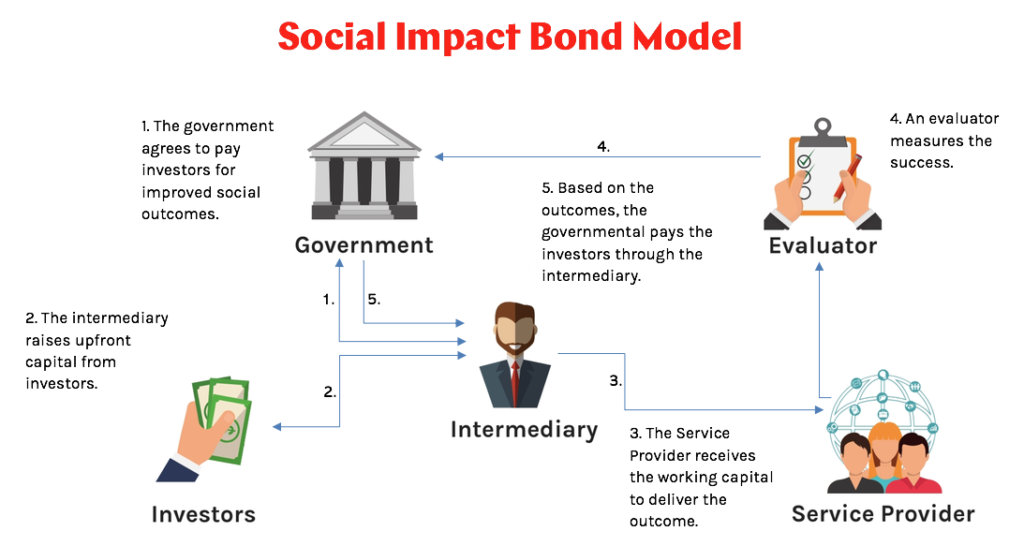

Social Impact Bonds are similar in some ways because they are issued by community focused non-profits and charities. They too, create impact investment opportunities for individuals who believe in the mission of the issuing organization. The main difference is that the issuing organization has established an agreement with the government, where the government will pay for performance by the non-profit or charity. The payment from the government is tied to clear social or environmental outcomes to which the issuing organization has committed. These are the funds that are used to repay investors. So rather than investing in the business model of a social enterprise (as is the case for Community Bonds), investors in SIBs are investing in the organization’s ability to realize detailed social or environmental outcomes.

For example, a community service organization that houses and provides employment training to homeless youth could establish a pay-for-performance contract with the government where they commit to housing and employing 80 youth. This organization could then issue debt in the form of an SIB to their community of supporters. Their investors will be repaid at the end of the program, assuming the organization has achieved the outcome to which they committed with the government.

According to the Ministry of Economic Development, Job Creation and Trade, “SIBs are not bonds, per se, since repayment and return on investment are contingent upon the achievement of desired social outcomes; if the objectives are not achieved, investors receive neither a return nor repayment of principal. SIBs derive their name from the fact that their investors are typically those who are interested in not just the financial return on their investment, but also in its social impact”.

What are the main characteristics of Community Bonds vs. SIBs?

What are the main characteristics of Community Bonds vs. SIBs?

As SIBs aim to solve big social challenges on behalf of the government, these programs often require larger capital injections than a project that may successfully issue Community Bonds. Thus, the investors targeted for SIBs are often high net worth, accredited investor. On the other hand, Community Bonds enable people of average means to transform from occasional donors or volunteers into citizen investors.

Today is a day to celebrate! In the Fall Economic Statement released this morning, the Federal Government announced the creation of a $755 million Social Finance Fund. This is a strong signal towards the growing movement of impact investment in Canada and a bold step towards advancing social innovation.

In June 2017, the Government created a Social Innovation and Social Finance Strategy Co-Creation Steering Group that sought feedback from hundreds of non-profit and charitable stakeholders to create a nationwide social innovation and social finance strategy. The Steering Group published its final report in August 2018: Inclusive innovation: New Ideas and New Partnerships for Stronger Communities.

One of the report’s central recommendations was to create a Social Finance Fund to accelerate the social finance market in Canada and help close the financing gap faced by organizations that are contributing to social and environmental change in their communities.

The Fund, which will make $755 million available over the next ten years, will support charities, non-profits and other social purpose organizations to access new financing and connect them with private investors that want to make impact investments. The Government has also proposed to invest $50 million over two years to create an Investment Readiness Steam, for these organizations to improve their ability to successfully attract investment.

Tapestry has also recognized the need to develop the investment readiness of non-profits, charities and co-ops. With the launch of our Bond Camp we will be supporting Ontario-based organizations to successfully raise community investment in 2019. We have seen the movement of private capital into meaningful, place-based investments and feel confident that this fund will feed the growing local and social investment ecosystem.

The Government has reported that this Social Finance Fund could generate up to $2 billion in economic activity, and help create and maintain as many as 100,000 jobs over the next decade.

In honour of this great news, we are giving the gift of one free investment readiness workshop. Do you know of a project that could benefit from community investment? Email us at info@tapestrycapital.ca.

On October 17th, Tapestry was joined by more than 80 non-profits, charities, co-operatives and social enterprises in Ottawa, all eager to learn how social finance can help them scale-up their impact. The question among all of them – where do we start? What are the tools that we can put to work in our favour?

Social enterprise is still a very new, and arguable poorly understood, sector of the economy. Even less explored is the realm of social finance.

Social finance is an approach to mobilizing private capital that delivers a social dividend and an economic return to achieve social and environmental goals. Mobilizing private capital for social good creates opportunities for investors to finance projects that benefit society and for community organizations to access new sources of funds.

The term can include community investing, microfinance, investing in socially-responsible and sustainable businesses (such as B-Corps), social impact bonds, and social enterprise lending. A social investment is not a grant or donation; it’s repayable, with interest.

Tapestry works specifically in the space of community investment. We make use of a social finance vehicle called a Community Bond. Simply put, a Community Bond, is an interest bearing loan from a community member. It could be for as little as $1000 or more than $1 million, but the bonds must always be repaid, providing a fair interest return and a proven social or environmental benefit.

Tapestry works specifically in the space of community investment. We make use of a social finance vehicle called a Community Bond. Simply put, a Community Bond, is an interest bearing loan from a community member. It could be for as little as $1000 or more than $1 million, but the bonds must always be repaid, providing a fair interest return and a proven social or environmental benefit.

To shed light on other tools across the social financing continuum, Tapestry brought in partners including:

Vancity works exclusives with organizations and entrepreneurs that are working to solve environmental, social and economic challenges. Committed 100% to impact, Vancity offers project, portfolio, and business lending; impact capital transaction advisory services; and investment banking for community and environmental enterprises.

The Ottawa Community Foundation (OCF) is a non-profit organization created by and for the people of Ottawa to connect people who care with causes that matter. OCF recently launched a new Impact Investing Strategy that will allow the Foundation to go beyond their traditional grant-making role by helping charitable and non-profit organizations access loans, guarantees and mortgages. Under the terms of the Strategy, OCF will allocate up to 10% of their endowment to impact investing.

The Ottawa Community Foundation is also one of the lead investors in the Community Forward Fund, a fund which lends exclusively to charities, non-profits and social enterprises.

As a not-for-profit social enterprise, PARO collaborates to empower women, strengthen small business and promote community economic development across Ontario. PARO has become well know for their Peer Circles – small groups of like-minded women who meet regularly to share their experiences, offer advice to each other and expand their individual and shared contact networks.

One of the key elements of a Peer Circle is that members also provide access to micro-credit of between $500.00 and $5,000.00. Members of the Peer Circle are involved in the review and approval of a member’s PARO loan application before it is approved. Today PARO is one of the strongest peer lenders of small business loans in North America, supporting a diverse range of women who may have no or poor credit history, and no sources of equity.

CSED is a non-profit organization based in Ottawa that offers a wide range of services to social enterprises, including access to technical expertise, coaching, financing, learning communities, training, and cross-sector partnerships. They have worked with hundreds of clients developing their social enterprise plans and provided them with the tools, strategies, and support to perpetuate positive social change and grow profitably.

CSED’s UNCAPPED program enables the start-up, growth and scaling of social enterprises through organizational readiness and capacity building support, including access to funding. The program is open to charities, not-for-profit organizations, co-operatives, and for-profit businesses with a clearly demonstrated social purpose. Under the program, participants will receive curated readiness and capacity building support that may include one-on-one coaching, facilitated cohort-based training, access to community mentors/experts, and funding in the form of grants, loans or grant/loan combinations.

The Ottawa Community Loan Fund (OCLF) is a non-profit organization providing microloans for business and professional development purposes. Since its inception in 2000, it has constantly pursued its overarching goal; to ensure their loan recipients eventually have access to traditional financing, increase their assets and/or achieve the professional development.

More recently, OCLF has expanded their scope of activity to include new micro-financing products, business technical expertise, financial literacy training, professional development, affordable housing and social enterprise development.

Impact Hub is a community and co-working space that Inspires, enables and connects people that are working to solve the world’s challenges. Impact Hub is part of a global network of 15,000 purpose driven individuals and organizations in 102 impact hubs worldwide.

In the context of our social finance discussion, the Impact Hub Ottawa shared their experience as a non-profit raising $400,000 in community bonds. To learn more about their story, click here.

David Cork, Tapestry Community Capital

Alfred Lee, Vancity Community Investment Bank

Brian Coburn, Ottawa Community Foundation

Jane Duchscher, Ottawa Community Loan Foundation

Michael Murr, Centre for Social Enterprise Development (CSED)

Kiran Pal-Pross, PARO Centre for Women’s Enterprise

Recent Comments