Earlier this year, the federal government officially launched the Social Finance Fund, a $755 million commitment to building up Canada’s ecosystem of socially and environmentally mindful capital.

It’s an exciting time to be in the social finance world. But what exactly is the Social Finance Fund? And where might community capital fit into the picture? We’re breaking it down for you in this explainer.

What is the Social Finance Fund?

Le site Fonds de financement social is a fund the federal government created to build up Canada’s social finance ecosystem by improving access to capital for Social Purpose Organisations (SPOs). — a sector in which socially- and environmentally-conscious investors support charities, cooperatives, social enterprises, and other social purpose organisations. The government has committed to funneling $755 million into the sector, to build up the capacity of social purpose organisations to take on investments, boost the capacity of social investing organisations, and bring traditional investors into the fold, too. (To note: when we say investors, we mean institutional investors, like private equity firms or loan funds — retail investors aren’t able to participate in the Social Finance Fund.)

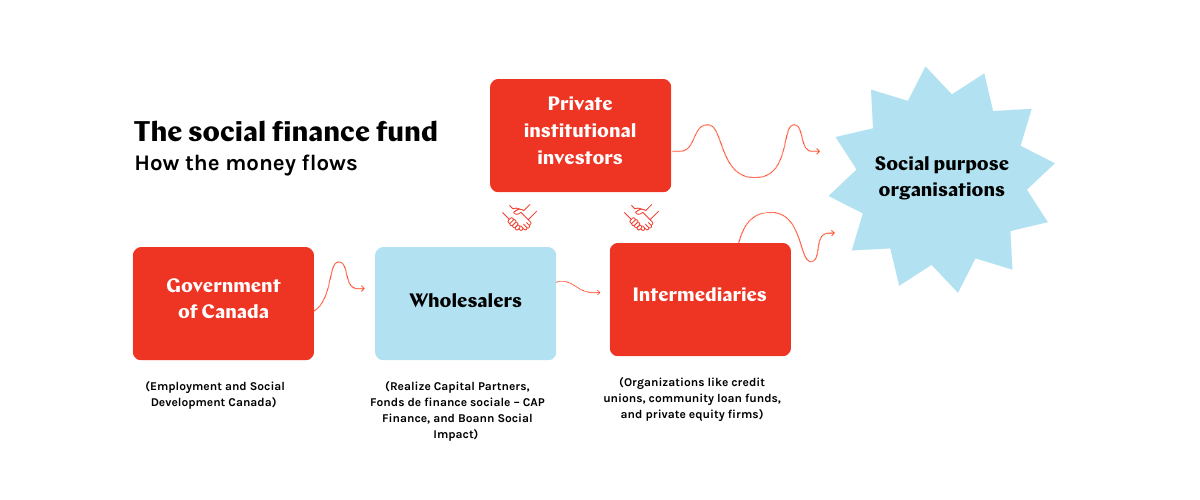

How will the Social Finance Fund money be disbursed?

The government has chosen three wholesalers to act as fund managers: Realize Capital Partners, Fonds de finance sociale – CAP Finance, and Boann Social Impact. These three organizations will invest in social finance intermediaries, like community loan funds, co-operative investment funds, and credit unions, who will then directly invest in SPOs. Both wholesalers and intermediaries will also be expected to leverage private capital to accompany the investments they make.

Why do social purpose organizations need investment capital?

Many social purpose organizations (SPOs), particularly non-profit ones, have primarily relied on philanthropic and government funding in the form of non-repayable grants to do their work. But as needs for SPOs’ work intensify in the face of economic, environmental and social crises, organisations are looking for ways to diversify their funding streams so they can boost their resilience. That’s where investment dollars come in.

What will motivate investors to participate?

There’s a growing movement among investors who want to divest from harmful and extractive industries. But the current social finance market isn’t very accessible to institutional investors wanting to place larger investments. The Social Finance Fund will help connect these institutional investors to investment-ready SPOs, and build the capacity of SPOs at the same time — catalyzing a long-term, viable social investment market.

Where might community bonds fit into all of this?

At Tapestry, we love this question. In our ideal vision, the Social Finance Fund will help build a more mainstream, inclusive, Canada-wide community finance market by crowding in, not out, local investors.

When institutions make big investments, retail investors take note and usually follow. Social Finance Fund intermediaries and their private capital partners can bring early capital to community bond issuers and catalyze investment from retail investors. In other words, they are a vote of confidence in community bond issuers.

Bigger institutional investors can also add more capital to underfunded parts of the community bonds market. For instance, we hear from SPOs who are excited about raising money with community bonds, but they worry that they don’t have the ability to fund their entire project with investment from their own community. For some organizations, this may be because their community has faced systemic barriers to building wealth. For others, they might be located in rural or remote areas with smaller populations.

In both these cases, funding from a Social Finance Fund intermediary could provide critical capital that would complement the funds raised locally from community investors.

An exciting example of how institutional investment can catalyze community capital is the Fonds L’Ampli initiative by the Chantier de l’économie sociale in Québec.

Institutional investors who have the means could also commit to being ‘first in, last out’ capital for organisations issuing community bonds or bring in philanthropic funding to guarantee their loans.That way, in the rare event that something goes wrong and the organisation isn’t able to pay back all its investments, it could pay back retail investors first. Institutions could play this important role in de-risking grassroots, community-led work.

At Tapestry, we’re excited about the Social Finance Fund. We believe it has the potential to give Canada’s community capital market a major boost, and we’re working to build a market that allows it to do so — crowding in, not out, community investors.

Curious about community bonds? Read more here, or connect with our team.