Levez des fonds auprès d'investisseurs qui croient en votre mission.

Une solution de financement puissante pour les organisations caritatives, les organismes à but non lucratif et les coopératives.

Community bonds are a social finance tool that can unlock the funding you need for your next project and grow your organization. They transform your social capital into financial capital.

Nous travaillons avec des organisations à travers le Canada pour lever et gérer avec succès des obligations communautaires., guiding you every step of the way to achieve your investment goals.

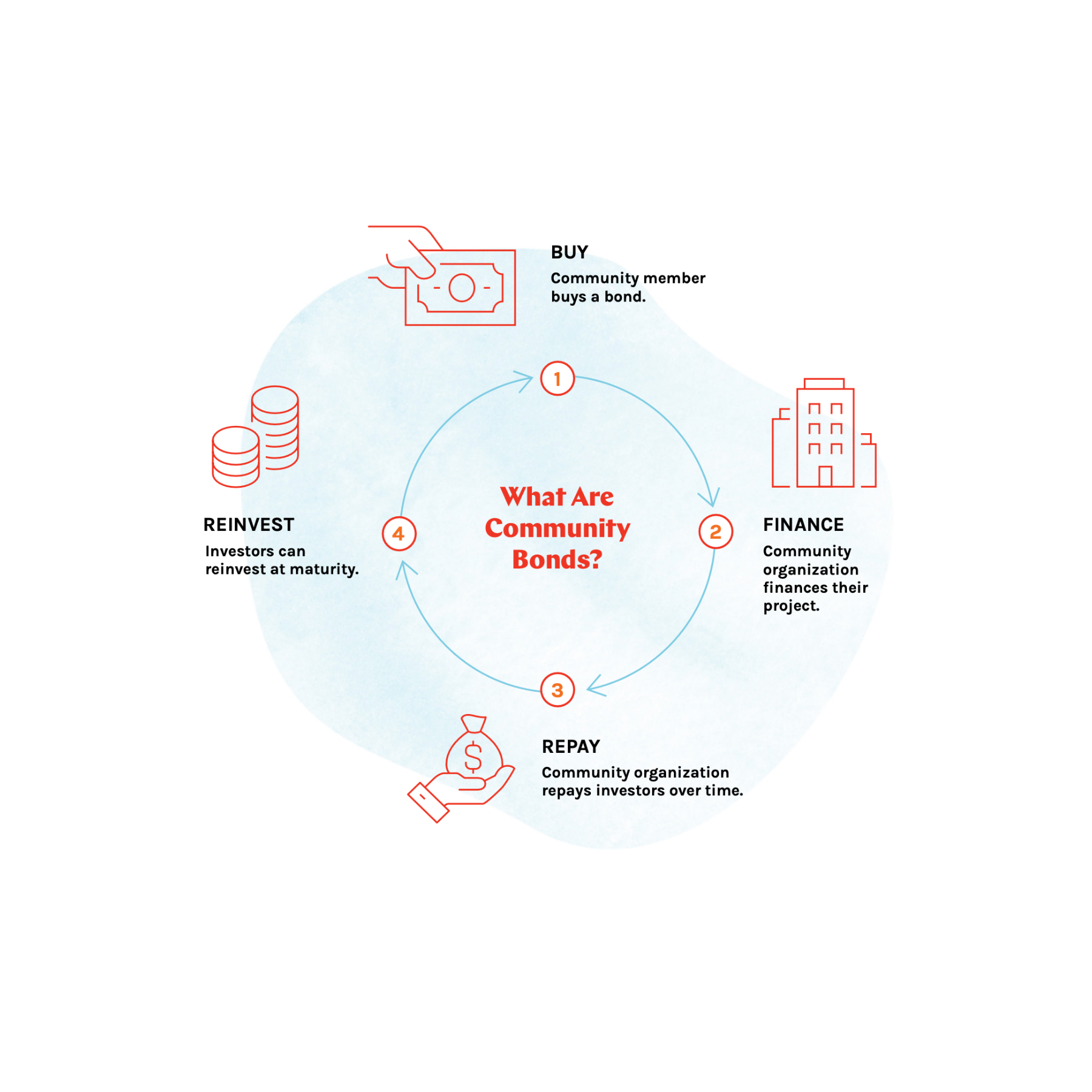

How community bonds work

- Concevez vos conditions d'obligations avec Tapestry

- Les membres de la communauté achètent vos obligations

- Vous financez votre projet

- Vous remboursez vos investisseurs au fil du temps

- Permettre aux investisseurs de réinvestir dans des projets futurs

$110M+

Levée d'obligations communautaires

4,000+

Community investors

59

Projects financed (and counting!)

Nous vous aidons à transformer vos supporters en investisseurs

Tapestry Community Capital est Le premier partenaire de services en obligations communautaires au Canada. Nous simplifions le processus de collecte des investissements communautaires and support you every step of the way.

We believe in the power of social capital to unlock financial capital. We have helped to raise over $100 million in community investment with some Canada’s most successful social enterprises.