The city of Kamloops, B.C. sits squarely at the intersection of the housing and climate crises.

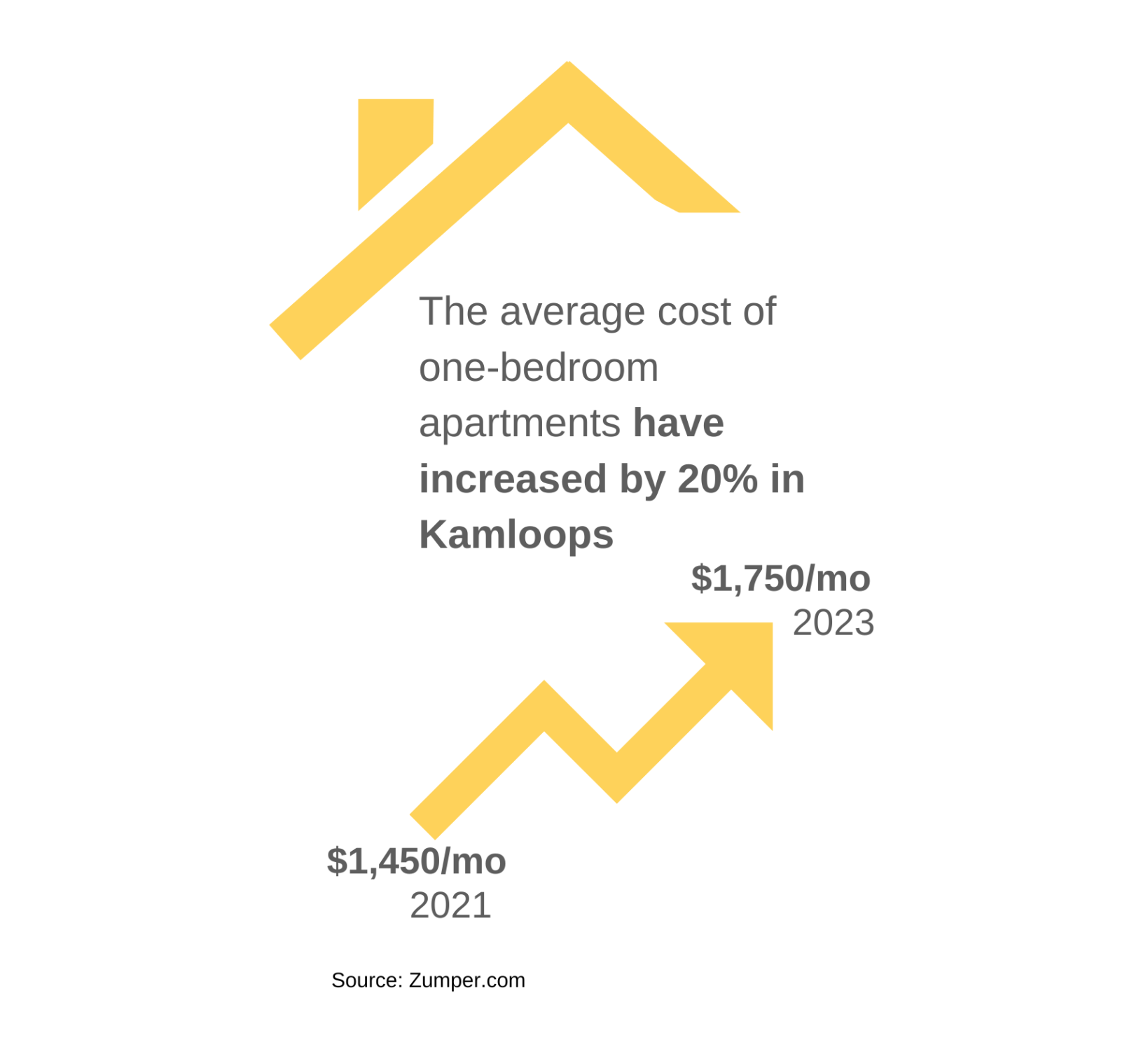

Average rent for a one-bedroom in the small, southern interior B.C. city is $1,750, up 11 per cent from last year and far more than the city’s average entry-level worker, who makes about $40,000 per year, can afford. Meanwhile, a low vacancy rate is exacerbated by a growing population — and many of the city’s new residents are evacuees from other areas of the province ravaged by annual wildfires. “It just feels so precarious for families here,” says Lindsay Harris. “Renting or buying a house is just unachievable for so many people right now.”

But far from letting that discourage her, Lindsay and her team are taking action. Lindsay is the president of Propolis Housing Cooperative, which earlier this summer launched a campaign to raise $1.1 million in community bonds to purchase a property in Kamloops’ North Shore. Propolis will then build a six-storey building on that property, featuring 50 affordable co-op housing units to be rented at 80 per cent of the market rate. It’ll also house community spaces — a theatre and a daycare — on the ground floor.

The Propolis team decided to go an innovative route to find $1.1 million of the funding needed to purchase the property: community bonds. Working with Tapestry Community Capital, Propolis launched a community bond campaign in early June, but not before lots of hard work leading up to that celebratory moment.

(New to community bonds? Learn more here.)

Étape 1 : Apprendre

Every organisation participating in Tapestry’s community bond program starts with a learning phase: what exactly are community bonds? How do they differ from other forms of financing? What are the costs and time commitment like? These are the kinds of questions the Tapestry team answers in an introductory workshop and through the early stages of working together in a phase called “planning and feasibility.”

For Lindsay, the benefits quickly became clear. As a career-long community developer — she volunteers to run Propolis; her day job is food policy implementation lead for the Kamloops Food Policy Council — the idea of mobilising the Kamloops community around housing made sense. Propolis is a cooperative, meaning residents of the building will make decisions about how the organisation operates together, democratically. So, democratising their funding through community bonds from the very beginning is fitting.

Lindsay also appreciates the do-it-yourself spirit of community bonds. “To be able to have this much ownership over a piece of our financing, and to really feel like the community is together with us in this project…it feels really good,” Lindsay says. “For a small and brand-new organisation like ours, all of these different opportunities that you have to finance a project take time and energy. You’re putting applications in and waiting a long time to find out the result, but community bonds are a financing opportunity that we have a lot of ownership over. We can set the terms that work for our organisation; we can raise the money when we need it, when the opportunity is right.”

That kind of flexibility and nimbleness is important for organisations like Propolis, which is a grassroots, completely volunteer-run organisation — and this building will be its very first project.

Étape 2 : Préparer

Once the Propolis team decided to move forward with a community bond raise, next came time to plan the campaign. To help organisations develop their community bond offering, Tapestry guides them through consulting their community and potential investors, and ultimately putting together all the documents needed to launch.

Lindsay says the process of speaking with potential investors was invaluable. “We learned how important it was to talk about the impact of our project,” she says. “A lot of times people’s investment decisions really hinge on: do they believe in the project?” Potential investors also wanted to know about the risks involved. “Being able to share with them that their investment is being used to purchase a property, so that adds additional security…that’s been really helpful.”

One important element investors can get behind? The building will be net zero.

Lindsay has teamed up with Miles Pruden, vice-president of Propolis and owner of Nexbuild Construction. Miles has a deep commitment to building energy-efficient, durable, and affordable housing, having completed an award-winning net-zero four-plex in Kamloops in 2018. Nexbuild’s approach is to build air-tight, well-insulated buildings with exposed concrete inside the building, which acts as “a giant thermal battery,” Miles explains, powering the units’ heating and air-conditioning.

Miles is passionate about making this kind of technology far more accessible than it is now. “If we have to become a sustainable society, you can’t have only special, rich people who want something to talk about at dinner parties having [net-zero homes]. It needs to be for everybody, and the only way that can happen is if it’s affordable,” he says. And building net-zero makes housing affordable, too: while upfront costs to build might be higher, over time lower energy use means lower energy bills.

The offering

After speaking with people in the Kamloops community and gauging their appetite for investment, the team decided on three levels of investment, or three bond offerings.

The first is a Worker Bee Bond — a $1,000 investment, with 2.5 per cent interest paid at the end of the three-year term. “We set that minimum so low because we wanted anyone who’s in a position to invest to invest with us. Even if someone’s not a huge investor,” Lindsay says, “their support for the project is just as important as someone who can afford a more significant contribution. Those are the people who can help us spread the word about the project. Having support from a big cross-section of the community feels important for us.”

Next up, the Queen Bee Bond allows supporters to invest $5,000 with 3 per cent interest paid annually. Lindsay explains: “We wanted interest to be paid annually [for this bond series] partly because it’s just a celebratory thing, at the end of the first year of the project, to be able to let folks who choose that series know, ‘Hey, your interest payment is on its way. The project is moving forward.’”

And for those who want to invest big in their community, a $10,000 Apiary Bond is paid with 3.5 per cent interest at the end of the three-year term.

Why all the bee references? The Propolis team explains:

“Like propolis, the resinous substance collected by honeybees used to fill crevices in the hive, we envision a community where no one falls through the cracks, and everyone has access to the homes they need. We hope that our work will pollinate community resilience and affordability more broadly across Kamloops and beyond.”

Étape 3 : Lever

Since launching, Lindsay, Miles, and the Propolis team of volunteers have been pounding the pavement, making their case to potential investors at farmers markets and other community events. “It’s been a lot of fun talking to people about something I’m really passionate about,” Miles says.

Lindsay is optimistic about how the campaign will go. Rather than convince people who aren’t yet on board with the vision for more affordable, sustainable housing, Lindsay says, “we really try to connect with people who already see the value in a project like this and have just been waiting for it to show up in the community…and I think there are so many people in the community like that.”

The challenge is figuring out the balance between sales and education, Miles says. “People don’t really understand what a community bond is. A lot of people don’t know what net-zero housing is. A lot of people don’t know what a cooperative is…It’s not a simple story,” he says, but “you can get a sense for what aspects of this people are interested in and tell the aspect of the story we think might appeal most to them — that’s an advantage.”

The next steps

The Propolis Cooperative Housing bond campaign is open now, and nearly sold out. Throughout the campaign and through the three-year bond terms, Tapestry’s investment management team now handles interest disbursements to investors, issue tax forms, and do any investor support needed.