“It’s brutal,” says Mike Bulthuis, of the housing market in Ottawa, Ontario.

And Mike sees every day just how brutal it is. He’s the executive director the Ottawa Community Land Trust (OCLT), an organization that acquires existing rental housing to convert it to non-profit and secures vacant land for affordable housing developments.

“During COVID, homelessness has become a much more visible phenomenon,” Mike says. “But I think that the affordability crisis is reaching a much wider swath of the population as well.”

The average rent for a one-bedroom apartment in Ottawa was $1,951 in July, according to Rentals.ca’s national rent report, a hike of 7.9 per cent since the same time last year. A person working full time on minimum wage simply wouldn’t be able to afford that, Mike says.

To combat those rising prices, Ottawa needs thousands of new, affordable units, Mike says. But there’s another piece of the puzzle that’s often forgotten: “We’re also losing a lot of affordable housing.”

Mike’s talking about the ‘renoviction’ trend, which tenant advocacy organization Acorn Canada calls Ontario’s “invisible eviction crisis.” Renovictions are when landlords evict tenants to make renovations — and more money. Under Ontario rules, units that are new or “extensively renovated” are exempt from rent control, so landlords can hike prices way above that average $1,951 for a one-bedroom.

Pictured to the right is an OCLT resident in their home.

How do we fight it? “One of the challenges is that people sometimes don’t quite know how to be a part of the solution,” Mike says. “And quite frankly…we need all hands on deck.”

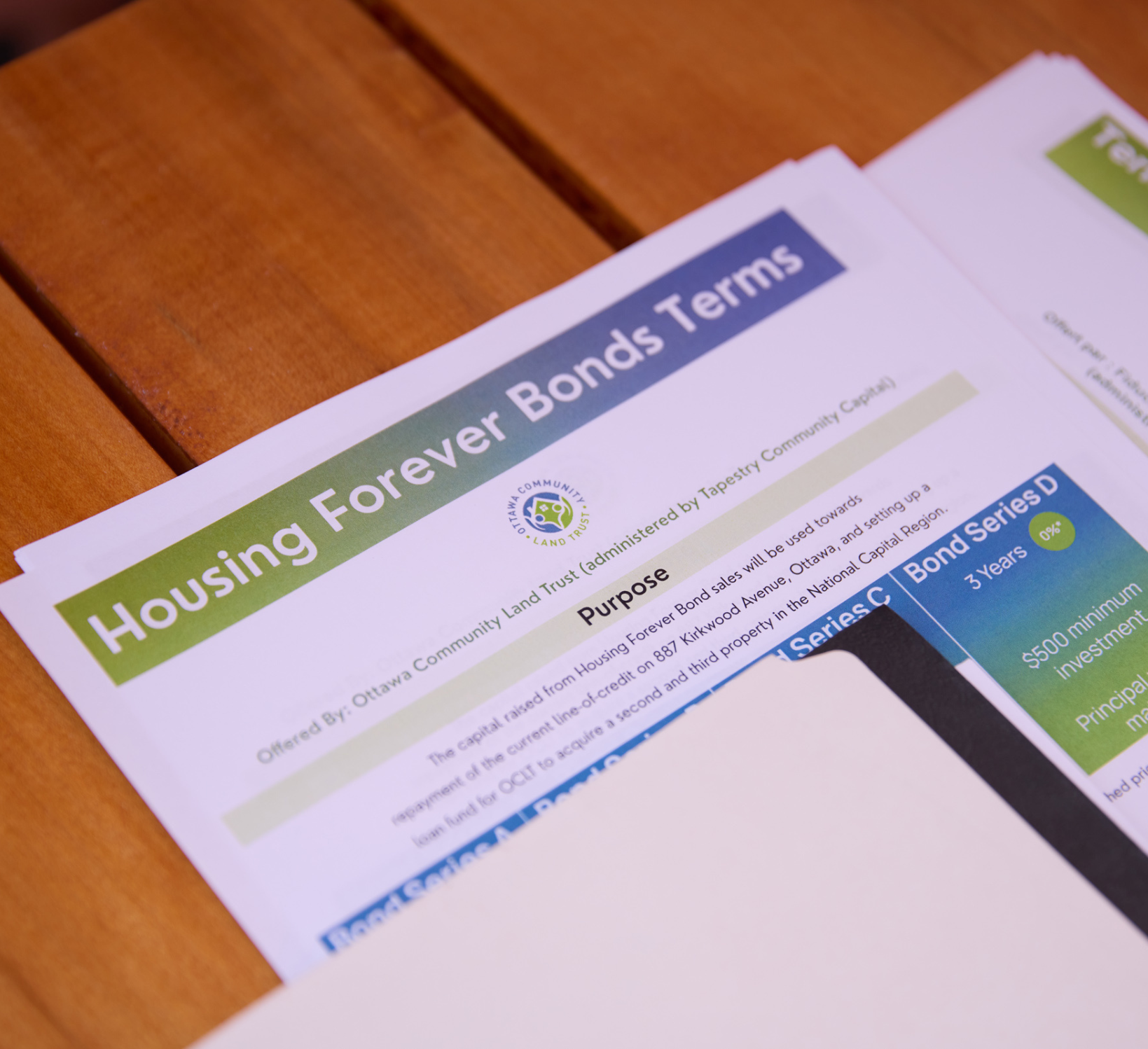

That’s why OCLT is raising $1.7 million in community bonds, to preserve affordable housing throughout the city. (New to the world of community bonds? Learn more here.)

That money will kickstart a “revolving fund,” Mike says — a fund that will be replenished through lease revenue, property renewal and refinancing. In turn, the funds will become available for additional acquisitions. While OCLT does have one property acquisition they’re currently working on, they want to make sure they’re not limited in scope.

It’ll help OCLT act more quickly when an affordable unit is at risk of being sold on the speculative market, or when a piece of vacant land is at risk of becoming unaffordable housing. “By scaling up a little bit, I think there are efficiencies to be gained,” Mike says.

Step 1: Learn

All Tapestry clients start by learning about community bonds, since they’re often a new model to organizations, in a stage called “planning and feasibility.” Workshops cover all the basics of community bonds: what they are, what kinds of projects are right for the model, and what the benefits are to communities.

A community-based organization like OCLT is a perfect fit. “What excites me about being a community land trust is that by mobilizing the assets of neighbours on a neighbourhood by neighbourhood basis, you can actually start to make things happen,” says Mike — and community bonds are a great way to do that mobilizing.

Mike also hopes to use the community bond raise to draw government attention to the issue of renovictions. He says there are very few government funding programs for organizations who save existing affordable housing (versus those who build new), hence the need for community investment. He hopes that by growing a community of people willing to invest in this solution, “governments will follow the lead of communities and other investors.”

And there’s good reason to support preserving existing affordable units: “It’s cost effective, it’s immediate, and I think there is a strong environmental argument to be made for recycling, alongside energy retrofits, as opposed to always building new,” Mike says.

It also helps combat NIMBYism, people who say ‘not in my backyard’ to new housing developments, Mike says. “In a sense, it’s the opposite, because what we’re trying to do is actually purchase properties to allow folks to stay within neighbourhoods.”

Step 2: Prepare

After learning about the benefits and efforts involved in a community bond raise, organizations then start planning their campaign. Tapestry helps organizations create a business plan detailing how they’ll earn revenue to pay bond investors back. This is the phase OCLT is in right now.

While the “revolving fund” plan was right for OCLT, it does pose a particular challenge, Mike says. When raising for “one initiative, one project,” Mike says, “it’s probably a bit easier to scope out your finances and predict your cash flow and what you need for the next 10 years. The notion of building out this fund brings in some complexity.”

Step 3: Raise

After a successful launch event at local Ottawa coffee shop Arlington Five, Housing Forever Bonds are on sale now!

At the launch, three local organizations — United Way East Ontario, Le Centre de ressources communautaires de la Basse-Ville, and Sandy Hill Housing Co-operative — each committed $100,000 investments in the campaign, bringing the campaign immediately up to about 20 percent of its total goal.

Stay tuned for more updates!