One of the most common questions we receive from groups interested in raising community investment is “What is the right amount to be raising in bonds and how will this financing fit with our other sources of funding?”

The long and short of it is, there is no correct financing mix. Every organization that we work with is unique, and therefore, there is no magic one size fits all answer to this question.

However, in this blog we will attempt to give you some high-level ideas and thresholds for project financing. Once we begin to work with your organization and better understand your project and financial situation, we will be able to provide your team with some guidance on how much your organization can raise in community bonds.

We always recommend that this work is done in close cooperation with your finance/accounting team and Board Members, as they will have important insight on the risk tolerance of your organization and its capacity to carry debt.

Types of financing available to nonprofits, charities and co-operatives

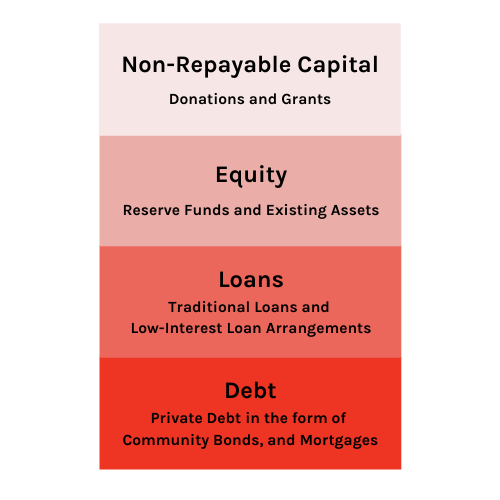

When we speak of an organization’s project financing, we will often refer to their capital stack. In simple terms, the capital stack represents the underlying financial structure of an asset or real estate deal. Often, the capital stack is presented as a graphic that shows the different types of capital in a deal stacked above each other, like a cake with many layers.

Types of financing that may appear in a capital stack:

In the case of co-operatives, it’s also possible to issue preferred equity in the form of preferred shares. This cannot be done for charities or non-profits because they cannot be owned.

Finding the right mix for your organization will mean balancing your appetite for risk and your cash flow situation. Ultimately, the goal of your organization should be to align your sources of financing with your project timelines and key cash output milestones, and balance this with finding the lowest cost of capital through a combination of the tools above.

Percentage of total financing

There is no correct percentage of bonds within an organization’s capital stack. It could be as little 5% for a large project or as much as 100%. In the past, most of our clients have raised 10-40% of their total financing in community bonds.

For certain organizations, it may make sense for the bond total to be a larger piece of the puzzle. This is common when an organization needs to access a large sum of capital quickly, and don’t have the time to fundraise, or when traditional lenders are only willing to finance a smaller piece of the project.

“Bonds are such a great tool for community organizations to use when considering a capital raise,” says Mary Warner, Co-Executive Director at Tapestry. “Community bonds allow the organization to set the terms of the financing in a way that works best for them and allows them to reach out to their community in a new way, offering a chance for their supporters to invest in the future of their project, and to directly benefit from a financial return on that investment”.

Total dollar figure

“There are a lot of factors that go into determining how much an organization wants to raise but we have seen many partners accomplish their goals in raising between half a million and five million in their first raise,” says Mary.

Setting an initial goal within this range can help set your organization up for success. This is simply because the concept of bonds will be new to your community, there will be no existing marketing and messaging around your project, and you won’t have had the opportunity to test your community’s appetite for investment yet.

Due to certain fixed costs (ex. Legal, marketing etc) raising less than $500,000 in bonds isn’t generally a cost effective way to raise capital. Typically, the more you raise, the less it will cost per dollar of financing.

Once an organization has successfully completed an initial raise, they will have the opportunity to tap into their existing investor base and issue reinvestment campaigns. They can also build on the message of a successful bond raise and consider raising bonds for different projects in the future.

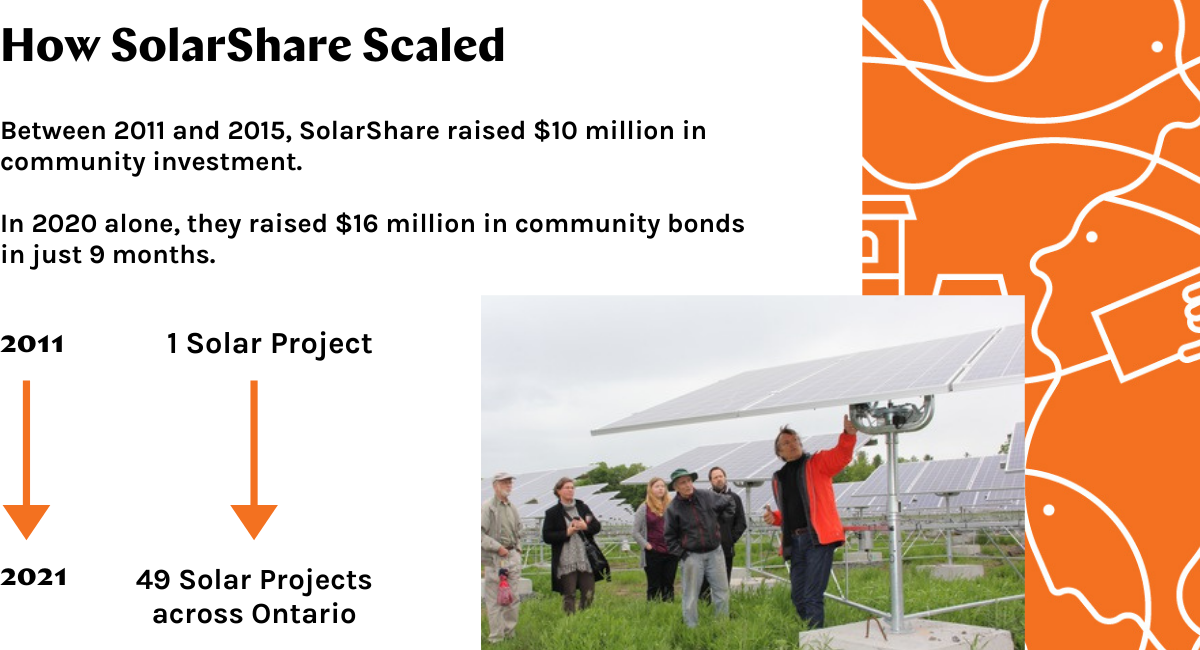

“We’ve seen this type of sequential bond raise with several partners, including SolarShare and ZooShare,” says Mary. “Building on the success of their initial raises, and foundation of proven ability to raise and manage community investments, has allowed these organizations to expand their projects and further their missions.”

We often see reinvestment campaigns that are much larger than first time raises. This is because, with time, issuers become more comfortable with their investor base, gain a better understanding of their community’s appetite for investment, and have built a solid marketing narrative around the organization, project and offering.

For example, our largest single raise to date has been $16 million, and this was a reinvestment campaign for an organization that has done repeated raises.

If a first-time raise over $5 million dollars is being contemplated, there are many things the organization will have to consider to ensure the raise is successful, including having sufficient staff and marketing support to maintain momentum.

Some organizations may have an easier time with a larger first campaign if they have:

- Experience running a substantial capital fundraising campaign

- A large and engaged pool of donors, members or supporters

- A large project that will gain significant community and/or media attention early on

Deciding which types of financing should be used for different expenditures

Ideally the duration of the liability should match the duration of the asset, to the extent possible. In simple terms, this is why a mortgage would have a 25 year maturity, while a car loan would have a 3-5 year maturity.

In the context of your project, you should be thinking of the underlying asset of your project, and its associated projected cash flow.

Generally, community bonds will work well for funding long-term assets. A line of credit would be better suited to funding a short-term project or addressing a short-term funding need.

Relationship to other funding sources

Typically, if there is a mortgage in place for a project, community bonds will be subordinate to the mortgage. In other words, in the case of a default, the financial institution holding the mortgage will have the first right claim on the asset, followed by the community bond holders.

These details will be negotiated as part of your mortgage deal, and you should inform your financial institution of your intent to raise community bonds. In our experience, traditional financial institutions welcome community bonds as part of the financing mix as they view them as standing in the place of equity, and as an additional capital buffer.

“When considering community bonds as part of your capital stack, if it will be in tandem with a mortgage, it is important to engage the mortgage lender with the idea early on,” says Mary. “We have seen many organizations use both community bonds and a traditional mortgage so it is a possibility but it is important to be clear with the lender or potential lender about your intentions so that you can have firm expectations about how much will be raised and what the timelines for financing are.”

Where do we start?

Figuring out your project financing can be complex, and at Tapestry we understand this very well. We are always happy to speak to your finance/accounting team about how community bonds could fit into your own unique mix.

If your team is interested in pursuing community bonds as a source of financing, we encourage you to reach out to our team and register for our Intro to Community Bonds Workshop.