Charities are one of three types of organizations in Canada that can make use of community bonds to raise investment from their supporters. What makes charities unique from the other two groups – co-ops and non-profits – is that they also have the ability to seek donations and offer tax-receipts to donors.

As community bonds and philanthropy are so different, yet both important types of financing, we are often asked if the two can work hand-in-hand for charities.

We sat down with Cathy Mann, founder of the Fundraising Lab, to tell you that yes, it can be done and there may be benefits to combining these two types of funding that you haven’t realized yet.

Cathy has over 20 years of experience teaching fundraising in college and university, and over 25 years of experience working as a front-line fundraiser and consultant. Cathy developed the Fundraising Lab to share fundraising skills and her best advice to help more charities achieve their mission.

Community bonds are an exciting tool for Charities

Community bonds are a social finance tool, similar in many ways to a traditional bond. They are an interest bearing loan from an investor, which has a set rate of return and a fixed term. The major difference is that in addition to offering a modest financial return, they also offer a social or environmental return.

Most charities will be familiar with traditional fundraising and building relationships with donors. They will also be familiar with donor fatigue and the struggles that can come with trying to align capital fundraising with project timelines. What community bonds do is create a new vehicle for accessing funds that might not otherwise have been possible to tap in to.

“Impact investing is such a hot topic right now,” shares Cathy, “there are a lot of institutional funders out there that don’t have a place to put the money they have earmarked for impact investment. Community bonds create a new avenue for these investors to make a return while also ensuring that money is doing good in the community.”

And it’s not just institutional investors who are searching for community bond investments. In fact, in a community bond campaign the majority of investors are your average retail investor interested in making an impact, or someone who is already a supporter of the issuing organization.

“I think community bonds are a really interesting form of financing” says Cathy, “but that doesn’t mean they are for everyone.”

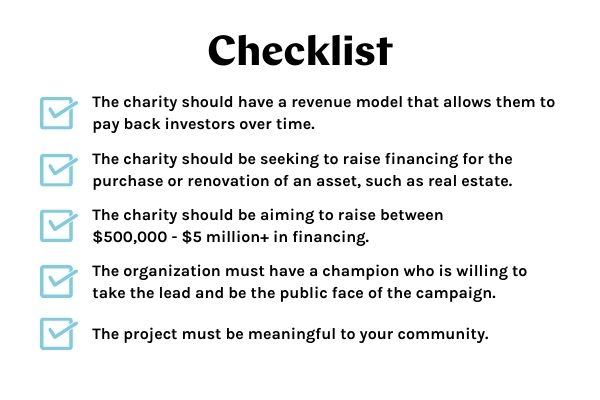

“I don’t want to be a Debby Downer,” she laughs, “but there is a checklist of conditions for charities interested in this tool.” Most importantly, the charity must have a revenue model that will allow them to repay investors over time. The second important condition is that the charity be raising the financing for the purchase or renovation of an asset, most likely real estate.

Financing to match project timelines

One element of community bonds that is often appealing is that they allow charities to access a lump sum of financing upfront. “With a typical capital campaign, donations come in as pledges, and those pledges are paid out over the course of 3-5 years,” explains Cathy. “This is something that many charities engaging in a capital campaign for the first time don’t realize.” Adding bonds into the financing mix can potentially help with project rollout, as these funds are available upfront.

Are charities ready for social finance?

“Some charities are better positioned to take on debt than others, and feel more comfortable,” shares Cathy. “My clients haven’t had a lot of experience in this area solely because most don’t own property, and without property, there is nothing to secure a loan. So many charities just don’t have a lot of experience with taking on financing.”

But that may be changing now with the emergence of community bonds. Charities are becoming more and more inventive with social enterprise models, there is growing government support in this area, and with rising rents across Canada, the business case for owning vs. renting is often there.

“I hope this model of financing becomes more prevalent,” says Cathy. “I think seeing somebody else do it first is going to make a big difference.”

What if Donors only want to be Investors moving forward?

Most recently, Cathy has been working with a charity called SKETCH Working Arts on their capital campaign Project Home. This $1.52 million fundraising campaign happens to be running alongside a $1.4 million community bond campaign that we at Tapestry are supporting with.

In total, SKETCH will be raising $4 million to purchase their studio and admin space, where they support homeless and marginalized youth through mentoring and development in the arts.

SKETCH is a great example of a charity that has been successful in running these two types of campaigns in tandem, and managing both investors and donors at the same time.

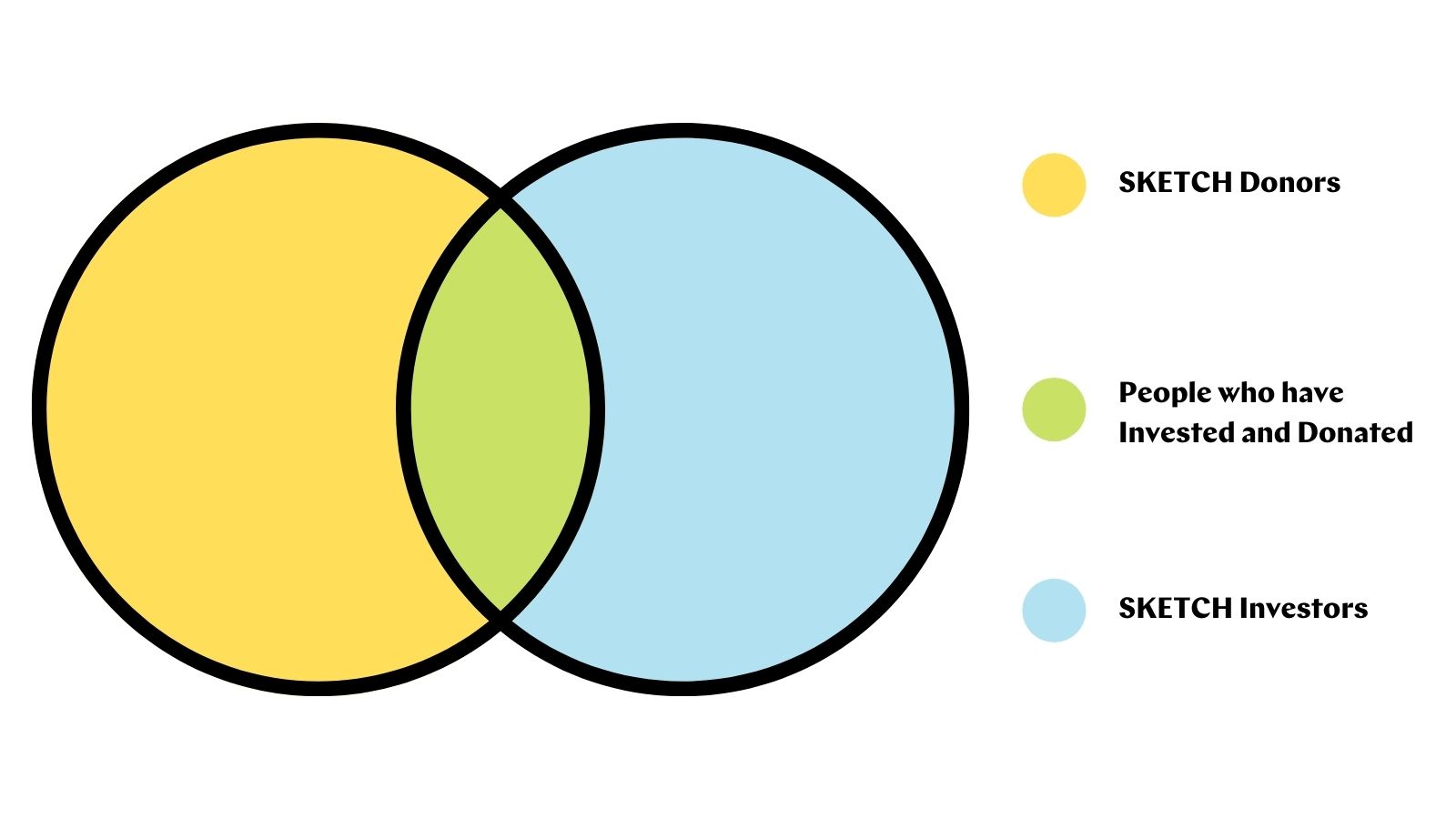

“I think there is a legitimate fear that some donors may choose only to invest,” says Cathy, “and this may be the case for some, but what we have learned from SKETCH is that many donors just want to remain donors, or want to donate AND to invest.”

At Tapestry, we’ve also seen that community bonds can re-engage lapsed donors. “Some may have stopped giving years back but are now interested in supporting the organization in a different way,” shares Jennifer Bryan, our Senior Campaign Manager.

The key according to Cathy, is that you need to make sure you have a good plan for both your fundraising campaign and community bond campaign before you begin on either element. “What is really critical is to speak to your donor base when you are in the planning phase to see what their reactions are and which way they will lean,” she says.

“In our experience, community bonds have actually extended the reach of our community,” says Dale Roy, Marketing and Resource Development Associate at SKETCH. “Community bonds allowed us to tap into a new group of people we never realized were out there. We hope that our investors will continue to support our work even once this project is complete.”

The Giving Bond

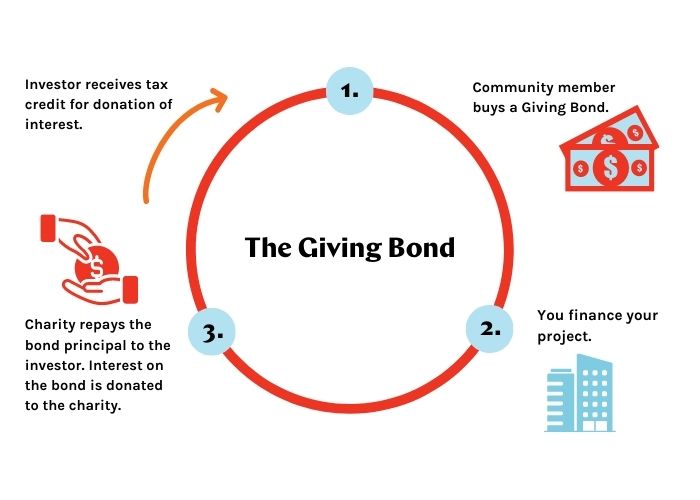

“The SKETCH creation of the Giving Bond has been amazing,” says Cathy. SKETCH is the first organization in Canada to utilize this form of a community bond. How it works: an investor purchases the bond, they receive their full principal back at the end of the term and the interest is donated to SKETCH. The investor then receives a tax receipt for the donation.

In a sense, the Giving Bond allows investors to make a donation, and gives the charity an interest free loan. “Lots of organizations just get tripped up by the notion of making the interest payments. So for many organizations, it might be easier for them to consider if it can be viewed as an interest free loan,” says Cathy.

The keys to success

One of the main reasons that SKETCH has succeeded, in Cathy’s opinion, is that they had a donor base that would support this kind of initiative. “They have great relationships with their supporters and a sizable group of people that they could reach out to from the get go.”

They also had experience with major gift fundraising, which was a great starting point for them. This meant that they already had a lot of the necessary infrastructure in place. They were able to take these existing tools and knowledge and pivot to effectively communicate with investors, whom require different messaging from donors.

“The other thing is that people love Rudy,” Cathy says with a big smile. Rudy Ruttimann is the Executive Director of SKETCH and the lead on Project Home. “She is a force to be reckoned with.”

“She was just so determined that this was going to succeed, that people got caught up with that enthusiasm, and believed in it because she believed in it so strongly.” Of course, Rudy also has an amazing team supporting her, to whom Cathy gives her kudos. It was SKETCH’s volunteer financial consultant, Michael Sacke, who initially put forward the idea of alternative financing, and he was a champion for the idea of community bonds from the start.

Some advice to charities interested in Community Bonds

“Prepare for some nail biting,” she says with a grin. “It’s not for the faint of heart. There will certainly be moments of doubt, and ups and downs, but in the end it can really pay off. This is something really cutting edge and exciting, and people want to be part of that.”

Are you interested in using community bonds to raise investment for your charity? Get in touch at info@tapestrycapital.ca.