Over the last decade, governments and social purpose organizations have been responding to the growing need for social and environmental services by developing and using innovative finance tools to both grow the base of community assets, and expand programming. Two tools that have received a lot of attention, and are gaining traction, are Community Bonds and Social Impact Bonds.

At Tapestry, we’re often asked what the difference is between these two tools, so in this article we will attempt to set the record straight.

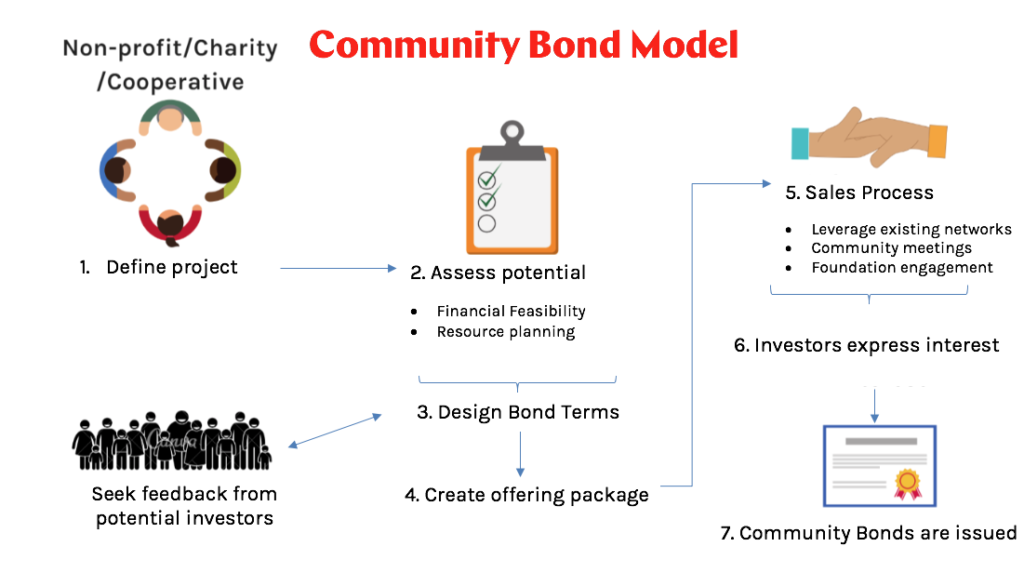

Community Bonds, by definition, are a debt financing tool issued a by non-profit, charity or co-operative organization. In simple terms, Community Bonds give these organizations the opportunity to take loans of varying sizes directly from their community of supporters. Both sides win – their supporters are paid interest for investing in a project that is meaningful to them, and the issuing organization gains access to the capital they need to grow.

In order to repay their investors, organizations issuing Community Bonds must have a revenue model. For example, an artist co-operative might issue community bonds to purchase a building. They will have revenue streams from operating a storefront, leasing studio space to their members, and renting out their event venue. This artist co-operative would be a good fit for a community bond raise because they have a way to repay their investors and have a strong base of supporters through their co-op membership and patrons.

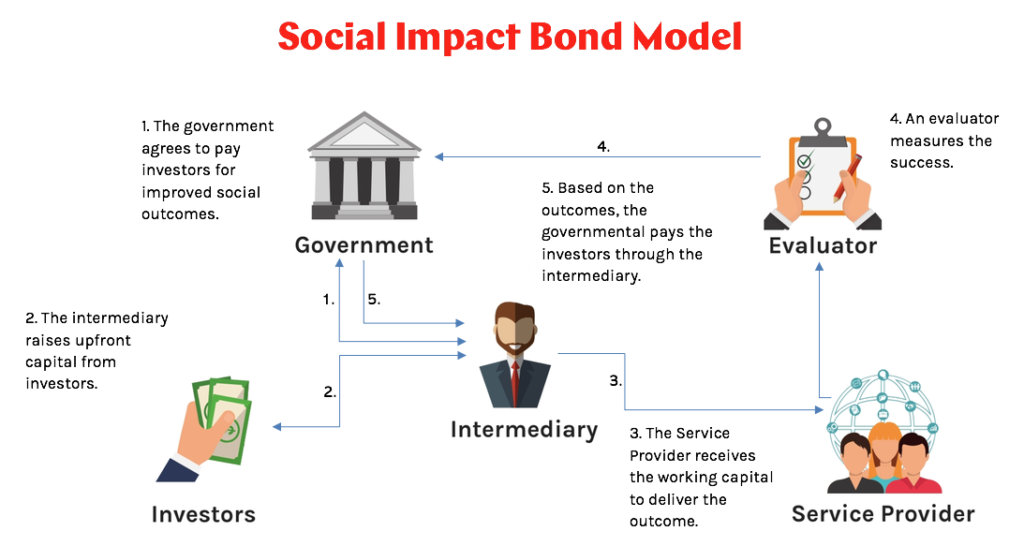

Social Impact Bonds are similar in some ways because they are issued by community focused non-profits and charities. They too, create impact investment opportunities for individuals who believe in the mission of the issuing organization. The main difference is that the issuing organization has established an agreement with the government, where the government will pay for performance by the non-profit or charity. The payment from the government is tied to clear social or environmental outcomes to which the issuing organization has committed. These are the funds that are used to repay investors. So rather than investing in the business model of a social enterprise (as is the case for Community Bonds), investors in SIBs are investing in the organization’s ability to realize detailed social or environmental outcomes.

For example, a community service organization that houses and provides employment training to homeless youth could establish a pay-for-performance contract with the government where they commit to housing and employing 80 youth. This organization could then issue debt in the form of an SIB to their community of supporters. Their investors will be repaid at the end of the program, assuming the organization has achieved the outcome to which they committed with the government.

According to the Ministry of Economic Development, Job Creation and Trade, “SIBs are not bonds, per se, since repayment and return on investment are contingent upon the achievement of desired social outcomes; if the objectives are not achieved, investors receive neither a return nor repayment of principal. SIBs derive their name from the fact that their investors are typically those who are interested in not just the financial return on their investment, but also in its social impact”.

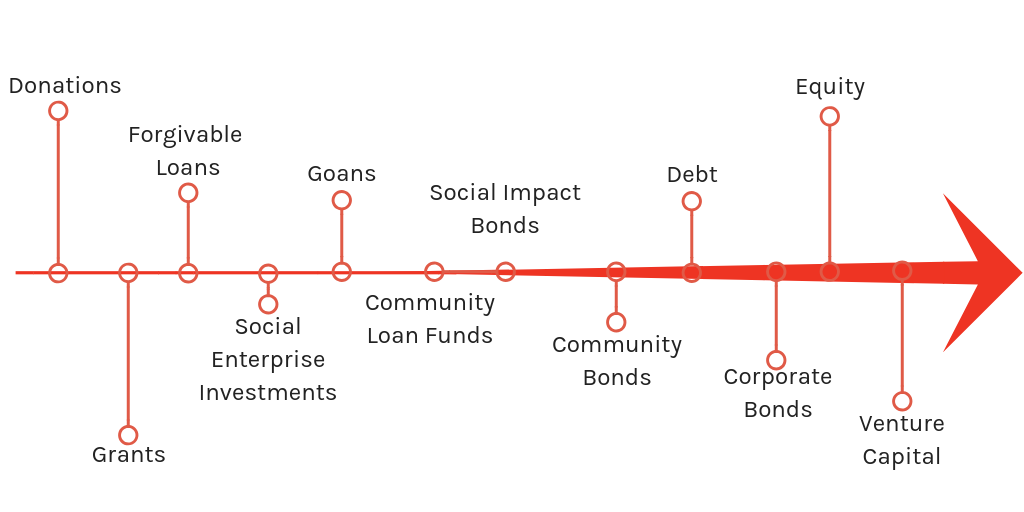

Where do these tools sit on the Investment Continuum?

What are the main characteristics of Community Bonds vs. SIBs?

What are the main characteristics of Community Bonds vs. SIBs?

How do the investor groups differ?

As SIBs aim to solve big social challenges on behalf of the government, these programs often require larger capital injections than a project that may successfully issue Community Bonds. Thus, the investors targeted for SIBs are often high net worth, accredited investor. On the other hand, Community Bonds enable people of average means to transform from occasional donors or volunteers into citizen investors.