Tapestry Community Capital has been selected as a winner of the Canadian Housing and Mortgage Corporation (CMHC) Housing Supply Challenge to scale up community investment in the affordable housing sector.

“We are incredibly excited to have the support of CMHC,” says Ryan Collins-Swartz, Co-Executive Director of Tapestry. “With this funding, we will help affordable housing providers to tap into a new source of capital, enable more projects to get off the ground, and increase the supply of affordable housing in Canada.”

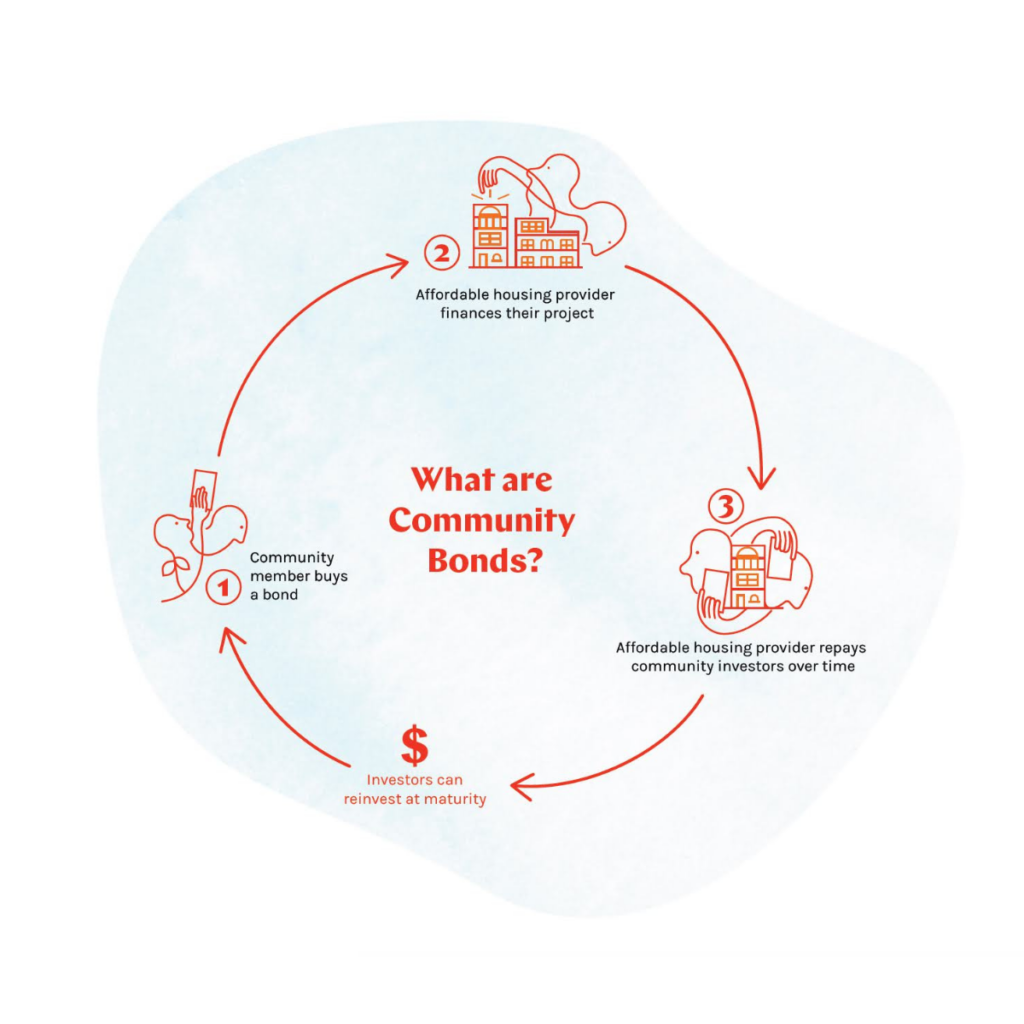

Community bonds are a social finance tool used by nonprofits, charities and co-ops to finance capital projects with impact. Similar to traditional bonds, they are interest bearing loans. The key difference – they provide investors with both a financial and social return.

While unlocking private capital, community bonds also build a powerful sense of community ownership. Residents, local businesses, and institutions alike can all invest to improve their community, while earning a fair return. Organizations such as Brique par Brique in Montreal, QC and The Mount in Peterborough, ON have successfully utilized community bonds to finance the construction of affordable housing.

“We have witnessed the power of community bonds to garner community support for projects,” says Mary Warner, Co-Executive Director at Tapestry. “When someone becomes an investor, they are not only becoming financially invested but also emotionally invested in the outcome of the project. For a sector that is often afflicted by NIMBYism, this support is critical.”

Tapestry is working with multiple partners to support program implementation. Key to the solution are a series of demonstration projects that will utilize and showcase the community bond model. Cumulatively, these projects will leverage $40 million in community investment, financing over 2000 affordable housing units.

“We are thrilled to be partnering with Tapestry to build a long term, sustainable, and value aligned funding source for our organizations to acquire and preserve affordable housing,” says Chiyi Tam, Executive Director of the Kensington Market Community Land Trust. “We are eager to forge a path forward, demonstrate the community bond model, and support other like minded organizations to follow in our footsteps.”

The solution also focuses on increasing the participation of retail and institutional investors in affordable housing. By raising awareness among investors and streamlining the process to invest in community bonds, Tapestry will grow the community investment marketplace tenfold.

“We know there is very strong interest among investors to support affordable housing projects and Tapestry is creating the pathway to make that a reality across communities” says Mritunjay (MJ) Sinha, Tapestry Board Member and responsible and impact investment advisor.

The program launched in early October and will run until March 2024. For more information about the upcoming events and support for community financing, sign up to The Thread newsletter here.

Photo credit: Cathy Crowe

About Tapestry Community Capital

Tapestry Community Capital is Canada’s leading non-profit service provider for community bonds. For the last decade, Tapestry has been supporting social purpose organizations across Canada to assess, structure, and manage community investments. Tapestry has supported in raising over $100 million from over 4,000 community investors.

For media inquiries, please contact Stephanie Pinnington at Stephanie@tapestrycapital.ca.

About the Housing Supply Challenge

The Housing Supply Challenge is an innovative competition that encourages interested parties from across the country to propose creative solutions to Canada’s housing crisis. The goal: to help meet Canada’s pressing need for safe and affordable homes by breaking down barriers to the creation of new supply.

Tapestry participated in Round 2 of the program, Getting Started, which seeks to find solutions to pre-development challenges, such as community resistance and obtaining financing. The program granted incubation funding to 29 organizations to allow them to further develop and test their solution proposal. After six months of research and consultation, Tapestry submitted a final solution funding proposal – “Financing Affordable Housing with the Power of Community”. Tapestry is one of 14 organizations selected for funding and will share a pool of $38 million to implement their solutions.

“I believe in a future where profits are returned to supporters rather than banks, and where investors can feel proud that they put their money in something that they believe in. To me, ‘co-operation in the world of tomorrow’ means communities coming together to support a common goal and jointly investing the capital it will take to realize that vision.”

“I believe in a future where profits are returned to supporters rather than banks, and where investors can feel proud that they put their money in something that they believe in. To me, ‘co-operation in the world of tomorrow’ means communities coming together to support a common goal and jointly investing the capital it will take to realize that vision.” “A Co-operative offers it’s members a concrete way to contribute to our inter-dependent reality; one where bridges replace walls. At Tapestry, when I see a cool Co-operative in action – one with shameless idealism and a strong collective resolve – I feel alive.”

“A Co-operative offers it’s members a concrete way to contribute to our inter-dependent reality; one where bridges replace walls. At Tapestry, when I see a cool Co-operative in action – one with shameless idealism and a strong collective resolve – I feel alive.”  “I imagine a world where problems, such as climate change, homelessness and poverty, are not shrugged off due to profit’s bottom line. I see inclusive communities whose inhabitants, both human and non-human, flourish with home-fullness, vibrant public and active transportation, and an economy based on the health of the planet.

“I imagine a world where problems, such as climate change, homelessness and poverty, are not shrugged off due to profit’s bottom line. I see inclusive communities whose inhabitants, both human and non-human, flourish with home-fullness, vibrant public and active transportation, and an economy based on the health of the planet.

Recent Comments