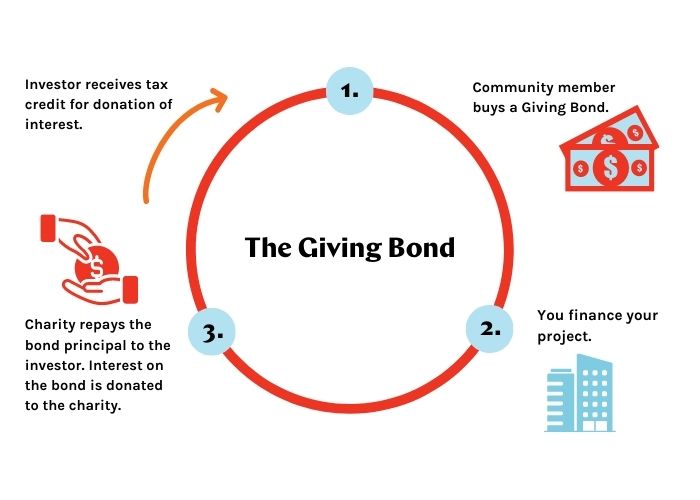

Community bonds can help you scale-up your non-profit, charity or co-op, and take ownership of important assets that you need to achieve your mission. They can also help you to strengthen and deepen meaningful ties to your community.

When a community member invests in your project, they are becoming part of your dream and vision. They are also putting trust in you to carry out your project efficiently and run your operations in a manner that will ensure that investors are repaid.

You might think that a community bond campaign ends when all the funds are raised. But at Tapestry, we have seen that our most successful clients are those that steward their investors from their first interaction with the organization all the way through to when their bonds mature, and beyond.

So, what does Investor Stewardship mean?

Effective investor stewardship means managing your investors and caring for their needs. You can look after your investors by staying in regular contact with them, giving them news and information about your organization and the project they are supporting, and providing reassurance that your bond campaign and project are running according to plan. In our opinion, the key elements of investor stewardship are:

Investor onboarding: First impressions are everything. This may be an investor’s first transaction with the organization and if you want to instill trust, this is the most important starting point. Information about the investment and organization should be presented clearly and provided on time, someone should always be available to field questions via email or phone, and there should be immediate follow-up once the investment is received.

E-newsletter: A monthly e-newsletter is one the most effective ways to keep in touch with your investors. In your newsletter you can share details about your investment campaign, project updates and highlights, and even industry news.

Social media: Social media provides a more informal channel to give your investors updates about what is happening within your community. Social media also allows investors and influencers to engage with your news and content, and share within their own network.

Seek input: Community bond investors often want to go beyond putting their money in an organization. Occasionally seeking their guidance or input via surveys or at events can help strengthen your relationship by making them feel that they are a meaningful part of your mission.

Professional Investment Management: Ensuring that investors are paid interest or dividends on time and in a professional manner is critical. You will also want to ensure that they receive the necessary tax forms at the appropriate time of the year, and that you can give statements and updates on their investment whenever they request them.

The Centre for Social Innovation (CSI) created Founders Bricks for their investors.

There are also many creative ways that you can acknowledge and thank your investors. Some organizations may choose to give investors naming rights of spaces which they are building, as is often done in a capital fundraising campaign, while others might choose to send a small gift.

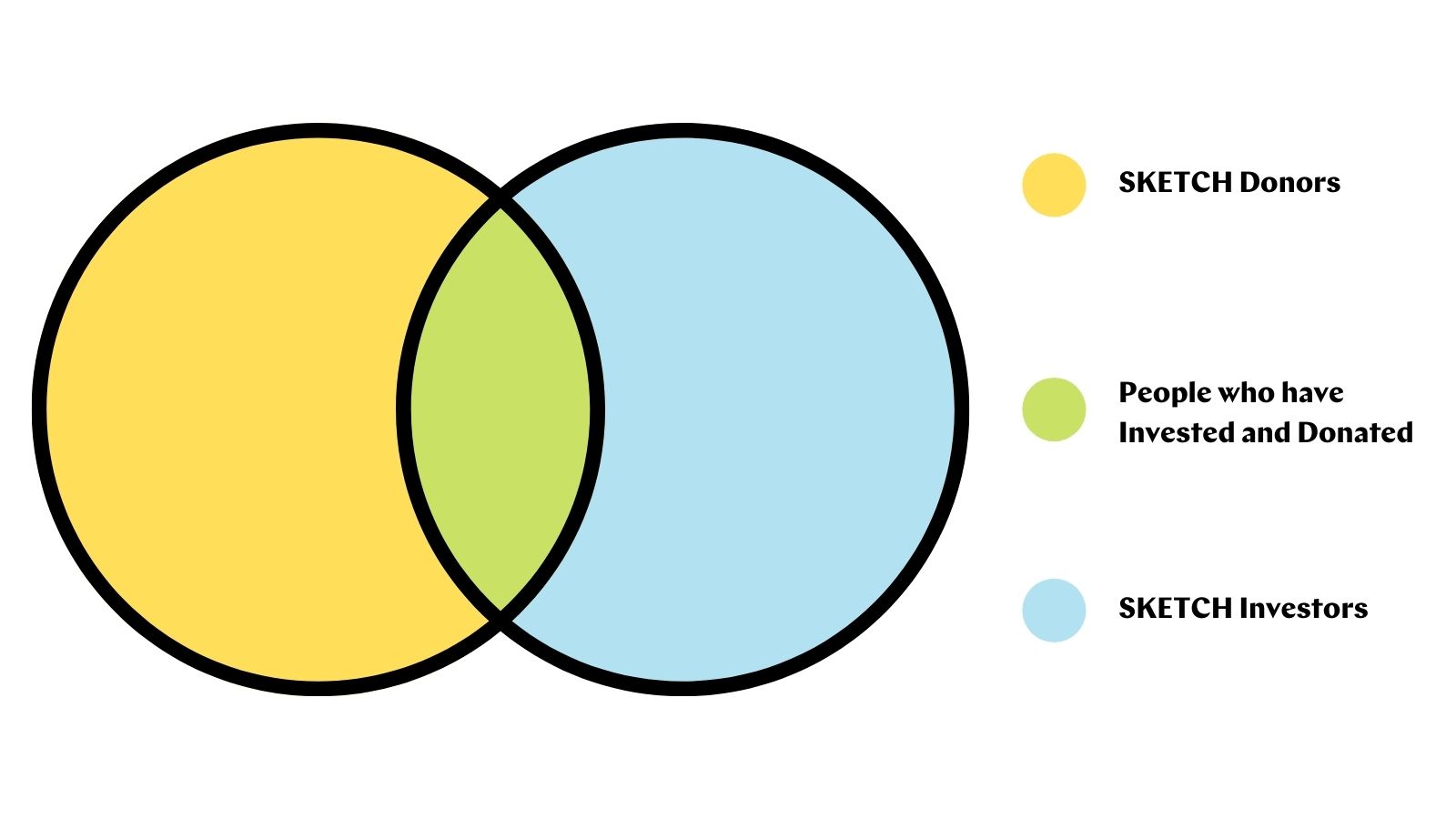

SKETCH Working Arts recently completed a $1.4 million community bond raise, to purchase their admin and studio space. Over the holiday season, in order to thank investors, SKETCH distributed coffee and brownies to everyone that made an investment.

Small gestures like this don’t have to be costly. In the case of SKETCH, they had the coffee donated and the brownies were baked by volunteers in their community kitchen. This was a low cost but memorable acknowledgement of the role that their investors are playing in bringing their vision to life.

Why is investor stewardship so important?

Your investors will be powerful spokespeople for your project, your investment opportunity, and your mission. If they have a positive investment experience, are able to trust in you, and have access to investment and project details, they will share this opportunity with others in their network.

“Word of mouth is actually the single most important source of new investment,” shares Jennifer Bryan, our Senior Campaign Manager at Tapestry. “In addition to generating new investment, stewarding investors throughout the life of their bond can mean that when their bond matures, they choose to reinvest in any new investment opportunities the organization has.”

Investors touring SolarShare’s Abbey Dawn installation (pre-covid). This is their 37th project.

SolarShare is a community power co-operative that sells bonds to finance community-owned solar projects. “They have over a 70% reinvestment rate, meaning that when bonds mature, 70% of investors will choose to put their money back in,” says Jennifer. “This pool of dedicated investors meant that SolarShare could scale extremely rapidly.”

To give you an idea of just how quickly they scaled, from 2011 to 2015 they raised $10 million total in investment. Last year, in 2020 alone, they raised $16 million in 9 months. SolarShare started with just one solar project and now has 49 solar projects across Ontario.

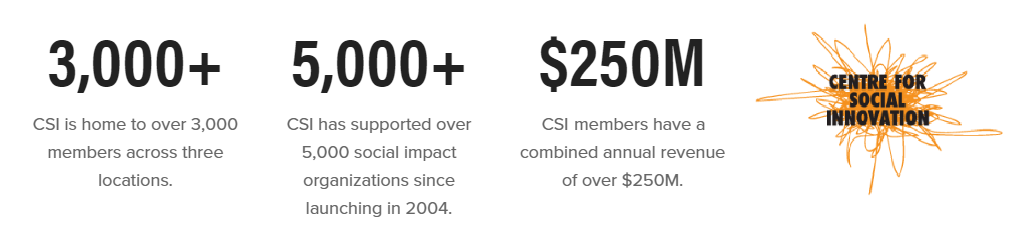

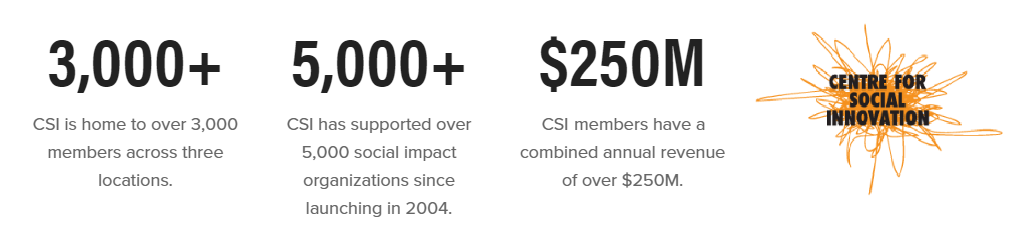

“The Centre for Social Innovation (CSI) also has a fantastic growth story,” says Jen. Their first bond campaign in 2010 raised $2 million to help them purchase their first building in downtown Toronto. Four years later, in 2014, they were able to turn around and re-approach investors to raise another $4.3 million to purchase a second building.

“What is truly incredible,” shares Jen, “is that in 2020, amidst a global pandemic, CSI was able to raise another $1.9 million in community bonds in just 41 days.” The speed at which their bonds sold out is a testament to the trust that investors have in CSI.

How can Tapestry help?

Building a community bond campaign means forging lasting relationships with your investors. Building these relationships takes time. “We often find that organizations don’t have the bandwidth to dedicate resources and time to stewarding investors, and this is why we are here to help,” says Jen.

“We see ourselves as a temporary part of your team, providing the additional resources to make sure that your investors receive the attention they need. We can provide advice, tools and templates to help you on your way. We don’t have to reinvent the wheel here,” says Jennifer, “we have done this so many times now that our process and methods are well formulated.”

Are you interested in using community bonds for your project? Get in touch.

Sattu brings to our team a wealth of experience in both social enterprise, and marketing and sales. He is a graduate of the MBA program at the Schulich School of Business, and a self professed pragmatic altruist and idealist.

Sattu brings to our team a wealth of experience in both social enterprise, and marketing and sales. He is a graduate of the MBA program at the Schulich School of Business, and a self professed pragmatic altruist and idealist.

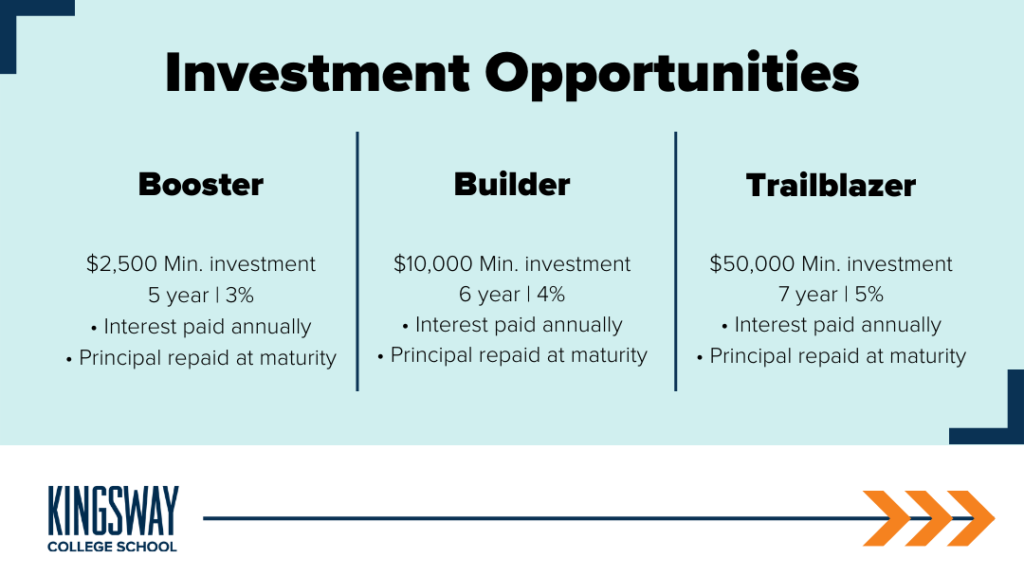

“We’ve intentionally launched a series of bonds to suit a wide array of people in our community, while offering them a competitive return at the end of each year,” says Bronwen Evens, Chair, KCS Board of Governors. “A Major pull is that our bonds are backed and secured by our real estate and are not correlated to financial markets.”

“We’ve intentionally launched a series of bonds to suit a wide array of people in our community, while offering them a competitive return at the end of each year,” says Bronwen Evens, Chair, KCS Board of Governors. “A Major pull is that our bonds are backed and secured by our real estate and are not correlated to financial markets.”

Recent Comments