On October 17th, Tapestry was joined by more than 80 non-profits, charities, co-operatives and social enterprises in Ottawa, all eager to learn how social finance can help them scale-up their impact. The question among all of them – where do we start? What are the tools that we can put to work in our favour?

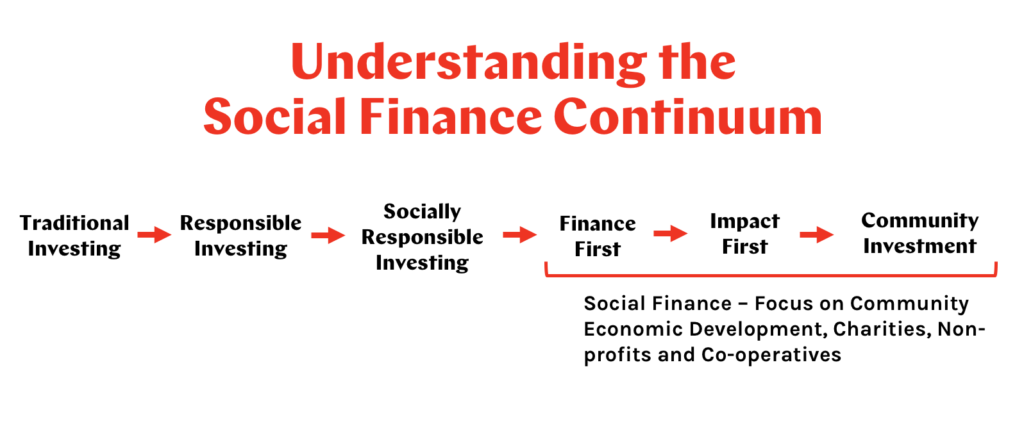

Social enterprise is still a very new, and arguable poorly understood, sector of the economy. Even less explored is the realm of social finance.

So what is social finance?

Social finance is an approach to mobilizing private capital that delivers a social dividend and an economic return to achieve social and environmental goals. Mobilizing private capital for social good creates opportunities for investors to finance projects that benefit society and for community organizations to access new sources of funds.

The term can include community investing, microfinance, investing in socially-responsible and sustainable businesses (such as B-Corps), social impact bonds, and social enterprise lending. A social investment is not a grant or donation; it’s repayable, with interest.

Tapestry works specifically in the space of community investment. We make use of a social finance vehicle called a Community Bond. Simply put, a Community Bond, is an interest bearing loan from a community member. It could be for as little as $1000 or more than $1 million, but the bonds must always be repaid, providing a fair interest return and a proven social or environmental benefit.

Tapestry works specifically in the space of community investment. We make use of a social finance vehicle called a Community Bond. Simply put, a Community Bond, is an interest bearing loan from a community member. It could be for as little as $1000 or more than $1 million, but the bonds must always be repaid, providing a fair interest return and a proven social or environmental benefit.

To shed light on other tools across the social financing continuum, Tapestry brought in partners including:

Vancity Community Investment Bank

Vancity works exclusives with organizations and entrepreneurs that are working to solve environmental, social and economic challenges. Committed 100% to impact, Vancity offers project, portfolio, and business lending; impact capital transaction advisory services; and investment banking for community and environmental enterprises.

Ottawa Community Foundation

The Ottawa Community Foundation (OCF) is a non-profit organization created by and for the people of Ottawa to connect people who care with causes that matter. OCF recently launched a new Impact Investing Strategy that will allow the Foundation to go beyond their traditional grant-making role by helping charitable and non-profit organizations access loans, guarantees and mortgages. Under the terms of the Strategy, OCF will allocate up to 10% of their endowment to impact investing.

The Ottawa Community Foundation is also one of the lead investors in the Community Forward Fund, a fund which lends exclusively to charities, non-profits and social enterprises.

PARO Centre for Women’s Enterprise

As a not-for-profit social enterprise, PARO collaborates to empower women, strengthen small business and promote community economic development across Ontario. PARO has become well know for their Peer Circles – small groups of like-minded women who meet regularly to share their experiences, offer advice to each other and expand their individual and shared contact networks.

One of the key elements of a Peer Circle is that members also provide access to micro-credit of between $500.00 and $5,000.00. Members of the Peer Circle are involved in the review and approval of a member’s PARO loan application before it is approved. Today PARO is one of the strongest peer lenders of small business loans in North America, supporting a diverse range of women who may have no or poor credit history, and no sources of equity.

Centre for Social Enterprise Development (CSED)

CSED is a non-profit organization based in Ottawa that offers a wide range of services to social enterprises, including access to technical expertise, coaching, financing, learning communities, training, and cross-sector partnerships. They have worked with hundreds of clients developing their social enterprise plans and provided them with the tools, strategies, and support to perpetuate positive social change and grow profitably.

CSED’s UNCAPPED program enables the start-up, growth and scaling of social enterprises through organizational readiness and capacity building support, including access to funding. The program is open to charities, not-for-profit organizations, co-operatives, and for-profit businesses with a clearly demonstrated social purpose. Under the program, participants will receive curated readiness and capacity building support that may include one-on-one coaching, facilitated cohort-based training, access to community mentors/experts, and funding in the form of grants, loans or grant/loan combinations.

Ottawa Community Loan Foundation

The Ottawa Community Loan Fund (OCLF) is a non-profit organization providing microloans for business and professional development purposes. Since its inception in 2000, it has constantly pursued its overarching goal; to ensure their loan recipients eventually have access to traditional financing, increase their assets and/or achieve the professional development.

More recently, OCLF has expanded their scope of activity to include new micro-financing products, business technical expertise, financial literacy training, professional development, affordable housing and social enterprise development.

Impact Hub Ottawa

Impact Hub is a community and co-working space that Inspires, enables and connects people that are working to solve the world’s challenges. Impact Hub is part of a global network of 15,000 purpose driven individuals and organizations in 102 impact hubs worldwide.

In the context of our social finance discussion, the Impact Hub Ottawa shared their experience as a non-profit raising $400,000 in community bonds. To learn more about their story, click here.

Explore Presentations from this Event

David Cork, Tapestry Community Capital

Alfred Lee, Vancity Community Investment Bank

Brian Coburn, Ottawa Community Foundation

Jane Duchscher, Ottawa Community Loan Foundation

Michael Murr, Centre for Social Enterprise Development (CSED)

Kiran Pal-Pross, PARO Centre for Women’s Enterprise

Recent Comments