Meet Erica Glueck, our Senior Manager of Investments.

Erica joined the Tapestry team in 2018 to help us manage our client’s growing base of community bond investors. In the 3 years since she joined, Erica has seen that number of investors under management nearly double to 4000, and now manages around $80 million in impact investment.

As we continue to grow and take on new clients, Erica’s role has also evolved to include a stronger focus on supporting new issuers in structuring their impact investment offerings, and preparing all the necessary infrastructure to enable investments. Alongside our new leadership team, she is also supporting organizational strategy.

This is why Erica is looking to grow her team with the addition of a new Impact Investment Associate. The Impact Investment Associate will oversee our portfolio of clients and their respective investors, ensuring that the entire investment process is a streamlined and pleasant one.

Are you interested in learning more or know a friend who might? We’ve asked Erica what a day in the life of our Investment Management Team looks like.

What does the investment management team at Tapestry do?

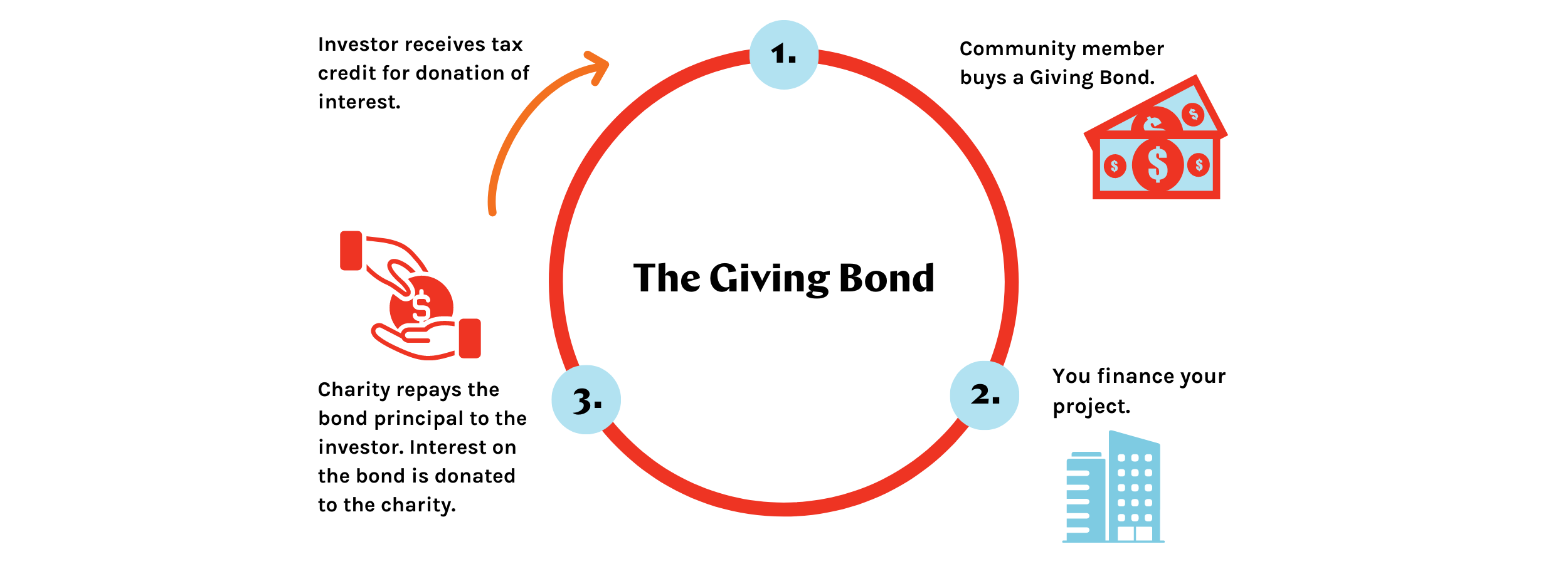

In a nutshell, we oversee all transactions – and by that I mean all the money going in and out through bond purchases, interest accruals, disbursements, and maturity events – and all the reporting and due diligence that goes along with those transactions.

A huge part of what we do is also client facing work. We work very closely with our portfolio of issuers, really helping them to manage their investors well. We want investors to feel confident in their community bond investments, feel that they are managed professionally, and ultimately, be champions for the organizations they have chosen to invest in. We know that when investors are treated well, they choose to re-invest, and this just means more money for greater impact!

What does a typical day look like for you?

It really depends! Some weeks I spend more time on our overall process and operations, working to improve efficiency, and others I really get into nuts and bolts and need to focus on detailed transactions…like for example, when we are moving $6 million dollars in interest and principal in a few short weeks!

But generally, I’d say that I like to have a lot of structure to my days. I spend about 30 percent of my time overseeing investment operations. About 40 percent of my time is spent on new and existing clients, helping them to move forward in structuring their investment deals, looking out for project risks, looking at financial statements and writing offering statements. The remainder of my time is usually focused on overall Tapestry strategy, building new systems (like our investment management platform), working with our Futures Committee and thinking about what’s next for our organization.

What motivates you to do this work?

When I first applied for the role I started in, I was really drawn to the organization because of the renewable energy work we had done. I actually came from a policy background, and I was really interested in the interaction between policy and sustainability, and how we could create a more energy efficient economy.

What’s really cool is that I get to do that, but I also get to see the direct impacts of how community financing puts any socially or environmentally oriented organization on a stronger financial trajectory. The growth we have witnessed in our clients has been remarkable – for example, seeing an operating budget grow from $400,000 to $9 million over the course of a few years.

I also love being able to see the physical projects that transpire as a result of these impact investments we are managing. It’s incredible to see an old historic building transformed into a new hub and meeting place for the community, or seeing an established organization finally take ownership of the space they have been in for so long.

I find it really powerful to see that transition from subsistence to a really sustainable and growth-oriented mindset. So many non-profits get stuck spending time on getting that next big grant that they actually don’t have the time and energy to think big and plan big. Community bonds really give them that power to be in control, set their own terms and move forward.

On a more personal level, I am a total word and data nerd, so investment management is really fun for me. I’m also a problem solver, and love the diversity of challenges we face working with such a broad group of clients, that are all financing very different projects.

How would you describe tapestry as an employer?

Tapestry has really grown and matured over the last few years, but even since the beginning, the ethos has been community ownership and community power. That word community is just really ingrained in the organization, and collaboration is really intrinsic and embedded in everything we do.

We rarely make big decisions unilaterally, and take the time to come to agreement together. There is also very little, if any, ego in the organization. We are all equally invested in our growth and passionate about what we do.

Sometimes working collaboratively like this is harder, because it means we have to talk things out and contemplate them a little bit deeper, but ultimately we end up with a better service, product and organization.

What is the team looking for in the Impact Investment Associate?

We would really love to see a bright systems thinker – someone who can appreciate how things work internally, externally, and together. I want to see someone who isn’t afraid to challenge processes, just because that’s the way it’s been done in the past, and someone who is keen to find weak spots in efficiency.

I hope that the new Impact Investment Associate will have the willingness and humility to really learn those problem areas before jumping to make changes. I think the better we can learn the problem, the more sustainable the solution will be long-term.

On a more personal level, I hope they will have a collaborative work ethic that will mesh well with our team. I want them to feel comfortable to ask questions, talk it out, and take ownership of their work.

Lastly, it’s really important to me that they are committed to our overall mission. Community bonds are an investment vehicle that should be accessible to everyone – not just accredited investors – but to everyday investors that just want to invest in a good cause.

We want someone who will be passionate about making the investor and issuer experience as pleasant as possible, and someone who will design processes in a way that makes what we do sustainable and scalable. Ultimately, we want to help as many organizations as possible to create these amazing impact investment opportunities for their communities of supporters, and this will only be possible by becoming more efficient and better at what we do.

Are you interested in supporting social change with innovative financing?

We are hiring for an Impact Investment Associate. Applications are due by June 14th, 2021. Click HERE to see the full job description.

Recent Comments