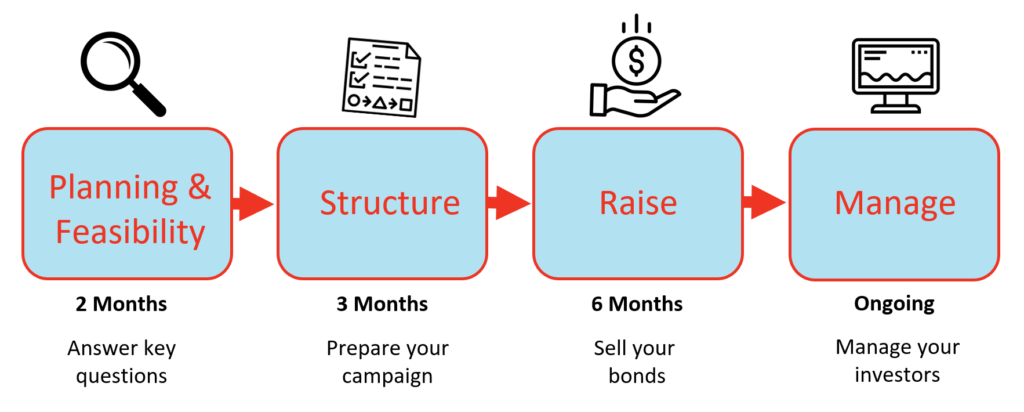

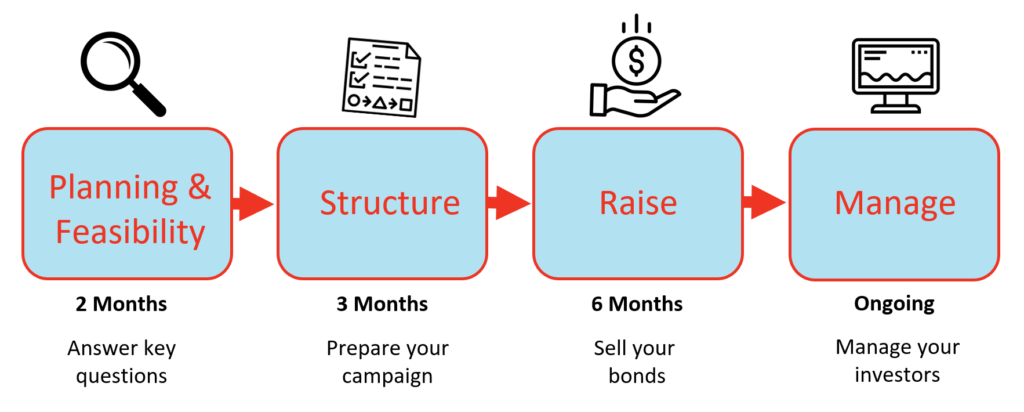

Typically, a community bond campaign takes about one year from start to finish. While every project is different, and may vary slightly depending on the total sum being raised and unique project milestones, we find that the vast majority of organizations are able to achieve their funding goal within this timeframe.

In this article, we will walk you through our community bond process so that you can understand how your funding timelines can fit with your project needs.

Getting Started

Each community bond campaign begins with an introductory workshop as the first step. This 3-hour session will be a chance to bring your entire organization together (Volunteers, Staff, Board Members, Advisors, etc.) to learn more about community bonds and how they could potentially be used to fund your project. After the workshop, you’ll receive a readiness assessment from Tapestry with a recommendation on whether community bonds will be a good fit for your project and organization.

If your assessment suggests that community bonds are a promising financing route, you will move into the Planning & Feasibility phase.

Planning & Feasibility

Clients come to us at all different stages. It is our job to get you to the point of being investment ready. In order to do this, we will model your finances to get a picture of how much debt your organization can comfortably carry.

Next, we will map your community stakeholders to understand their needs and appetite for investment. Together, these two critical steps will take approximately 2 months.

If it is clear after Planning & Feasibility that 1) your organization is in a financial position to carry debt and repay investors, and 2) there is a sizable community to support your project, you will move into the Structuring phase.

Structuring

During the 3 months in Structuring, we will be helping you to set your bond terms. This will be done through a combination of financial modelling and community consultations to test the bond terms.

We will also be preparing all the necessary documents to bring your investment offering to the public. These will include a:

- 5-10 year business plan

- Offering statement

- Term sheet

- Trust agreement

Your Tapestry Campaign Manager will work with you to create your marketing and communications strategy, and set you up on our sales platform so that investors can easily invest online. We will train you to use these tools, and to communicate effectively with potential investors.

By the end of the structuring phase, you will have:

- Your investor package ready to go

- A campaign website that links to your organization’s homepage

- A marketing and communications plan that will include a detailed budget and timeline for key messages through social media, e-newsletters, investor information sessions and press

- A sales process set-up on our customer relationship management (CRM) system and on Tapestry’s investor management platform, Atticus

Raise

At this point, you will be ready to go live and bring your campaign to the public! Once your campaign is launched, it will take 6 months to raise your target investment. Though this timeframe can vary slightly, we find that a period of 6 months gives your organization enough time to tell your story and demonstrate your impact, and gives investors ample time to do their research and make an investment decision.

We generally don’t recommend extending beyond the 6-month timeframe as there needs to be a sense of urgency in order to engage investors.

Your Tapestry Campaign Manager will meet with you regularly throughout your raise and make sure your campaign is on track. As bonds are being purchased, our Investment Management Team will work in the background to onboard investors and process their transactions.

Management

Once you have reached your target investment, Tapestry will continue to support you with professional investor management services for the duration of your bonds.

Our Investment Management Team will look after interest disbursements, issue tax forms and provide customer service to investors as needed. At year end, we will also support you with financial reporting on your bonds.

An accelerated timeline is sometimes possible

We are often approached by organizations that are on a tight timeline and interested in pursuing an accelerated plan. In some cases, this may be possible but will depend on the readiness of your organization.

In certain cases, organizations may have already taken the time to build detailed financial models on their own. In such a situation, we would work together to assess whether it is possible to by-pass the Planning & Feasibility phase.

If your project will require tighter timelines, it will be important to share this with the Tapestry team early on so that we can adjust your schedule accordingly.

Don’t raise before you can spend

Another important question is when to raise your funds. We always advise organizations not to begin raising funds until they have a defined use for the capital, and there is a planned transaction date within sight.

Of course, if you are searching to purchase a property, finding the right property may take time and you will need the funds in hand to do so. However, once your raise is complete, we recommend deploying the funds as soon as possible as you will be beginning to accrue interest.

Under certain circumstances, it may make sense to stage your raise to match project milestones. For example, if you are constructing a building rather than buying one, you may wish to issue multiple offering statements in order to secure the funds only when you need them.

Tapestry will always work with your team to understand the important milestones of your project, and do our best to match the timing of your funding.

Where to start?

Are you interested in raising community bonds for a project? The first step is our Introductory Community Bond Workshop. Learn more about it here, and get in touch with a member of our team at info@tapestrycapital.ca.

Recent Comments