The project that charmed Ontario

“Everyone is just so excited to talk about poop,” laughs Daniel Bida, Founder of the ZooShare Biogas Co-operative. I’ve just connected with him over Zoom to hear about the recent completion of their biogas project at the Toronto Zoo. “The joke never seems to get old and that’s an advantage we’ve always had,” he says, “it’s part of what drew people to our story and mission.”

With a background in finance and a passion for the environment, Daniel has always been fascinated by the potential to turn waste into something useful. Ten years ago, that curiosity turned into a bold vision to build Canada’s first zoo-based biogas plant.

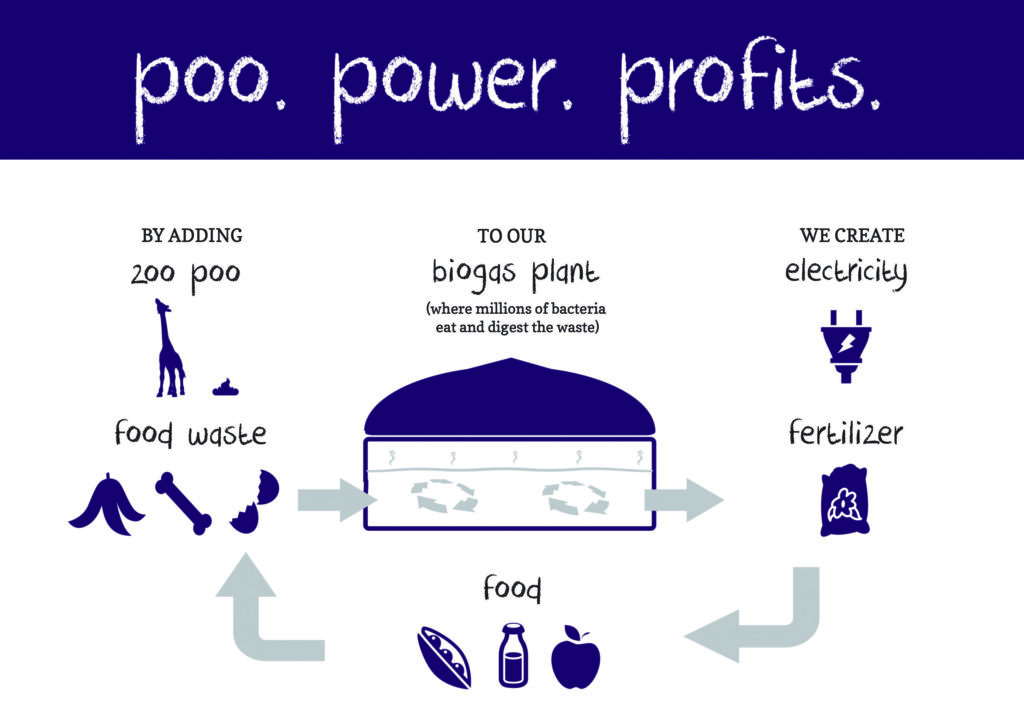

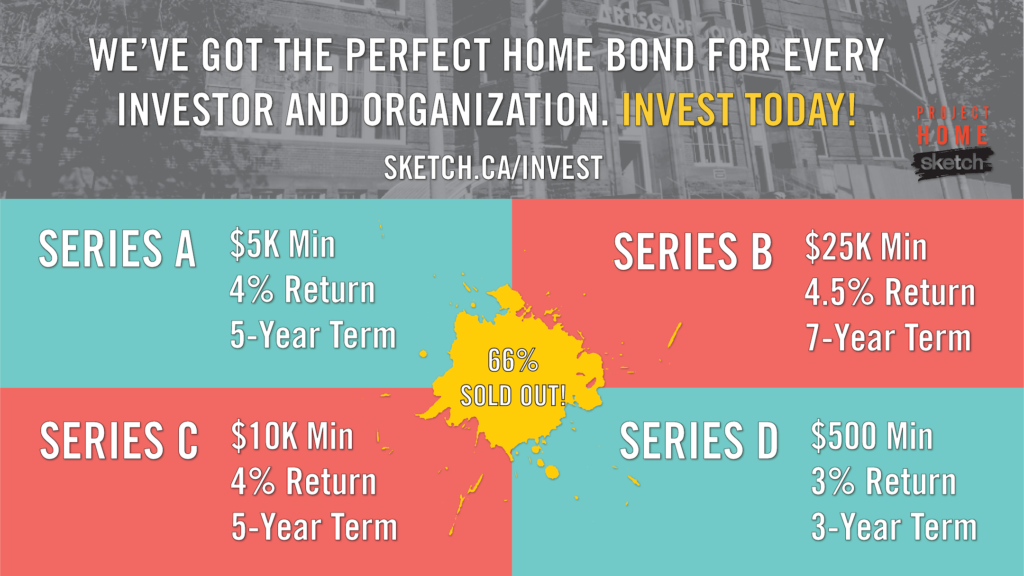

The plan was simple – take zoo waste (yes, poop!) and commercial food waste collected from the Greater Toronto Area, use an anaerobic digester to produce biogas, and burn that gas to produce clean power. His plan also revolved around financing the project through community investors, like you or I, who could invest as little as $500.

“We’ve been really lucky that the media loved to tell our story. I think that’s partly because the conversation on food waste and its impact on greenhouse gas emissions has really picked up in recent years, and partly because of the ‘cuteness’ of our project,” says Daniel, “these two elements really helped us to raise the financing that we needed.”

To date, the organization has raised over $7 million from over 700 investors, to invest in the project and to refinance earlier investments that are now maturing. The co-op also joined forces with Oshawa Power and Utilities Corporation, who made an investment in the project in exchange for 49% of the equity, and the Federal government, which granted $2.7 million from the Low Carbon Economy Fund.

What started as a mere idea, now stands fully constructed across from the Toronto Zoo processing zoo poop and commercial food waste, producing biogas, and running a combined heat and power generator to produce clean power for Ontario’s electricity grid.

Now that the project is operational, it will divert 15,000 tons of food waste from landfills each year, reduce CO2 emissions by up to 20,000 tons, generate 500kW of renewable energy each year, and produce a nutrient rich fertilizer as a by-product.

The Investors made all the difference

“I don’t think I realized at the time how proud people were to become investors in ZooShare,” says Daniel, “that’s something I only came to understand with time.”

While Daniel’s plan for the biogas digester may have appeared simple on paper, the execution was far from it. He was working in what is still an emerging industry and using a technology that was not widely understood in Ontario at that time.

ZooShare faced several hurdles along the way, including finding long-term suppliers of waste and dealing with organic waste that was not free of plastics, just to name a couple.

In 2017, ZooShare held what Daniel describes as their most difficult Annual General Meeting. They had come up against so many hurdles that they were faced with a major decision. “Essentially, we were at the point where we either just had to pull the plug and return investor’s money, or as a Board and co-op, make the decision to deploy the capital we had even though all the financing to complete the project was not yet in place ,” shares Daniel.

The co-op was quickly approaching the cut off date of their feed-in-tariff contract – a key element of their business model to ensure that their renewable power would be purchased by the Ontario power grid. They needed to begin generating power to maintain the contract, and to do that they needed to finance the combined heat and power generator.

They put the decision to the investors. “I was fully expecting for people to ask for their money back,” shares Daniel, “I really thought there was a limit to the patience the members would have after the previous delays we had faced.”

“But I was wrong, this wasn’t a traditional boardroom,” says Daniel, “the investors just said ‘you just keep fighting, you get back in there!’ It was really powerful to have that type of support.”

With their community bond investors behind them, they met the deadline to generate electricity. There were still hurdles ahead to be met, but it was clear at this point that the investors were in it for the long haul.

ZooShare investors gather for the groundbreaking.

Impact First, Returns Second

“The patient investors we have are the reason we were able to do what we did,” says Daniel. “These are people that were motivated to make an impact. They weren’t people who wanted to make a return and the impact was ‘a nice to have’. They wanted to make an impact and the return was ‘a nice to have.’”

With a background in finance, it was very interesting for Daniel to see the ways in which different people perceive risk. “When we got started we priced our offering based on the pricing of securities with a similar risk profile,” he says.

“I’m not sure that the people who ultimately invested in ZooShare would have been swayed by a 0.5% or 1% difference in interest.” says Daniel. “That’s not to say that they didn’t care about the return, they did, but they cared about the impact first.”

Daniel believes that if you are doing something environmentally or socially positive and you offer at least an average return, then it really comes down to telling a compelling story.

Some advice to those looking to raise financing

The ZooShare Biogas Co-operative was one of the first non-profits in Canada to issue community bonds. As pioneers in the space, they have a wealth of knowledge and experience to share with fellow organizations looking to build a project and finance it through community investment.

Reflecting on his experience, Daniel shared three pieces of wisdom for those looking to follow in the co-op’s footsteps.

1. Assume things are going to go slower and cost more than you think.

Pad your assumptions so that you don’t have to go back to the drawing board and find more funding. Be frugal and diligent with the money you have in pocket. Having some wiggle room will give you the flexibility to make good decisions.

2. Even if things don’t go as planned, it’s important to keep investors informed.

My approach was always to be hopeful and optimistic, but also as forthcoming and transparent as possible. I think investors appreciate and respect that.

3. Don’t issue bonds to build something until you are ready to build.

When we got started, I really felt that we needed to have the money in hand to prove that we were serious to the other stakeholders we were negotiating with. The problem was that once it was in the bank, we were paying interest on it and as the delays piled up, so did the interest costs. You don’t want to be paying for capital that you aren’t using.

What’s next for Zooshare?

From the very start, one of the main drivers behind this project was to leverage it as an educational asset. It is one of the reasons that Daniel selected the Toronto Zoo as the site for the digester. “Our hope with this project is not just to process waste and generate power, but also to introduce people to biogas,” says Daniel. The co-op is actively working with the Zoo, Parks Canada and a renewable energy education charity called Relay Education to make this a reality.

Expansion could be a likely next step for ZooShare. In bioenergy, Daniel explains, economies of scale are very much at play. The co-op could conceivably build another digester tank, take more waste and generate more gas. “There is strong demand for renewable natural gas (or RNG), to be sold as gas, rather than used to generate electricity. We are actively exploring this market,” says Daniel.

Daniel stands next to the completed biogas digester. Photo Credit: Dan Pearce.

A time to celebrate the accomplishments of Zooshare

While Covid-19 may have thrown a wrench in their plans, ZooShare still intends to find a way to celebrate the launch of the facility. They will be releasing a video about the project next month, and hope to host an open house in the fall so that the public can tour the facility.

Stay tuned to the ZooShare’s newsletter and social media to stay up to date on what they have planned!

Recent Comments