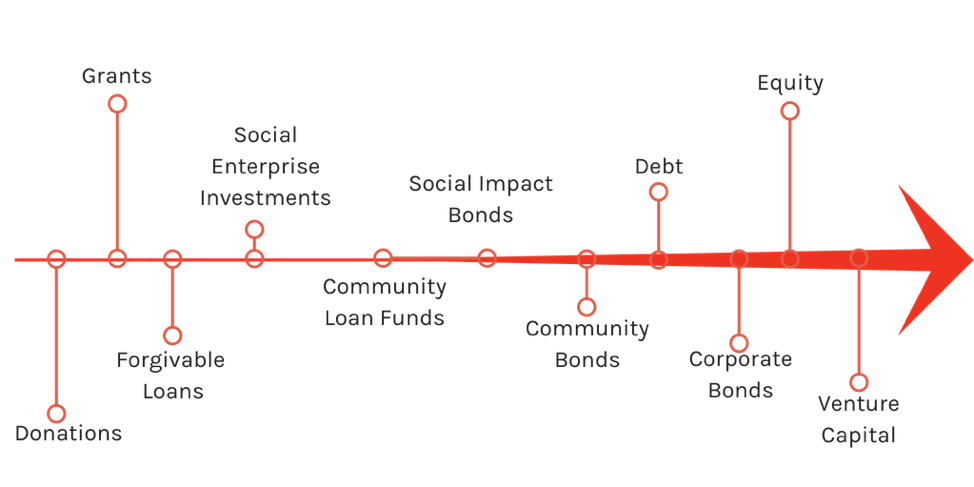

Last week, the Tapestry Team launched the first edition of The Thread, Tapestry’s bi-monthly community newsletter.

We’re excited to be able to bring you news and events related to community bonds, social impact investing and not for profit organizations, engaging their community to do amazing things all around the world. If you haven’t viewed the newsletter and don’t want to miss out on future editions, click the link below:

If you find an interesting piece of community bond news, have an event you want to feature, or just have questions/comments about the newsletter, please get in touch. We will review every comment and take it under consideration when designing the newsletter.

If you find an interesting piece of community bond news, have an event you want to feature, or just have questions/comments about the newsletter, please get in touch. We will review every comment and take it under consideration when designing the newsletter.

Recent Comments