Tapestry Community Capital is proud to share that we’ve been selected as a semi-finalist in the CMHC’s Housing Supply Challenge!

What does it mean? We’ve received funding to continue our work supporting affordable housing providers across the country in raising community capital. From building new affordable, net-zero housing in Kamloops, B.C. to preserving affordable units for residents of Toronto’s quickly-gentrifying Kensington Market, the work affordable housing providers do is essential and they need better financing options.

What is the Housing Supply Challenge?

From the CMHC website:

The Housing Supply Challenge invites citizens, stakeholders, and experts to propose solutions to the barriers to new housing supply. The challenge will distribute $300 million in funding over 5 years.

Successful submissions that address barriers to supply will receive funding to prototype or incubate their proposal. Following the prototype stage, a number of selected finalists will share a pool of additional funding to implement their proposed solutions.

Each round awards proposals that address housing supply barriers such as building timelines, construction productivity, and improving data on land availability.

How do community bonds support affordable housing?

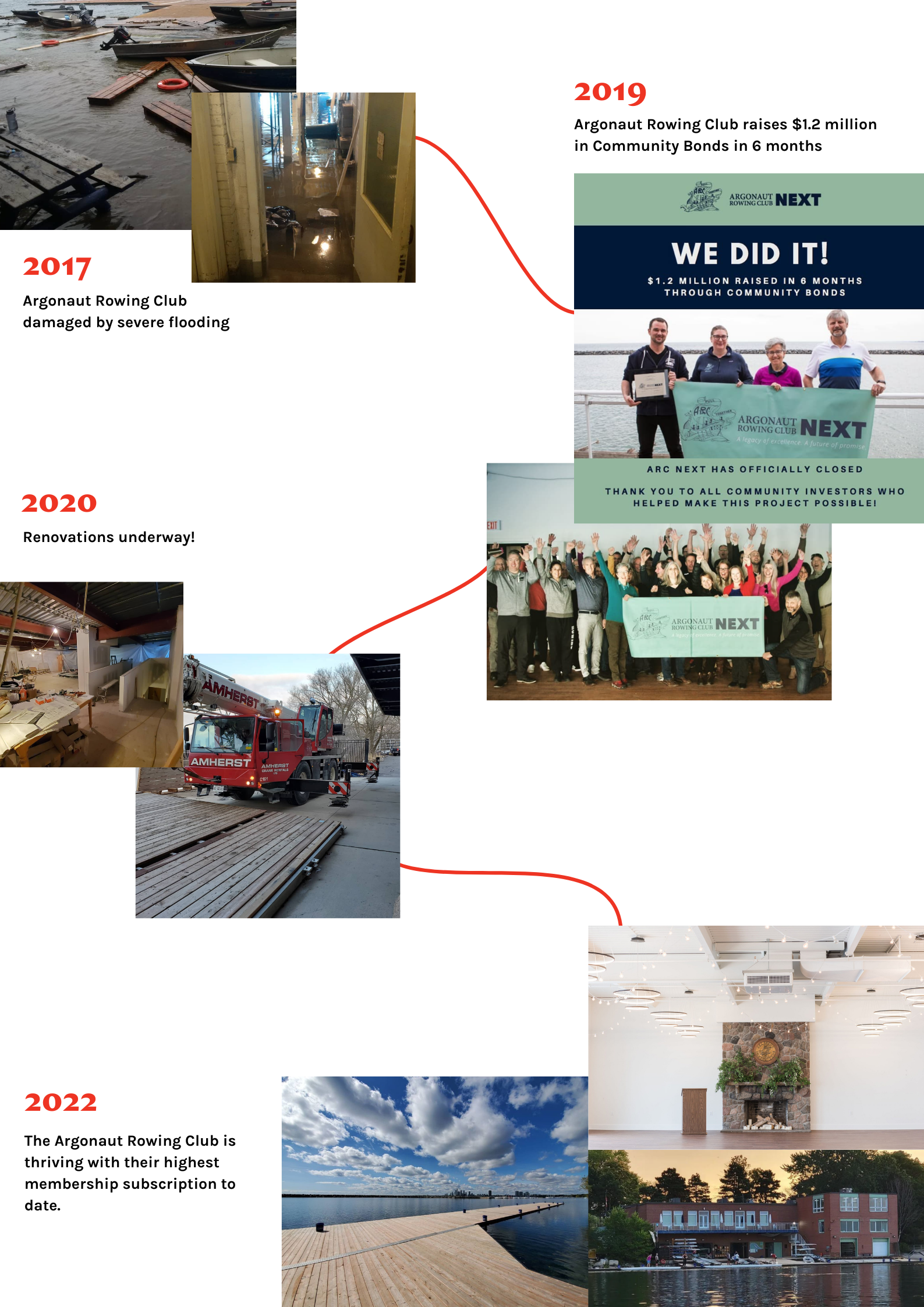

Community bonds are a social finance tool that can be used by charities, non-profits and co-operatives to finance socially and environmentally impactful projects. Similar in many ways to a traditional bond, they are an interest bearing loan from an investor, which has a set rate of return and a fixed term.

For affordable housing providers, community bonds can:

- Help fill financing gaps — for example, there aren’t many other financing paths to cover pre-development costs like buying land, having architectural plans drafted, and legal and consulting fees.

- Build community support for more affordable housing — affordable housing providers can grow their network of supporters by offering their communities investment opportunities.

- Contribute to local economic development — by offering returns to everyday community members rather than big banks, community bonds build community wealth, indirectly helping to end the housing crisis.

Learn more about Tapestry’s Investing in Housing program here, and about the CMHC’s Housing Supply Challenge here.

For media inquiries, contact Kylie Adair, Communications Lead at kylie@tapestrycapital.ca. For general inquiries, get in touch with our team at info@tapestrycapital.ca.

“I believe in a future where profits are returned to supporters rather than banks, and where investors can feel proud that they put their money in something that they believe in. To me, ‘co-operation in the world of tomorrow’ means communities coming together to support a common goal and jointly investing the capital it will take to realize that vision.”

“I believe in a future where profits are returned to supporters rather than banks, and where investors can feel proud that they put their money in something that they believe in. To me, ‘co-operation in the world of tomorrow’ means communities coming together to support a common goal and jointly investing the capital it will take to realize that vision.” “A Co-operative offers it’s members a concrete way to contribute to our inter-dependent reality; one where bridges replace walls. At Tapestry, when I see a cool Co-operative in action – one with shameless idealism and a strong collective resolve – I feel alive.”

“A Co-operative offers it’s members a concrete way to contribute to our inter-dependent reality; one where bridges replace walls. At Tapestry, when I see a cool Co-operative in action – one with shameless idealism and a strong collective resolve – I feel alive.”  “I imagine a world where problems, such as climate change, homelessness and poverty, are not shrugged off due to profit’s bottom line. I see inclusive communities whose inhabitants, both human and non-human, flourish with home-fullness, vibrant public and active transportation, and an economy based on the health of the planet.

“I imagine a world where problems, such as climate change, homelessness and poverty, are not shrugged off due to profit’s bottom line. I see inclusive communities whose inhabitants, both human and non-human, flourish with home-fullness, vibrant public and active transportation, and an economy based on the health of the planet.

This fall Suzanne will be returning to her Masters of Planning program at the University of Toronto, equipped with new experience and expertise in social finance and community economic development.

This fall Suzanne will be returning to her Masters of Planning program at the University of Toronto, equipped with new experience and expertise in social finance and community economic development.

Marzie describes herself as a jack of all trades, with a career path that led her from cell biology to civic tech, youth empowerment, political engagement and education. The constant throughout her career has been her deep interest in, and passion for, systems thinking and people-centered research design. She has spent the vast majority of her career working with nonprofits, first with rural and marginalized communities in Iran, and more recently in Peru and Canada. For the past 8 years, she has focused on mix-method research, and measurement and evaluation.

Marzie describes herself as a jack of all trades, with a career path that led her from cell biology to civic tech, youth empowerment, political engagement and education. The constant throughout her career has been her deep interest in, and passion for, systems thinking and people-centered research design. She has spent the vast majority of her career working with nonprofits, first with rural and marginalized communities in Iran, and more recently in Peru and Canada. For the past 8 years, she has focused on mix-method research, and measurement and evaluation.  Suzanne is currently pursuing her Masters in Planning at the University of Toronto, with a concentration in Housing and Community Economic Development. The focus of her research is to assess the feasibility of crowdfunding platforms to facilitate land acquisition groups such as community land trusts. Suzanne is joining our team in a part-time capacity while she completes her studies and is working with Marzie and support our progress in the CMHC Housing Supply Challenge.

Suzanne is currently pursuing her Masters in Planning at the University of Toronto, with a concentration in Housing and Community Economic Development. The focus of her research is to assess the feasibility of crowdfunding platforms to facilitate land acquisition groups such as community land trusts. Suzanne is joining our team in a part-time capacity while she completes her studies and is working with Marzie and support our progress in the CMHC Housing Supply Challenge. Baljmaa’s interest in climate change mitigation began early in her career while she was working as an internal auditor at a commercial bank in Mongolia. Her role took her to remote regions of the country where she could see the impacts that climate change was having on local people and businesses, from drought to extreme heat waves.

Baljmaa’s interest in climate change mitigation began early in her career while she was working as an internal auditor at a commercial bank in Mongolia. Her role took her to remote regions of the country where she could see the impacts that climate change was having on local people and businesses, from drought to extreme heat waves.

Recent Comments