At Tapestry, this is one of the most common questions we are asked. Organizations are often first introduced to the concept of community bonds by seeing them in action, coming to learn about them as an investor, or because they have been searching for alternative forms of financing. When they approach us, they are curious to learn how bonds can work for their unique set of circumstances.

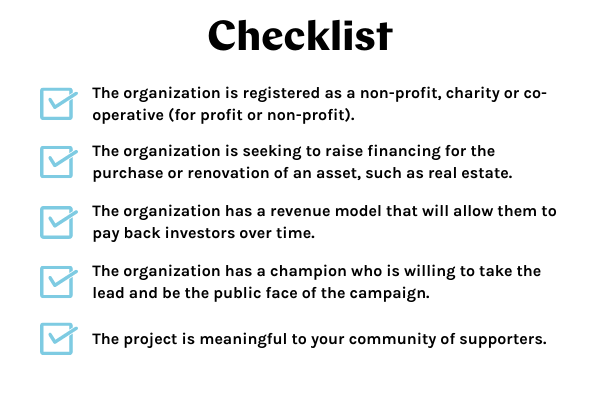

While every organization and project is unique, there are five main criteria that typically apply across the board. We always begin by walking organizations through a simple checklist to see if their team and board should invest the time to explore this opportunity in greater detail. In this article, we will walk you through the checklist below, step by step.

The organization is a non-profit, charity or co-operative

Community Bonds are a social finance tool that allow organizations to raise capital from their community of supporters. Just like a regular bond you might purchase – say a Canada Savings Bond – these bonds are repayable, and have a fixed term and a set interest rate.

There are two main features that differentiate community bonds and traditional bonds. The first is that in addition to a financial return, community bonds generate an environmental and/or social return. The second, is that community bonds can only be issued by non-profits, charities and co-operatives (both for-profit and non-profit).

In Canada, the sale of bonds is regulated at the provincial level by the provincial securities commissions, and at the federal level by the Canada Revenue Agency. These agencies have strict requirements for private companies that want to sell securities to the public, and the process is complex and expensive.

Charities and non-profits, however, are exempt from these requirements under National Instrument 45-106 s. 2.38, and are able to issue community bonds so long as they can guarantee:

- They are a non-profit organized exclusively for education, benevolent, fraternal, charitable, religious and recreational purposes

- No commission or other remuneration will paid in connection with the sale of the security

Co-operatives go through a slightly modified process under the Co-operative Corporation Act, and their regulations vary among provinces. The process, however, remains straightforward and much less onerous than that of a private company.

In order to safeguard the interests of community bond investors, our documentation and process for issuing community bonds always meets the requirements set for co-operatives, regardless of whether we are working with a charity or non-profit.

The organization is seeking to raise financing for the purchase or renovation of an asset

Technically speaking, there is no legal document stating that community bonds must be used towards the purchase of an asset. However, in our experience of managing over $70 million in community bonds, we have found that having these securities backed by an asset increases investor confidence, and hence the success of the campaign. This is particularly true for organizations that are issuing bonds for the first time and have not built a reputation and rapport with their investor base.

Asset backed projects are also typically easier to build an inspirational story around. We’ve come to understand that investors like having a brick and mortar outcome – a tangible and physical project that resulted from their investment. While operational expenses are critical, they are rarely inspirational, and do not excite investors in the same way.

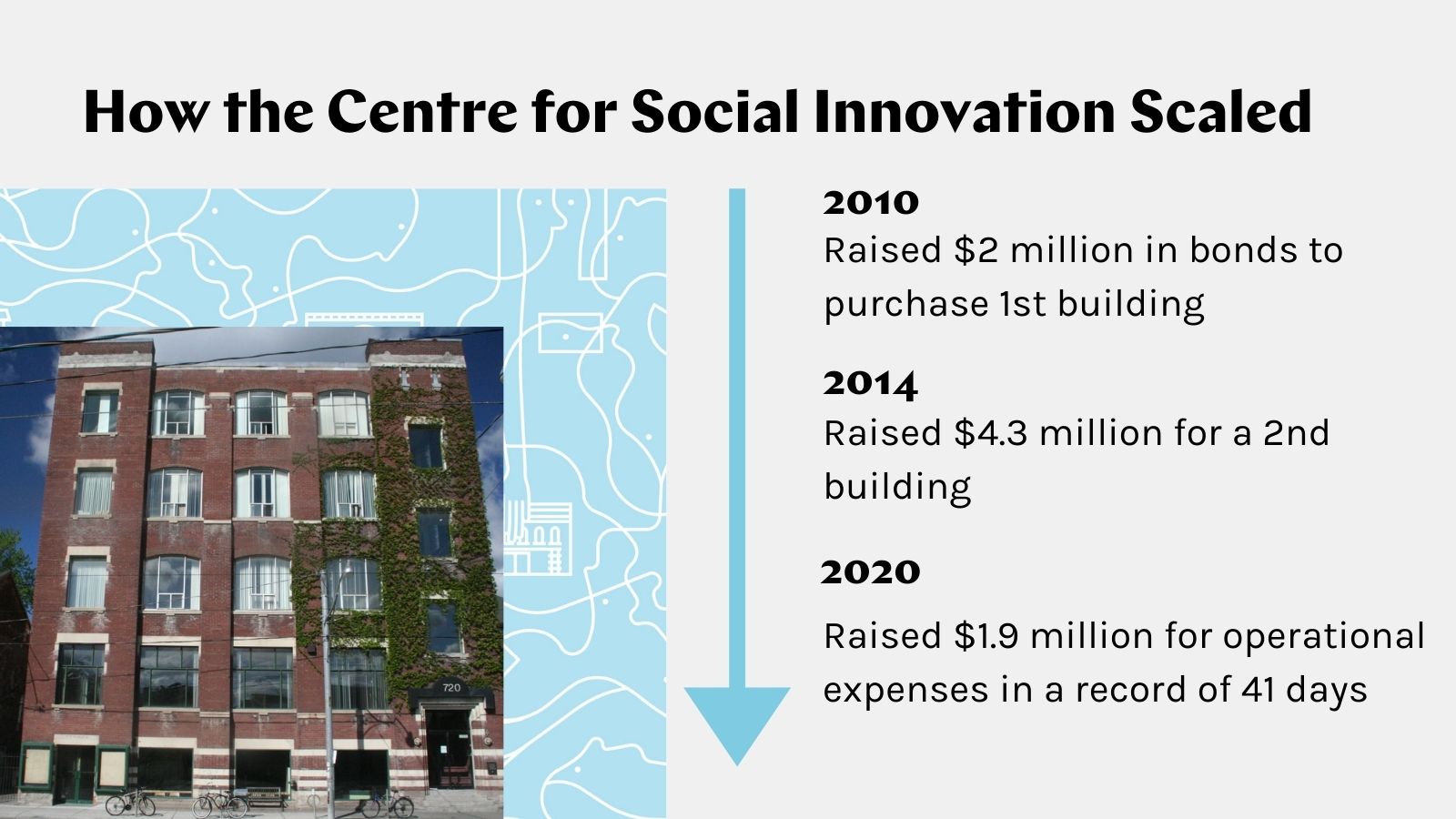

In some circumstances, if an organization has run several asset backed campaigns, and proved their ability to meet repayment schedules, they have gone on to raise capital for operational expenses.

The organization has a revenue model that allows them to repay their investors over time

While community bonds offer a social and/or environmental outcome, they are also a financial product, and issuers must have the capacity to repay the principal investment and pay out interest on schedule.

For some organizations, income is generated through the operation of a social enterprise, for example by selling tickets, renting spaces or operating a shop. Others, and particularly those who are purchasing an asset to be used for office and administrative purposes, are able to redirect capital previously earmarked for rent payments.

In almost all cases, community bonds will be only one piece of a larger financing puzzle. They are often used in tandem with donations, grants, interest free loans and traditional bank financing.

One appealing aspect of community bonds is that the issuer has the ability to set their bond terms in a way that will match their cash flow situation. For example, some organizations may prefer to have a longer term in order to pay off the principal investment or may decide to delay interest payments for a year or two while they get their project off the ground.

We always work with our clients to find terms that work for their investors and their balance sheet.

The organization has a champion

What is a community champion? They are the natural leader of the project, pushing at every stage to make it come to fruition.

Tonya Surman, Founder and CEO of the Centre for Social Innovation (CSI)

In some cases there will be two champions, an internal lead who drives the project management, and a public face of the campaign, who will engage the media and publicly represent the organization.

In either case, a champion is critical to campaign success. Investors want to see a responsible and charismatic face behind their investments. They want to see someone who is passionate about the potential of the project and determined to see it come to life. This excitement is what inspires people to take the next step in learning about the project and investing their money.

The project is meaningful to your community of supporters

Of course, this probably goes without saying. If you want your community to invest, they will need to feel one of two things, or both.

1) They are doing something positive and productive with their money. They are making a meaningful contribution to society while also making a fair financial return.

2) They will personally benefit from seeing the project come to life. For example, they will benefit from improved access to services and spaces that meet their needs.

In order to target the first group, the project needs to have a strong social impact and/or a positive impact on the environment. In order to target the second group, there must be a sizable group of people that stand to see their community (be it geographical or values based) benefit from the project’s development.

This last criteria is the one that organizations tend to struggle to answer. That’s why we always help organizations interested in this model to dig deeper on this topic and begin to assess who their community truly is and understand what their appetite for investment might be.

Once an organization has been through this checklist and feels comfortable that they fit within these criteria, the next step in assessing a community bond campaign is to participate in a community bond workshop hosted by Tapestry.

During the 3-hour, online workshop, you will have the chance to bring together your team and board to learn more about community bonds, see how community bonds have worked for other organizations, understand how investors make decisions, and understand what a campaign budget and resource plan might look like. Upon completion of the workshop, Tapestry provides a readiness assessment to help your team and board make a decision about whether or not community bonds are an appropriate financing tool for your project.

If you think your organization might have a project that fits these criteria, get in touch with us at info@tapestry.captial.ca.