To say this past year has been tough would be a massive understatement. We’ve all been stretched to our limits balancing childcare, social isolation and economic challenges, just to name a few.

But we are a resilient bunch. Across Canada, communities and social purpose organizations have been rallying together to provide critical social services. Non-profits and charities, in particular, have worked tirelessly to fill the void by providing food, mental health support, housing, and so much more.

At Tapestry, we are always on the hunt for good news, and now that we’re a full year into the pandemic, we feel we are all well overdue for some.

So what’s been the silver lining of the pandemic?

The pandemic, as difficult as it has been, has undeniably prompted a dramatic shift towards collectivism. Movements to support local and community initiatives have triggered the attention of the masses. We’ve all seen the hashtags to #supportlocal, had an old friend ring up out of the blue, or offered to collect groceries for a neighbour. These are all signs that despite social distancing, social cohesion appears stronger than it has in recent years.

The same has been true in the world of finance. Now, more than ever, we are seeing that investors aren’t just interested in a financial return. They also want a tangible social outcome, and a positive impact that’s visible in their own community.

Even amid lockdowns and widespread restrictions, the past year was a great success in community financing. In 2020 alone, Tapestry supported raising $18.3 million in community investment for Canadian non-profits, co-ops, and charities. This investment is creating spaces for marginalized youth, producing clean energy, and supporting the growth of social purpose organizations.

Now that’s not to say that COVID hasn’t created new hurdles for Tapestry and our clients. It has. But like everyone, we are learning to adapt, and in the process becoming more productive and efficient.

We thought we would take this opportunity, on the anniversary of the pandemic, to share some of the lessons we’ve learned from a year of lockdowns and restrictions.

A chance to redefine community

As a result of the pandemic, we’ve all been forced online like never before. Our clients, in particular, have had to double-down on their digital tactics. Where in-person events used to be the modus operandi for meeting potential investors and selling community bonds, Zoom calls are the new norm.

We are lucky to be working in a sector that is nimble and flexible. Our clients were quick to adapt, and made the move online seamlessly. And in doing so, they found some unexpected benefits.

Going digital, has meant much greater reach. Events no longer have geographic restrictions and can be accessed by potential investors all across Canada. This has hugely increased the pool of impact investors for our clients.

Online events are also more accessible. There is no longer the need to arrange transportation or child-care. Anyone can join in so long as they have an internet connection and a few minutes to listen. The other plus? Putting together an online event is much more time efficient, and there is the added benefit that content can be recorded and repurposed.

SKETCH Working Arts just completed their bond sales campaign, raising $1.4 million – all during the pandemic. “Interestingly, 80% of their investors were new to the organization,” shares Satyameet (Sattu) Singh, one of Tapestry’s Campaign Managers. “Pushing digital strategies can really help non-profits expand their presence to new supporters.”

This has made us, and our clients, think more deeply about who our communities truly are. Are they a group of individuals living in the same region? Or is it a much broader community of beliefs? With digital connectivity tools abound, the opportunity exists to bring online and offline communities together as never before.

Take advantage of the amazing tools at hand

We have had to pivot in the way we work with our clients, and the ways in which our clients interact with their potential bond investors. One major change has been an even greater shift to making use of online tools. And there are so many great ones!

With team members working from home, team management platforms have become ever more important. We are big fans of Trello, which allows our clients’ teams to follow along on their campaign progress, interact, and respond to other teammates all on one interface. “It’s highly interactive and keeps everyone on that same page. It also reduces the need for a lot of back and forth on email – saving all of us time,” says Sattu

With investor leads coming in from a multitude of digital streams, the importance of tracking incoming traffic is also critical. We train our clients to use a great customer relationship management (CRM) tool called Pipedrive. “We help our clients to integrate Pipedrive with as many entry points as possible, so that no potential investor lead is lost,” says Sattu. “Once a lead is in Pipedrive, we work with our clients to make sure that they are providing the necessary content and touch points to move that lead along to becoming an investor in their project.”

Our clients are also all set up to sell community bonds directly to investors online. We provide our clients with a clean and streamlined campaign website, which gives investors access to a simple investment platform to make their purchase quick and easy.

“All of these tools mean that campaigns can be optimized quickly, and can reduce resource requirements significantly,” says Sattu. “Nowadays we can have a campaign up and running in about 2 months, and we are working really hard to reduce costs and make community financing available to a wider array of organizations.”

We can’t meet in person but we can still make meaningful connections

It’s true that we live in an age where we can easily connect online, but that doesn’t necessarily mean that the connections we make over the internet are the same as in-person meetings. “We need to be very aware of this,” say Sattu “being online, we need to take extra care to read the room, gauge interest and build trust.”

“This may mean adding in additional touch points for potential investors, to ensure that they feel informed” shares Sattu. “We encourage our clients not to just rely on email but to pick up the phone.”

“We also suggest that our clients ask their potential investors what form of communication they prefer,” says Sattu, “we want potential investors to feel comfortable.”

Let’s rebuild this post-pandemic economy to be more sustainable

We know that Covid-19 is changing society in complex ways. We also know that there will be winners and losers in this pandemic, and that those who are most adversely impacted are also those with the fewest resources to cope.

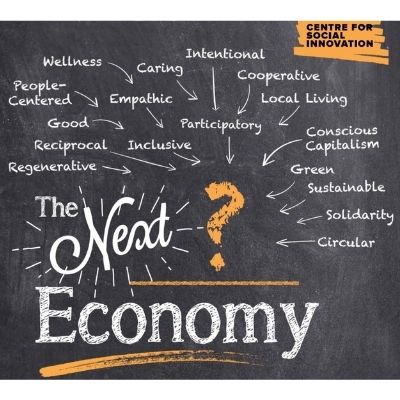

As we focus on the post-pandemic recovery, we should all be thinking hard about the economy we want to see on the other side. Is it the old norm that concentrates wealth in the hands of a few? Or are we interested in creating a more inclusive and sustainable system?

If you are interested in the greater conversation on this ‘Next Economy’, check out our friends at the Centre for Social Innovation (CSI), who are doing amazing work on intentionally building a more equitable system.

We know that innovative forms of financing will be integral to building the next economy. We envision financing that 1) involves and rewards communities, 2) funds meaningful and quantifiable impact, and 3) creates financial sustainability and power for non-profits and charities that provide such critical services to society.

“We promote this idea at both the government level but also on a grassroots level,” says Sattu thoughtfully, “we encourage non-profits where appropriate and possible, to consider seeking investment from their own community, to feed wealth back into that community, and to change the cycle of grant dependence.”

If you are a non-profit, charity or co-operative interested in financing a project with the support of your community, reach out to us at info@tapestrycapital.ca.