A group of at least 11 charitable, nonprofit and cooperative housing providers across the country are using a financing tool called community bonds to raise a collective $110 million from everyday Canadians in their communities, creating or preserving more than 3,000 units of affordable housing altogether.

The 11 organizations are supported by Tapestry Community Capital’s Investing in Housing initiative, which is funded by the Canada Mortgage and Housing Corporation (CMHC)’s Housing Supply Challenge. Tapestry is a national nonprofit providing consulting and administrative services to community bond issuers. Community bonds are an investment opportunity issued by nonprofits and cooperatives and purchased by both everyday Canadians and institutional investors.

Tapestry is currently working with four housing providers raising capital with a combined total goal of $9 million ($8 million raised to date) in community bonds, from the Kensington Market Community Land trust preserving affordable housing in a rapidly-gentrifying neighbourhood of Toronto, Ont. to Propolis Housing Cooperative building new net-zero, affordable homes in Kamloops, B.C.. The additional $110 million target by 11 new organizations (with more to be announced) represents an over 1,200 per cent scale-up for the community bonds model among housing providers. These campaigns are set to launch on a rolling basis until March 2025.

This comes as the systematic exclusion of low- and middle-income Canadians from access to affordable housing intensifies. According to CMHC’s Spring 2024 Housing Market Outlook, “growing demand for rental homes will not be met because the cost of homeownership will lead households to stay in rental housing.” Meanwhile, CMHC reports, “unfavourable financing conditions are expected to make more new rental projects unfeasible in 2024.”

Ryan Collins-Swartz, Co-Executive Director at Tapestry, says: “Canada’s housing system isn’t designed to ensure that everyone has a safe, affordable place to live. But the good news is that more and more Canadians are recognizing this injustice and looking to contribute to change. Community bonds are helping them invest directly in more affordable housing for their neighbours and earn a fair return in doing so. These community investors are also offering housing providers access to affordable, predictable funding — a rarity in the sector.”

Redwood Park Communities runs a YIMBY — ‘Yes, in my backyard!’ — campaign to encourage support for affordable housing development in Simcoe County, Ontario.

Organizations set to raise the collective $110 million include:

- Redwood Park Communities: a Barrie, Ont.-based nonprofit raising $10 million to create up to 146 new units of affordable housing across Simcoe County.

- The Inclusive Housing, a new nonprofit subsidiary of Toronto-based Spotlight Development, which plans to raise between $15 million and $20 million to build more than 1,000 new units of affordable housing across Toronto and Kitchener.

- Indwell, an Ontario-based affordable and supportive housing provider has already raised $5 million and plans to raise significantly more through its next campaign. Indwell’s Finance Manager Nick van der Velde says: “Our current raise with the Hope and Homes Hamilton Community Bond is going well and we see an opportunity to expand and finance additional supportive and deeply affordable housing in South and Southwestern Ontario. The Community Bond has allowed us to engage our support community well and we are interested in growing that.”

- Winnipeg-based Inuka Community Inc., which is set to launch Manitoba’s first-ever community bond campaign, a $3 million campaign to finance the construction of a 60-unit development.

- Two land trusts, a model growing in popularity where nonprofit organizations buy land to keep it off the speculative market and in community benefit: Muskoka Community Land Trust et Hogan’s Alley Society, who will raise a cumulative $12 million.

- Le site Housing Trust of Nova Scotia will be Tapestry’s first affordable housing client in Atlantic Canada, raising between $5 million and $10 million.

- Vancouver-based Hogan’s Alley Society will raise capital to provide culturally-informed housing to Black communities, as will the African Canadian Affordable Housing Village Coop in Toronto.

- United Way Perth Huron’s subsidiary United Housing plans to raise $750,000 for the construction of 10 new units of affordable housing, with a longer-term goal to raise up to $24 million over several years.

- Central Ontario Co-operative Housing Federation, which supports 41 housing cooperatives and will soon raise capital to finance three affordable housing sites of their own, with an emphasis on investment from cooperatives in their network. COCHF’s Executive Director Elana Harte says: “Community bonds closely align with the cooperative housing sector’s values. COCHF chose to work with Tapestry because our project needs flexible, low-cost, community-rooted funding. On the other side of the equation, we plan to engage cooperatives as investors – offering them a low-risk investment opportunity and fostering cooperation among cooperatives themselves, all for more affordable housing.

- Habitat for Humanity Victoria, Tapestry’s first affordable home ownership project (other issuers focus on rental housing) in Victoria, B.C.. The organization will raise between $3 million and $4 million toward a 14-unit stacked rowhouse development.

- More community bond issuers are to be announced.

With funding from the CMHC Housing Supply Challenge, Tapestry has upped its capacity to support these organizations with larger community bond raises, including by redeveloping its digital platform for administering community bonds.

Gracen Johnson, Senior Specialist, Innovation and Research, Canada Mortgage and Housing Corporation, says: “Through the Housing Supply Challenge, Tapestry was twice recognized by industry peers for its potential to scale community bonds with real impact. In Round 2, they expanded their capacity and infrastructure to apply community bonds across a broad portfolio of housing projects. As semi-finalists in Round 5, they’ve continued to build momentum and raise community capital. We look forward to watching them continue their innovative work.”

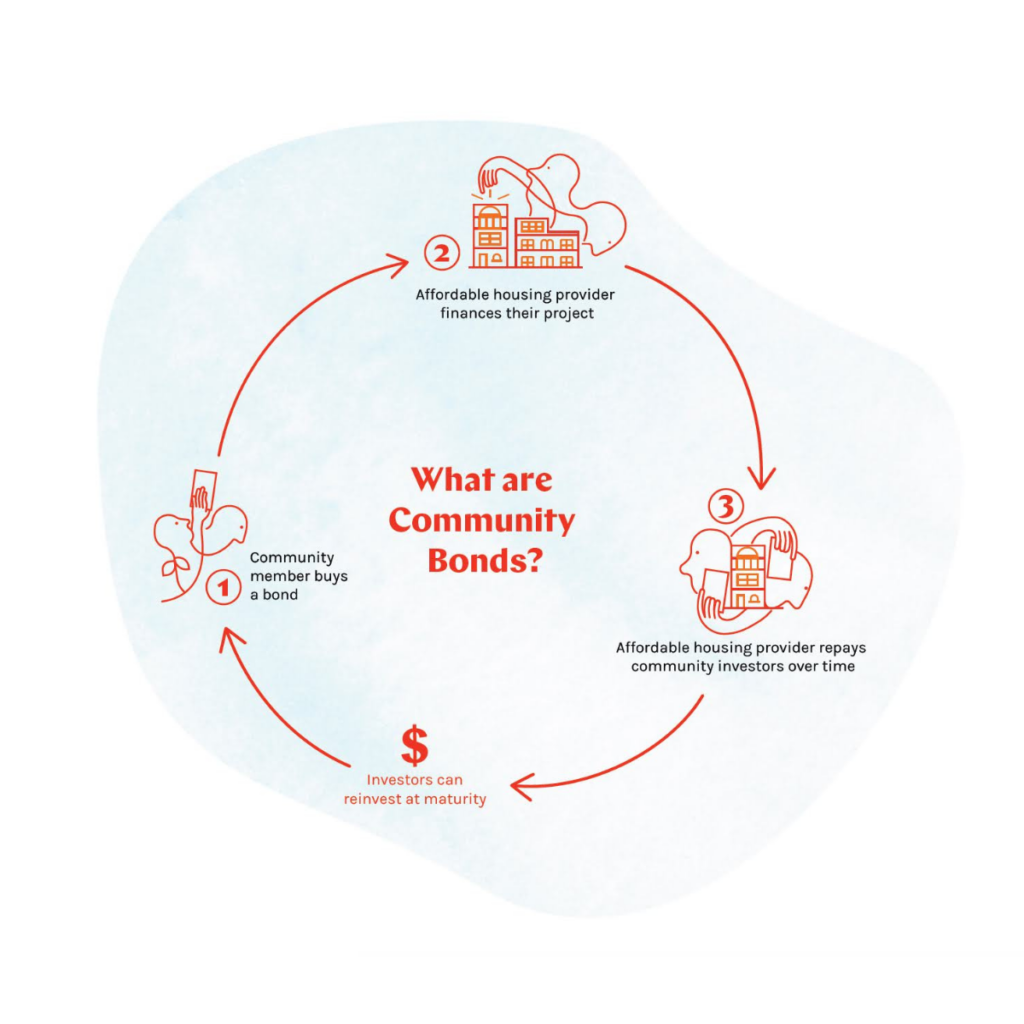

About community bonds

Obligations communautaires are similar to a traditional bond, but instead of being issued by governments or corporations, they’re issued by nonprofits and cooperatives to fund socially- and environmentally-conscious projects. They’re a flexible, self-determined way for organizations to raise capital, since issuers set the investment terms that work best for their project rather than needing to accept commercial lenders’ terms. On the other side of the equation, community bonds enable everyday Canadians to support important projects in their communities while earning a fair return.

For affordable housing providers, community bonds can:

- Help fill financing gaps — for example, there are few other funding paths to cover pre-development costs like buying land, having architectural plans drafted, and legal fees.

- Build community support for more affordable housing — affordable housing providers can grow their network of supporters by offering their communities investment opportunities.

- Contribute to local economic development — by offering returns to everyday community members rather than big banks, community bonds build community wealth, indirectly helping to end the housing crisis.

About Tapestry Community Capital

Tapestry is a nonprofit organization that supports community bond issuers across Canada. While Tapestry focuses on affordable housing, it also supports nonprofits and cooperatives in raising capital to purchase community arts venues, build community-owned renewable energy infrastructure, and more. Launched six years ago, to date Tapestry has helped issuers raise over $110 million from more than 4,000 community investors — this next wave of community bond campaigns for affordable housing providers will double Tapestry’s reach. Learn more at tapestrycapital.ca.

About the CMHC Housing Supply Challenge

The Housing Supply Challenge is a $300-million commitment over five years, which invites citizens, stakeholders and housing experts to propose solutions to the barriers to new housing supply. Most recently, CMHC announced Round 5 of the Challenge, which aims to increase the adoption of transformative, system-level solutions that enable the quicker delivery of both community and market housing. Learn more on the CMHC website.

Commentaires récents