When Buy Social Canada and Tapestry Community Capital first started collaborating, our conversations noted how siloed conversations around community finance and social procurement could be. In any given calendar year, we both attend quite a few conferences, but we rarely find conversations, panels, and plenaries that delve into how we bring community finance and social procurement together.

For us, it’s a simple premise: businesses need both access to capital and ongoing customer spending to succeed in the market. This is especially true for social enterprises, which deliver blended value through social and financial outcomes, but may face additional barriers that traditional for-profit businesses do not. One without the other may mean that social enterprises are unable to develop and scale as they desire. It’s clear to us that community finance and social procurement play complementary roles in creating and strengthening the social value marketplace. We’d like to kickstart this conversation with this blog and generate momentum towards better connecting our shared values and work.

For readers who don’t know, let’s first define some key terms:

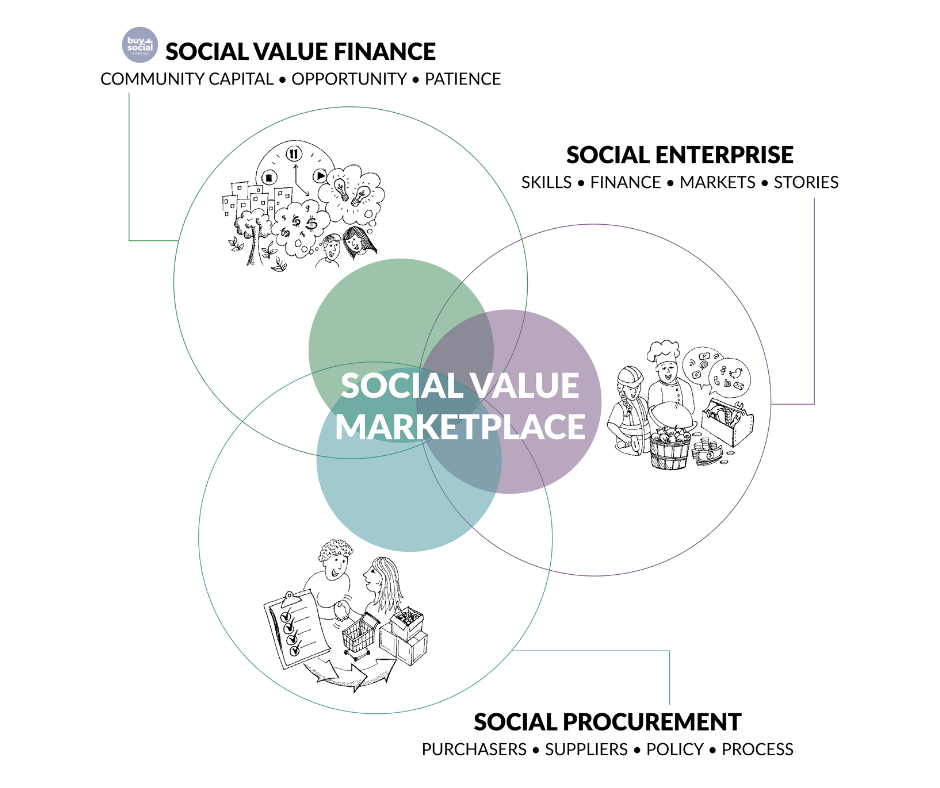

- The social value marketplace (SVM) — a term coined by Buy Social Canada’s founder, David LePage — is “a marketplace where we trade goods and services for the purpose of creating healthy communities.” This marketplace consists of three critical components: social procurement, social value finance, and social enterprise. The SVM is analogous to the social economy.

- Social value finance — or social finance for short — is an umbrella term. It’s defined as (repayable) financing that generates both financial and social, cultural, and/or environmental “returns” (outputs or outcomes). Community finance is a type of social finance, defined by its place-based nature and community engagement/participation.

- Community finance entails both philosophies about and tools (i.e. debt, equity, outcomes financing) that enable capital to flow into, and circulate within, communities. This can be via community bonds, micro-financing, promissory notes, friends-and-family loans, member shares, credit unions’ lending, community-based loan funds or community-driven outcomes contracts.

- Social procurement uses purchasing to achieve institutional, governmental, or individual goals, shaping inclusive and healthy communities. This involves designing policies, adding social value criteria to bids, and seeking out social value suppliers like social enterprises. By focusing on ‘best value for money,’ rather than just the lowest price, makes procurement a tool for building healthy communities.

- Social enterprises sell goods or services with a social, cultural, or environmental purpose, reinvesting most profits into their mission. They operate in a diverse range of sectors including groceries, catering, waste disposal, healthcare, family services, arts and culture, employment assistance, and construction. They compete with traditional businesses but invest their earnings into healthy and vibrant communities. The future of business is social enterprise, built on justice, equity, and inclusion for all stakeholders.

How community finance and social procurement work together to strengthen the social value marketplace

Community finance can ensure social enterprises acquire the capital needed to grow or expand, which can also help them win new procurement contracts. On the flip side, every purchase has a social, economic, cultural, and environmental impact. In order to make community finance work, social enterprises often need procurement in order to not only pay back their financing, but also to help them sustain and grow.

Mike Brigham at SolarShare’s Waterview Facility. Source: Green Energy Futures.

For example, SolarShare Cooperative — Canada’s largest solar energy cooperative — leveraged community bonds to great effect (raising $80M and paying out almost $12M in interest to 2000 + community investors). They were able to leverage community bonds not only because they had a solid business model, but because at that time, Ontario’s government also had a Feed-in Tariff program which guaranteed SolarShare revenues and ensured that they not only could pay back their investors but also scale their projects — and thus scale their impact. At Tapestry, we’re keen to explore how we can stack community bonds and outcomes-based purchasing to create more equitable financing terms for social enterprises.

Social procurement complements finance because it often provides more stability for social enterprises in the long term. If a social enterprise can secure repeat clients or ongoing contracts with purchasers, this can build sustainable revenue models that enable social enterprises to grow or maintain operations.

Certified Social Enterprise: Purpose Construction.

A clear example of this comes from Purpose Construction, a Winnipeg-based Certified Social Enterprise. Their base of operations is a major social procurement agreement with Manitoba Housing, but they also have relied on grants and other government funding. Purpose Construction Executive Director Kalen Taylor says the cycles of government funding “leave us vulnerable, and we’re really trying not to lay folks off because then they lose housing or custody of their children.” Learn more in Buy Social Canada’s Sell with Impact report.

Oftentimes, to help new social enterprises scale, it is necessary to build the financial tools, marketplaces, and procurement that help level the playing field for organizations.

In order to support social enterprise and grow the social value marketplace, we need the community finance and social procurement movements to continue to grow. There is more work to be done by everyone in this sector to increase social enterprise access to funding and procurement opportunities — through policy, advocacy, and action.

Connect with us to continue learning and get involved:

- Join Buy Social Canada and Tapestry Community Capital for two upcoming webinars:

- On July 10, Buy Social Canada will host Tapestry Community Capital for an introduction to community bonds.

- On July 23, Tapestry Community Capital will host Buy Social Canada to share an introduction to social procurement.

- To discover more about Tapestry’s policy advocacy to strengthen community financing tools, download and read Moving Community Bonds Forward, a research report that explores how we can equitably scale community bonds.

- Read David LePage’s book Marketplace Revolution to learn more about the social value marketplace and how social finance, social procurement and social enterprise are the tools we need to create community capital.

This blog is co-written by Tapestry Community Capital and Buy Social Canada to help amplify each other’s work to our respective networks, and reinforce our mutual support.

About Tapestry Community Capital:

Tapestry Community Capital is a non-profit cooperative that aims to democratize access to capital. Tapestry guides other non-profits, charities and cooperatives to raise community bonds. Tapestry is also a Buy Social Canada Community Champion that supports a shared mission to grow the social value marketplace and social economy within their networks and communities.

About Buy Social Canada:

Buy Social Canada is a social enterprise that believes procurement is more than an economic transaction, it contributes to community social and economic goals. Buy Social Canada works with public and private sector purchasers to implement social procurement, and offers the only Canada-wide third-party social enterprise certification.

Recent Comments