What are Community Bonds?

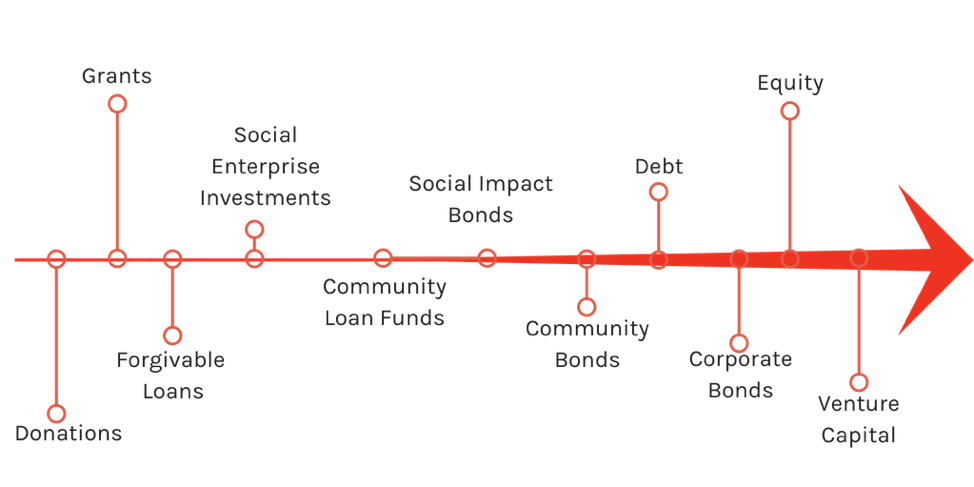

Community Bonds are an innovative social financing tool issued by a non-profit, charity or co-operative organization to finance projects that have a community impact. Figure 1. demonstrates the social investment continuum of financial instruments used by various organizations. The left side of the continuum is dominated by grants and philanthropic mechanisms, while the other end consists of instruments typically used by for profit corporations when pursuing growth opportunities. These instruments on the right side of the continuum are typically supported by the securities market trade.

Figure 1: Investment Continuum

The Investment Continuum Defined:

- Donations: capital given by anyone for charitable purposes and to benefit a cause.

- Grants: funds given by a specific granting body, particularly the government, corporations, foundations, educational institutions, businesses, or an individual. To receive a grant, an application is required.

- Forgivable Loans: a form of loan in which its entirety, or a portion, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

- Social Enterprise Investments: investment funds that can be accessed by social enterprises.

- Community Loan Funds: a fund that provides loans to the community usually for the purpose of financing a community project.

- Social Impact Bonds: a tool based on the pay-for-performance principle where the government agrees to repay investors for the improved social outcomes of the project/program.

- Community Bonds: an interest-bearing loan with a face value, fixed term and set interest rate. Community bonds always generate a social or environmental return, in addition to a fair financial return.

- Debt: money that is owed or due to another institution or individual.

- Corporate Bonds: a debt security tool issued by a corporation and sold to investors in order to raise capital for a variety of reasons. In return, investors receive repayment in terms of financial capital.

- Equity: equity financing is the process of raising capital through the sale of shares. By selling shares, the company sells ownership in their company in return for cash.

- Venture Capital: capital that usually takes monetary form but can also be technical or managerial expertise. Investors provide to startup companies and small businesses that are believed to have long-term growth This type of financing usually comes from accredited, high net-worth investors, investment banks and other financial institutions.

Community Bond Benefits

Community bonds sit close to the centre of the continuum. They are more closely aligned with tools typically used by for-profit organizations, but still very much rooted in community engagement and support. In recent years, Community Bonds have emerged as an innovative financial tool used by non-profits, co-ops and charities to attract capital beyond traditional philanthropic sources. This tool enables organizations to receive funding from citizen investors to finance a project in their community. At Tapestry, we ensure that the issuers we work with are giving their investors a world-class experience by providing all of the necessary information on the bond before they make an investment decision, at the time they purchase a bond, and throughout the entire term of their Community Bond. Since a Community Bond is an interest-bearing loan, at the end of the term, investors get paid back their capital investment, a fair financial return on that invested capital, and a tangible social return in the form of the community benefit.

As one tool among many on the social finance continuum, it is important for organizations to closely evaluate the purpose of the financing when determining what combination of tools would be best suited for their goals and the vision of their organization.

Are community bonds the right fit?

Some of the questions that organizations can ask when making this determination are:

- What type of organization do you represent?

- What is the nature of the project in need of funding (operational, capital development, research, etc.)?

- How much funding is required for the project?

- Do you already have funding from other sources?

- Does your organization have a revenue generating business model?

- How quickly is the financing required?

These questions are not definitive or exhaustive, but in answering them organizations can have a better sense of what finance tool is most appropriate for their purposes.

If you think community bonds may be among the tools that make sense for your project, fill out the below qualifier survey and get in touch. We want to hear from you!

Recent Comments