The Canada Mortgage and Housing Corporation (CMHC) Housing Supply Challenge has named Tapestry Community Capital a finalist, awarding the organization a $3 million prize to scale up Canada’s community finance market for affordable housing.

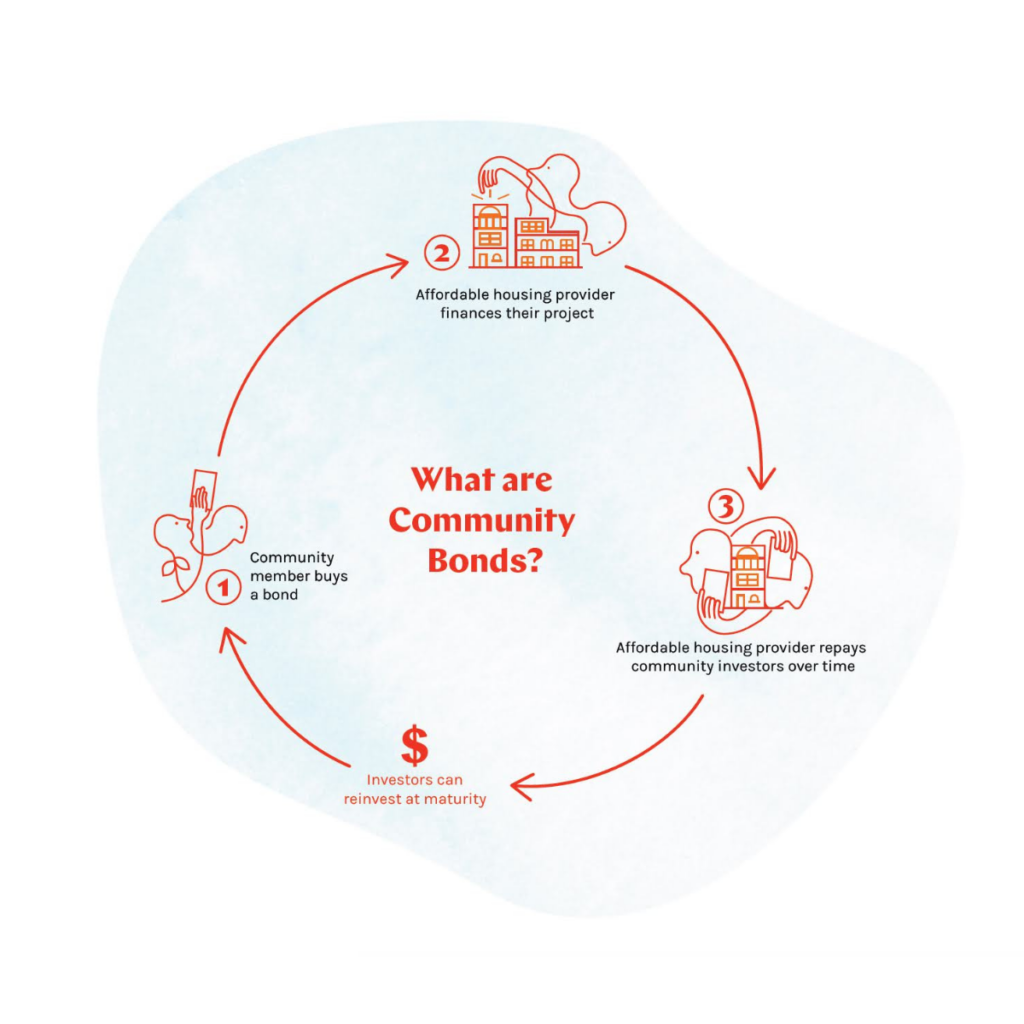

Tapestry works with charities, nonprofits and cooperatives, including 19 affordable housing providers, to support them in raising capital using a tool called community bonds. Housing organizations issue community bonds — which can be purchased by anyone in and beyond their communities — to finance any part of the development process. Community bonds allow these providers to take control of their financing, since they can set their bond terms to align with their project timelines, rather than relying on grant cycles or accepting terms offered by commercial lenders.

The investment vehicle also allows organizations to engage everyday Canadians in solving the housing crisis via their investments — and to offer returns directly to their communities, making community bonds a local economic development tool, too.

Ryan Collins-Swartz, Tapestry’s Co-Executive Director, says: “Canadians witness the effects of our broken housing system daily, but feel powerless to make a difference. It doesn’t have to be this way. By investing in community bonds, people across the country are directly funding affordable housing for their neighbours. Tapestry is working to make community bonds mainstream, empowering thousands of Canadians to help solve the housing crisis. We’re grateful to the CMHC Housing Supply Challenge for its support, which will accelerate this work.”

The Tapestry Community Capital team.

With the Housing Supply Challenge prize, Tapestry will continue its work on three key initiatives:

- A new pooled community bond fund: In 2025, Tapestry will launch a $30 million investment fund, which will pool capital to invest across community bonds across the country, helping them reach targets faster and more reliably. This will be especially important for rural and remote communities which may not have the population density or the local wealth to support an entire community bond raise. The fund will also allow institutional investors to participate in the community bond market by making the large investments needed to justify their due diligence processes without crowding out everyday community investors in individual campaigns.

- An improved back-end experience for issuers and investors: Tapestry is building a new version of its investment management system, with features that will significantly streamline the process of preparing to sell community bonds. In the future, Tapestry plans to convert this technology into a public-facing marketplace, where investors can browse and easily purchase community bonds from across the country on one central platform.

- Building cross-sector support for community investing: Tapestry is inviting representatives from across financial institutions, governments, academia, the nonprofit sector, and more to join and shape a coalition committed to moving the community bond sector forward. This means bringing awareness of the model to their respective communities and strategizing ways to remove barriers to community bond issuers and investors.

About Tapestry Community Capital

Tapestry is a nonprofit organization supporting community bond issuers across Canada. While Tapestry focuses on affordable housing, it also supports nonprofits and cooperatives in raising capital to purchase community arts venues, build community-owned renewable energy infrastructure, and more. Launched six years ago, to date Tapestry has helped issuers raise over $110 million from more than 4,000 community investors, and is set to double that raised amount in the next two years via affordable housing community bonds. Learn more at tapestrycapital.ca.

About the CMHC Housing Supply Challenge

The Housing Supply Challenge is a $300-million commitment over five years, which invites citizens, stakeholders and housing experts to propose solutions to the barriers to new housing supply. Round 5 of the Challenge aims to increase the adoption of transformative, system-level solutions that enable the quicker delivery of both community and market housing. Learn about the other Round 5 finalists on the CMHC Housing Supply Challenge website.

Media contact:

Kylie Adair

Communications Lead, Tapestry Community Capital

kylie@tapestrycapital.ca

613-601-5636

“I believe in a future where profits are returned to supporters rather than banks, and where investors can feel proud that they put their money in something that they believe in. To me, ‘co-operation in the world of tomorrow’ means communities coming together to support a common goal and jointly investing the capital it will take to realize that vision.”

“I believe in a future where profits are returned to supporters rather than banks, and where investors can feel proud that they put their money in something that they believe in. To me, ‘co-operation in the world of tomorrow’ means communities coming together to support a common goal and jointly investing the capital it will take to realize that vision.” “A Co-operative offers it’s members a concrete way to contribute to our inter-dependent reality; one where bridges replace walls. At Tapestry, when I see a cool Co-operative in action – one with shameless idealism and a strong collective resolve – I feel alive.”

“A Co-operative offers it’s members a concrete way to contribute to our inter-dependent reality; one where bridges replace walls. At Tapestry, when I see a cool Co-operative in action – one with shameless idealism and a strong collective resolve – I feel alive.”  “I imagine a world where problems, such as climate change, homelessness and poverty, are not shrugged off due to profit’s bottom line. I see inclusive communities whose inhabitants, both human and non-human, flourish with home-fullness, vibrant public and active transportation, and an economy based on the health of the planet.

“I imagine a world where problems, such as climate change, homelessness and poverty, are not shrugged off due to profit’s bottom line. I see inclusive communities whose inhabitants, both human and non-human, flourish with home-fullness, vibrant public and active transportation, and an economy based on the health of the planet.

Recent Comments