About Inspirit Foundation

Inspirit is a public foundation based in Toronto. They work to build more pluralist societies–one where multiple groups can coexist. Inspirit works towards this mission through granting, impact investing, and working to make systemic change through young change leaders. The foundation’s granting activities are focussed on the main priorities of reconciliation and addressing islamophobia through a media and arts lens.

Our main interest in speaking with Jory was exploring the criteria that Inspirit Foundation uses to evaluate organizations from an impact investment perspective. The conversation was wide-ranging, but he provided three key takeaways that organization should consider when positioning themselves for investability.

Key Lessons Learned

“There is a higher likelihood of financial profitability alongside higher levels of impact (or), at least the intent of impact…”

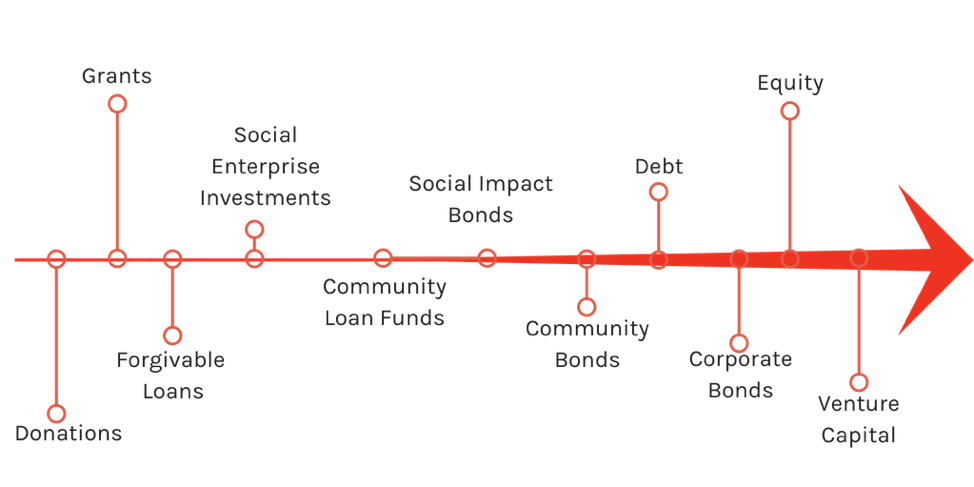

There is sometimes an aversion in the non-profit world towards thinking of organizations like a business. Whether knowingly or unknowingly, this can result in short-term decision making that prioritizes direct program delivery over the long-term health of an organization. What Jory has found through impact investing, is that impact and profitability do not have to be mutually exclusive, and in fact, can go hand and hand.

As Jory explains, an investor can decrease their volatility by investing in organizations that have a focus on impact. The chances of a crisis arising, and a subsequent dramatic drop in the company’s value, is lessened when social good is at the centre of their business practice. This is part of the reason why Inspirit has moved towards 100% impact investing. It’s just good business.

To learn more about Inspirits impact investment practices, click here.

“We don’t like investing under $250,000.00 because investing is a lot of work. Every investment takes a few months from start to finish.”

Inspirit Foundation does not have a large team of people assessing investments. For that reason, Jory has to be selective about the types of investments that the foundation chooses to take on, and any opportunity under $250,000.00 will likely be too low for consideration.

In positioning an organization for investability, it’s important for organizations to be conscious of not asking for too little. While an organization may think that a smaller ask makes them more attractive because the amount is more accessible, it can actually have the opposite effect.

“Quite honestly, most (organizations) come to us. Canada is a small market for impact investing still and I think we’ve got the word out that we’re active impact investors, active in the sense that we like making investments.”

Inspirit doesn’t need to seek organizations out.

While the ecosystem is small, Canada still provides a healthy pipeline for investors seeking impact investment opportunities. What that means for not for profits developing investible projects is that they need to be proactive in seeking organizations out. This means more than just putting up a website.

Get your pitch ready, have your financials in order, and set up some meetings!

Full Interview Audio

If you’re interested in learning more about Inspirit Foundation, what they look for when investing in Community Bonds specifically, and how they approach impact investing more generally, check out the full audio of our conversation below.

If you’re interested in reading about Jory’s journey towards 100% impact investing, you can view his blog, Impact Invest with Me, by clicking here.

And, if you want to receive more stories like this directly to your inbox, signup for our newsletter The Thread, by clicking here.

Recent Comments