At Tapestry, we speak with many non-profit organizations on a weekly basis. With Budget 2021 announcements, the Investment Readiness Program (IRP) has been a common thread of conversation. When we bring up IRP, we tend to get a variety of responses ranging from excitement to confusion. What is the Investment Readiness Program? How can it benefit non-profit organizations? What does investment readiness even mean?

The idea of private capital being invested in the nonprofit sector is a new sort of conversation in Canada. In past blog posts, we’ve discussed the investment continuum and where community bonds sit in reference to traditional philanthropic tools. IRP is another piece in this financing conversation.

In this blog post, we’ll seek to:

- Provide clarity about the program

- Give some insight into the idea of investment readiness

- Point you in the right direction for learning more about the program

Social Finance Fund

With the release of Budget 2021, the federal government confirmed the establishment of a $755 million Social Finance Fund, and plans to disperse up to $220 million in the next two year. The objective of the Fund is to provide social purpose organizations (which include charities, non-profits, co-ops and social enterprises, both non-profit and for-profit) with access to capital to carry out activities which will have a positive social or environmental impact. The Fund was first announced in the 2018 Fall Economic Statement and the federal government re-affirmed its commitment to the Fund in the 2019 Federal Budget.

In recognition of the fact that private investments and social finance are new concepts for many social purpose organizations, Budget 2021 also proposes to renew the Investment Readiness Program for $50 million over two years. This program aims to assist these organizations with building capacity to allow them to participate in Canada’s social finance market, and to prepare them to participate in the Social Investment Fund.

Investment Readiness Program

The Investment Readiness Program will be administered through several readiness support partners. A full list of partners can be found here.

Starting this year, these readiness support partners will put a call out to social purpose organizations (both for profit and not for profit), that are interested in becoming investment ready.

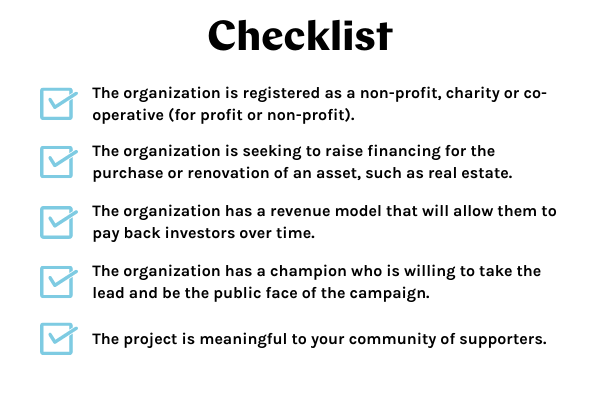

In practice, investment readiness refers to an organizations ability to successfully participate in the social finance market. This means generating revenue through a new social enterprise, or scaling existing social enterprise activities. The capital earned through investment will allow organizations to increase their social impact, and being “investment ready” means the organizations will have the capacity to repay that investment.

There are different financial vehicles that allow organizations to accept financing, including community bonds. What is common amongst these social finance vehicles, is the expectation of a financial return in addition to a social or environmental return.

How can Non-profit Organizations benefit from the program?

For not for profit organizations that have only ever relied on grants and fundraising, the Investment Readiness Program presents an amazing opportunity to think differently about financing. In leveraging this opportunity to establish a social enterprise, or grow existing revenue generating activities, organizations can both position themselves for social investment, and create long-term sustainability that could come in the form of:

- Investing in social purpose real estate

- Addressing food insecurity and clean energy generation

- Providing equitable jobs and training opportunities

The Argonaut Rowing Club leveraged community bonds to raise $1.2 Million for their club revitalization project.

Organizations that we have worked with, like the Argonaut Rowing Club (ARC), are a great example of how private capital can enable a greater social impact. By leveraging community bonds, ARC was able to increase their clubs membership capacity, make the club accessible, and make essential improvements to the revenue generating events space. To learn more about how the Argonaut Rowing Club leveraged social finance, click here.

What’s Next?

We are still waiting on further information on the Investment Readiness Program. As we learn about funds being released through the different Investment Readiness Partners, we’ll be sure to let you know through the Tapestry Community Capital newsletter, on our Twitter account, or through LinkedIn.

Recent Comments