Our community spaces are vital – whether they are sports facilities, schools or community centres, these places sit at the heart of our neighbourhoods. They provide physical space for services and are places that unite us.

We know that across the country, community spaces are being lost, and with the impact of the pandemic, this trend is only likely to worsen. We see places that were once vibrant hubs of community activity ending up in the hands of private developers, being pushed out of gentrifying neighbourhoods, or worse, left derelict.

“Too often, outside corporate interests come in and change a neighbourhood and it doesn’t reflect the needs of the community,” says Ryan Collins-Swartz, Co-Executive Director of Tapestry, “the story is all too familiar – the place of worship with low attendance sold to a developer, storefronts in rural communities left empty, a beloved historic theatre being demolished – the list could go on.”

“The amazing thing is that this problem actually presents a huge opportunity,” shares Ryan. “We have the potential to empower communities, redefine public services and reinvigorate local economies through community ownership.”

What is community ownership?

There are many accepted definitions of what community ownership means, but for us at Tapestry, it means a community organization (a co-operative, charity or non-profit) taking legal possession of an asset. These community assets are diverse and represent a wide range of uses from community solar farms to land trusts. The asset may be held for the benefit of the organization itself (ex. Office and program space) or for the wider community (ex. Affordable housing).

We know that community ownership can be a powerful catalyst for social action. Taking control of an asset means that a community organizations can:

- Protect key services and facilities from being pushed out of neighbourhoods

- Make major alterations to assets to fit their needs

- Reverse economic decline of an area and attract investment

- Instil a renewed sense of pride and confidence in the community

- Increase future participation through membership, volunteering, attendance, etc.

- Build credibility with funders, and leverage future financing to grow

- Encourage, through their success, further innovation within the community

At Tapestry, we have seen the power of community ownership firsthand. The very first project we were involved in began back in 2002, when a group of community members came together with the vision to build a community owned wind project in downtown Toronto.

It was to be the first urban wind turbine in all of North America. “At the time, this was no small feat,” shares Ryan, “our lawyer often jokes that it would have been easier to build a nuclear power station in the city than that turbine.”

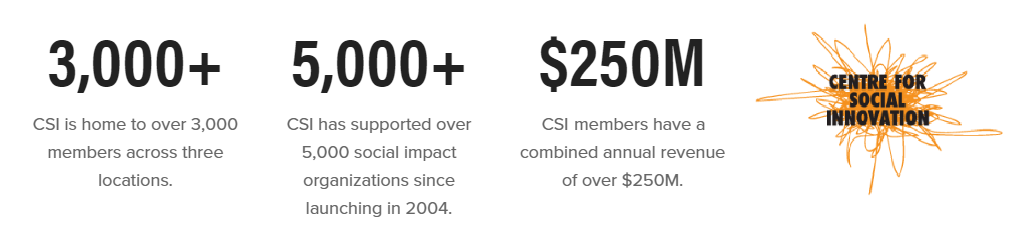

But the community was focused and determined, and the sense of pride and ownership was immense. By bringing together almost 600 members, WindShare became a model not only for sustainable energy but for community ownership across Canada.

In the years since, we have seen amazing historic buildings rescued and repurposed for community needs, expanded and revitalized sport facilities, community arts spaces anchored within gentrifying neighbourhoods, and communities shaping their own needs for education. The common thread? The purchases of these assets were all made possible, in part, by engaging community members as investors.

“Community finance is a natural fit for community ownership,” explains Ryan, “when a community member invests, they feel they are taking a meaningful stake in the future development of the place in which they live and/or work.”

Community investment not only mobilizes financial capital, but also social capital within a community. “Once a community member is an investor, they really feel they are part of the project. We see them wanting to volunteer, participate and talk about the work of the organization they have invested in. They get really excited!” says Ryan.

What’s more, there is a significant public appetite for making these types of impact investments.

What are Community Bonds?

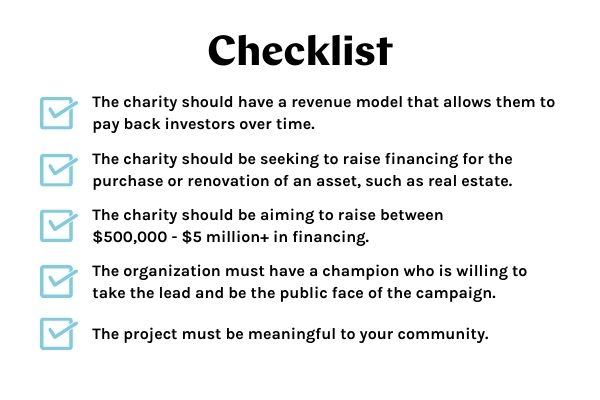

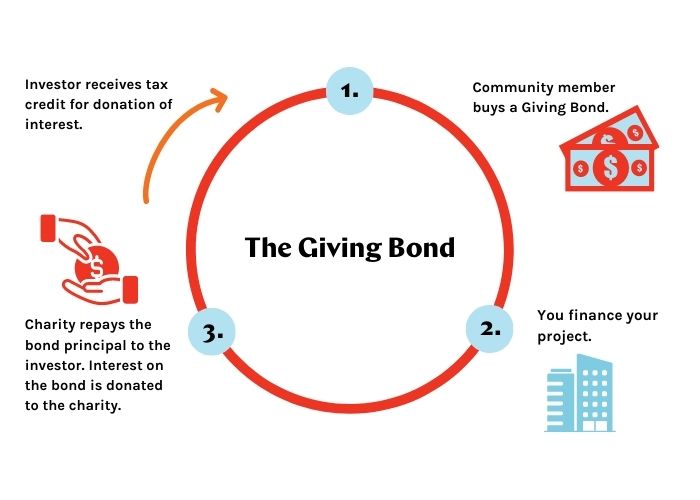

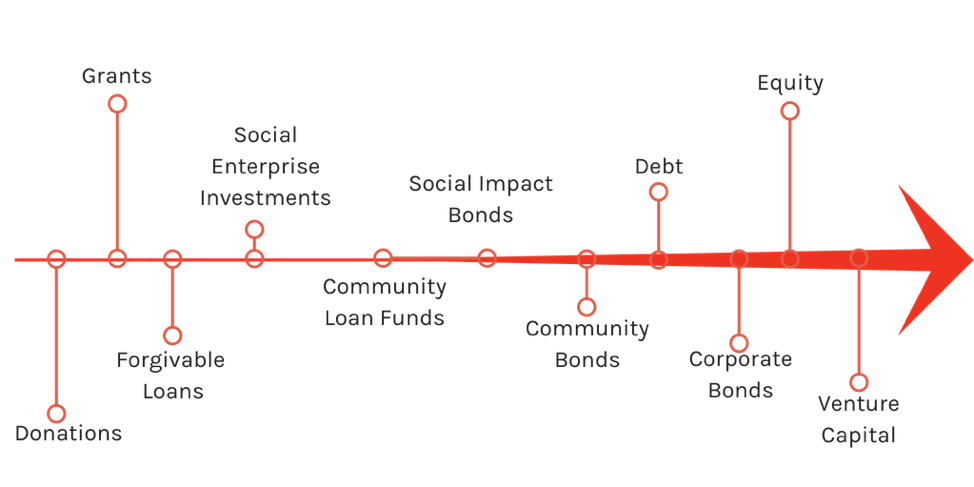

All too often, communities have a great idea but they don’t have the money they need to bring their visions to life. Community bonds can help complete the financing puzzle for these projects, alongside other important types of financing such as grants, mortgages, and donations.

Community bonds are a social finance tool, similar in many ways to a traditional bond. They are an interest bearing loan from an investor, which has a set rate of return and a fixed term. The major difference is that in addition to offering a financial return, they also offer a social or environmental return.

What makes community bonds so unique is that they allow capital to flow back into the local economy, rather than to a bank. Investors get a double benefit – the financial return and a stake in shaping their own community.

“We believe that communities should control their own destiny. And community bonds are a financial tool that give communities the agency to decide what develops and how their community transforms,” says Ryan.

Economic Inclusion

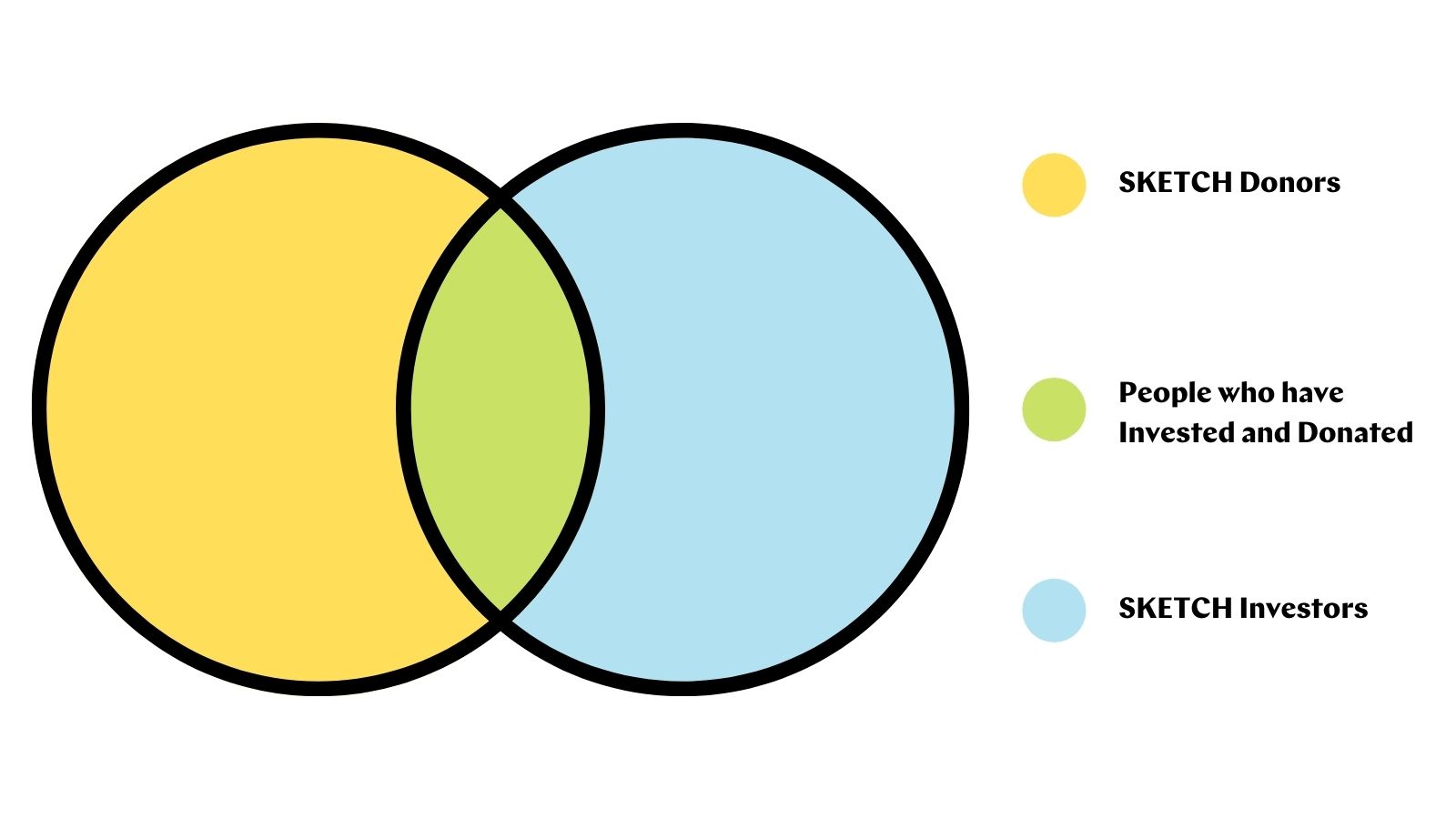

Community organizations issuing bonds have the ability to customize the terms of their investment offering so that they fit the needs of their project and their community. “We have seen community bonds priced for as low as $250 to be as inclusive as possible,” says Ryan, “still, in disadvantaged communities, organizations often have to extend their notion of community beyond the physical boundaries of their neighbourhood.”

Community bonds have been very popular among community foundations who have earmarked funds for impact investing and local businesses looking to make a social impact, and there is a growing community of impact investors across Canada that want to make a return while also doing good.

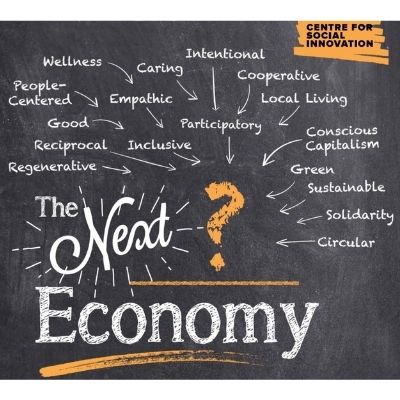

The future of Community Investment and Community Ownership

We need to be learning from past successes and supporting innovative financing in order for this model to flourish. Local governments can play a huge role in helping communities to regenerate their areas by supporting community ownership.

We are encouraged by the steps that some municipalities have been taking to this end, particularly with covid recovery at the top of the agenda. The City of Kingston, for example, recently launched an initiative to explore how community investment might contribute to initiatives that support vital community needs.

We invite local governments, community leaders and community organizations to engage with us on community ownership as a model for post-COVID recovery. If you are interested in learning more or have a project in mind, please get in touch at info@tapestrycapital.ca.

“Because there are restrictions on withdrawals from these types of accounts,” says Erica, “most of the money remains locked in place there – making it difficult, for say Bob Smith, to withdraw $2,000 to invest in a community bond.”

“Because there are restrictions on withdrawals from these types of accounts,” says Erica, “most of the money remains locked in place there – making it difficult, for say Bob Smith, to withdraw $2,000 to invest in a community bond.”

Recent Comments