Last week, our Co-Executive Director, Ryan Collins-Swartz, had the pleasure of joining Tim Nash on the Toronto Star podcast Responsible Investing for a Sustainable Economy.

Host Tim Nash is the founder of Good Investing and has been a leader in responsible investing and the green economy for more than a decade.

Host Tim Nash is the founder of Good Investing and has been a leader in responsible investing and the green economy for more than a decade.

In this episode, the topic of discussion is impact investing – a strategy that seeks to generate financial returns while also creating a positive social or environmental impact.

Are you interested in investing with impact or raising investment from your community for an impactful project? Delve into the the recording and transcript of Ryan and Tim’s conversation on the world of Community Bonds.

Tim: Today I am with Ryan-Collins Swartz, Co-Executive Director of Tapestry Community Capital. Ryan, thanks so much for joining me.

Ryan: Great to be here Tim.

Tim: Now, you’ve been in the impact investment space for a little while now, how did you first get involved in this ecosystem?

Ryan: It’s been a long road Tim. I would say, looking back to when I was in school, my first real job was working at a residential real estate investment trust. At that point, I was amazed by how big capital could be put to use – in this case, for apartment buildings.

Then I discovered social enterprise while at Ivey Business school. I learnt that non-profits can create side activities that are revenue generating, that can allow them to operate more sustainably. Afterwards, I became involved in different non-profits – I did a research project with the Toronto Public Library, a fellowship at the Mars discovery district here in Toronto, and worked with several social service agencies.

I started to see two clear perspectives. First, going back to that real estate investment trust, I saw how capital is mobilized and how investments are made, but I also saw the reality for a lot of organizations searching for funding. And there are a lot of barriers there – especially for non-profits, charities and different social enterprises.

I became introduced to the community bond model because I was a member of the Centre for Social Innovation. Then I was reached out to by the Toronto Renewable Energy Co-operative (TREC), who had for the past 20 years been raising impact investment for local renewable energy projects. Their first example, that a lot of people know of, is the wind turbine down at exhibition place, which is half owned by Toronto Hydro and half owned by 500 community investors.

What I learnt was that a lot of organizations were starting to duplicate this model. The Centre for Social Innovation was one, and several other co-working spaces did it, but there wasn’t a lot of support or an easy solution for other organizations that wanted to raise this type of impact investment. So, I joined TREC and about 6 months later we launched Tapestry Community Capital, as an organization that provides end-to-end support to both raise and manage impact investments.

Tim: I love it. So basically, your job is doing these social finance campaigns. Finding non-profits that want to raise money, who probably have an asset they need that money for, and then raising a successful campaign so that they can buy that asset. As part of your job, you often meet with non-profits who are thinking about raising capital. How do they initially feel about doing this?

Ryan: I think the first emotion for a lot of them is excitement. They might come with a lot of frustration about the existing ways that they can raise funding for their organization. So for example, donation campaigns can be difficult, donors can be tapped out depending on the community, they are also a more old-fashioned way of raising a lot of money from a small group of wealthy individuals. Secondly, they could have had difficulty working with financial institutions and banks. And then, they might also be very grant dependent.

Grants are difficult – although you don’t have to pay them back, you also don’t have a lot of choice once you receive them or if you receive them. There can be a lot of limitations on what you can spend the funds on. So a lot of organizations get really excited about raising funds in this new way, because with community bonds they get to set the terms (i.e. decide the rate of return, maturity, etc.).

Tim: I often joke that for a lot of non-profits, debt is a four-letter word that they are just not used to dealing with. What do you think really needs to click with them psychologically before they are really ready to move forward?

Ryan: I think really understanding how this all works, learning from the stories of other organizations who have done this before, and feeling confident that Tapestry is here to support them every step of the way. There is definitely excitement as the first emotion, but then they may also feel apprehension – the, “oh my god, are we really going to do this?”

For some organizations that have a longer track record with fundraising, they might be concerned that if they are offering people the opportunity to invest (i.e. make a return and also get their money back), why would someone make a donation? So I think there is also a realization that, no, this isn’t cannibalizing your donor base. This is a chance to engage a whole new community of people who might not be making large donations into capital campaigns, but like me, have a small pool of money they want to put to work locally to make an impact.

Tim: You talk about investors that do want to earn a financial return, but they also want to feel good about their investment. So tell me, what role does story-telling play in an impact investment campaign?

Ryan: Storytelling is vital. When we think of an impact investment, it’s really about understanding what the impact of this project is and who it is impacting, down to an individual level or environmental level, and getting that message out. This is where a community bond investment varies from the rest of the investments in your portfolio. This is likely the only investment where you can actually see, feel, touch, visit, and know where your money has gone. So yes, it’s vital.

But I would say Tim, it’s not on its own what’s going to close the deal. So maybe that’s where impact investing and traditional fundraising shares a lot in common in the value of storytelling. But the separation is that the story will get someone in the door, but then they need to understand the business model, the repayment strategy, and have confidence in the team that this is a fair and wise investment.

Tim: Yes, I think confidence plays a huge role. This is a bit of a new thing to both non-profits, who might be raising capital for the first time, but also for the investors that are often making these types of impact investment for the first time. Having that transparency and being on the same page is key. Understanding that risk return, just like we do for any other investment, and really having that information allows us to make confident investments – both from a financial standpoint but also from that impact standpoint. People do want to make sure that their investments are having an impact. Do you agree with that?

Ryan: The first, and exciting thing, is that this is new for everyone. Anytime I meet with an organization thinking about issuing an impact investment, it’s the first time that their staff and their Board is learning about it. And likewise, when they go out to their community of investors, it’s the first time that that community is learning about investing in community bonds. It’s still very nascent and new. I was reflecting back to a few years ago when we could all be in person at the Social Finance Forum at Mars, when you were moderating a session on impact investing and you asked the panellists and the crowd “how many of you have made an impact investment, raise your hand?”. Do you remember what the response was like?

Tim: It wasn’t a huge number of people in the room.

Ryan: So even in the “in group” of people who know about impact investing, they aren’t that personally involved with making these types of investments. That’s changed a lot over the past few years due to the availability of more products, but I’m excited to see the space of impact investing grow from everyone involved to friends and families, to colleagues and institutions, and outwards from there.

Tim: I think it’s cool that when I deal with clients, it’s often the first time they make an impact investment. That first time is often the toughest decision they make, and then after they do it, the experiential learning kicks in, such that once they’ve made one investment they tend to be a lot more open and receptive to other impact investments on the market.

Are there any impact investments of organizations that you are working with now that you can share with us?

Ryan: One that I’m really excited about is Earth Day Canada (Jour de la Terre) based in Quebec. They are developing Canada’s first non-profit, community owned, electric vehicle charging network. This project, called EcoCharge, is starting with 100 charging stations across Quebec and New Brunswick and is going to be scaling across Canada. Anyone across Canada is able to invest as little as $1000 and make 3.5% a year on a 5-year bond. That’s one that I’m really excited about. (To learn more about the EcoCharge investment opportunity, visit the Earth Day Canada website here)

Tim: Same. I don’t own an electric vehicle but when I talk to people that do, they often worry about this idea of range anxiety, and not being able to take a road trip. So, I love this idea of being able to finance charging stations. I think it’s along the trans-Canada highway and they’ve partnered with grocery stores, such that when you are along the highway, you don’t really have to worry about it – there will be somewhere to charge your car. You can go in, have a little bite and take a break on the roadtrip that you’d want to take anyway.

This is a great opportunity where investors can put up some of that upfront capital, earn an interest rate on that community green bond and hopefully have that network of charging stations across the country.

Thanks for joining us Ryan!

For those that are interested in learning more about impact investing, check out Tim’s Good Investing online Course here.

This fall Suzanne will be returning to her Masters of Planning program at the University of Toronto, equipped with new experience and expertise in social finance and community economic development.

This fall Suzanne will be returning to her Masters of Planning program at the University of Toronto, equipped with new experience and expertise in social finance and community economic development.

Marzie describes herself as a jack of all trades, with a career path that led her from cell biology to civic tech, youth empowerment, political engagement and education. The constant throughout her career has been her deep interest in, and passion for, systems thinking and people-centered research design. She has spent the vast majority of her career working with nonprofits, first with rural and marginalized communities in Iran, and more recently in Peru and Canada. For the past 8 years, she has focused on mix-method research, and measurement and evaluation.

Marzie describes herself as a jack of all trades, with a career path that led her from cell biology to civic tech, youth empowerment, political engagement and education. The constant throughout her career has been her deep interest in, and passion for, systems thinking and people-centered research design. She has spent the vast majority of her career working with nonprofits, first with rural and marginalized communities in Iran, and more recently in Peru and Canada. For the past 8 years, she has focused on mix-method research, and measurement and evaluation.  Suzanne is currently pursuing her Masters in Planning at the University of Toronto, with a concentration in Housing and Community Economic Development. The focus of her research is to assess the feasibility of crowdfunding platforms to facilitate land acquisition groups such as community land trusts. Suzanne is joining our team in a part-time capacity while she completes her studies and is working with Marzie and support our progress in the CMHC Housing Supply Challenge.

Suzanne is currently pursuing her Masters in Planning at the University of Toronto, with a concentration in Housing and Community Economic Development. The focus of her research is to assess the feasibility of crowdfunding platforms to facilitate land acquisition groups such as community land trusts. Suzanne is joining our team in a part-time capacity while she completes her studies and is working with Marzie and support our progress in the CMHC Housing Supply Challenge. Baljmaa’s interest in climate change mitigation began early in her career while she was working as an internal auditor at a commercial bank in Mongolia. Her role took her to remote regions of the country where she could see the impacts that climate change was having on local people and businesses, from drought to extreme heat waves.

Baljmaa’s interest in climate change mitigation began early in her career while she was working as an internal auditor at a commercial bank in Mongolia. Her role took her to remote regions of the country where she could see the impacts that climate change was having on local people and businesses, from drought to extreme heat waves.

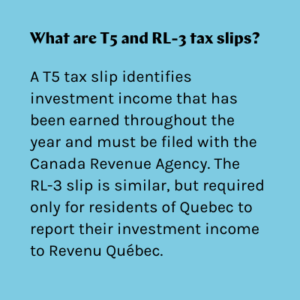

For issuers working with Tapestry, this process is a simple and straightforward one. Our clients need only email their investors to inform them that the tax slips are en route, and we take care of the rest!

For issuers working with Tapestry, this process is a simple and straightforward one. Our clients need only email their investors to inform them that the tax slips are en route, and we take care of the rest!  Beyond tools such as Atticus, which streamline this process for tax reporting, Tapestry also builds on 20 years of experience in the field. “Ultimately, this knowledge saves our clients time and money, so that they can focus on what they are good at – growing their positive impact within their communities.”

Beyond tools such as Atticus, which streamline this process for tax reporting, Tapestry also builds on 20 years of experience in the field. “Ultimately, this knowledge saves our clients time and money, so that they can focus on what they are good at – growing their positive impact within their communities.”

Host Tim Nash is the founder of

Host Tim Nash is the founder of

Recent Comments